Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The UK's second-largest city is bankrupt

Unable to balance its budget as required by law, Birmingham placed itself under the protection of "section 114" on Tuesday. This means that only essential expenditure is covered. The news had all the more resonance because the city council has a million people under its umbrella - the largest local authority in the country, since London is divided into boroughs. And because this failure has raised fears of a domino effect on other struggling English cities.

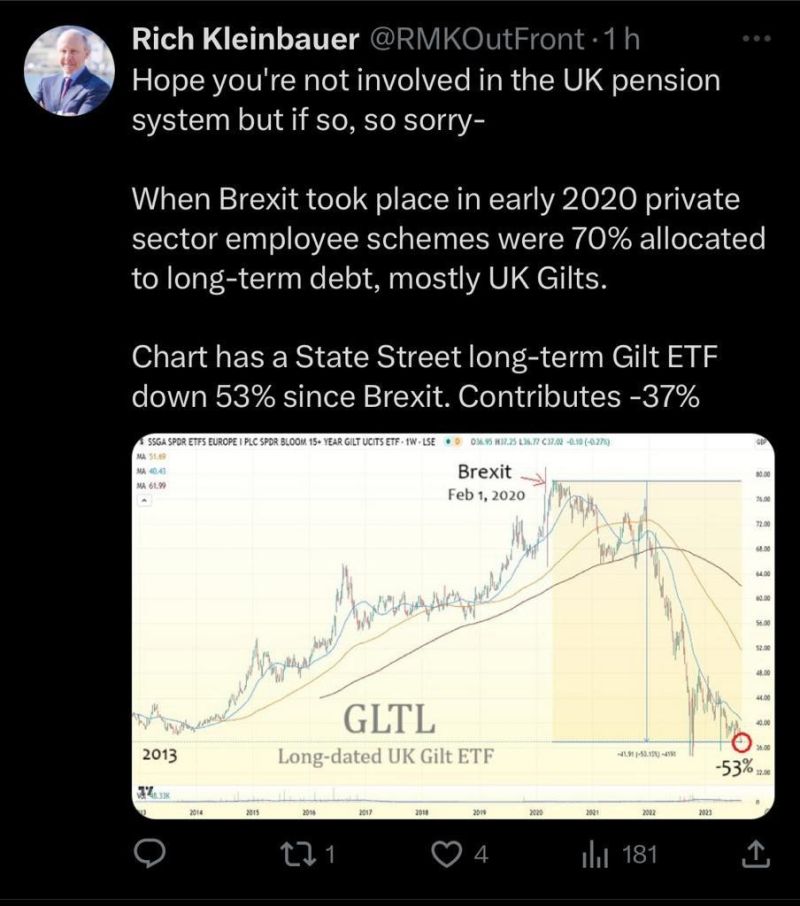

A nice tweet by Rich Kleinbauer

In February 2020, 70% of private sector employee schemes were allocated to long-term debt (mostly UK Gilts). This investment is down -53% since then, i.e a MINUS 37% contribution to performance...

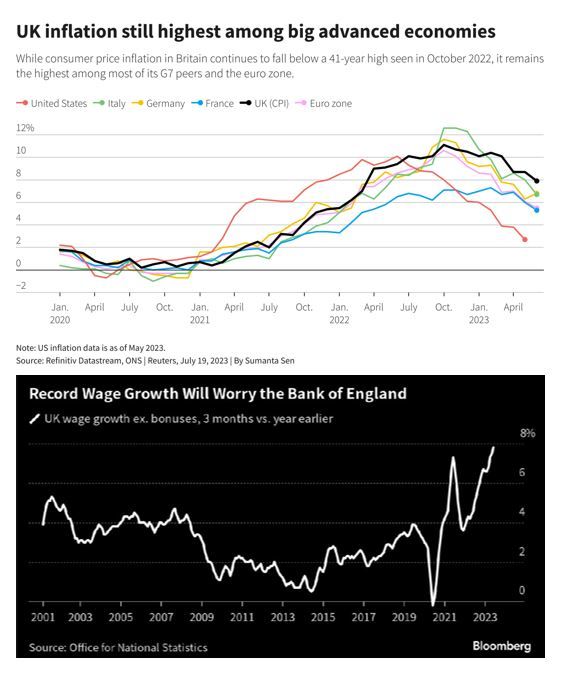

UK headline inflation cooled sharply in July to an annual 6.8%, but the core consumer price index remained unchanged, posing a potential headache for the Bank of England

The headline CPI reading was in line with a consensus forecast among economists polled by Reuters, and follows the cooler-than-expected 7.9% figure of June. Despite the decline, UK inflation is still the highest among "advanced" economies (see upper chart below). On a monthly basis, the headline CPI decreased by 0.4% versus a consensus forecast of -0.5%. However, core inflation — which excludes volatile energy, food, alcohol and tobacco prices — stayed 6.9%, unchanged from June and slightly above a consensus forecast of 6.8%.

U.K. inflation cooled significantly in June, coming in below consensus expectations at 7.9% annually

Economists polled by Reuters had projected an annual rise in the headline consumer price index of 8.2%, following May’s hotter-than-expected 8.7% reading, but annualized price rises continue to run well above the Bank of England’s 2% target. On a monthly basis, headline CPI increased by 0.1%, below a consensus forecast of 0.4%. Core inflation — which excludes volatile energy, food, alcohol and tobacco prices — remained sticky at an annualized 6.9%, but fell from a 31-year high of 7.1% in May. Source: CNBC

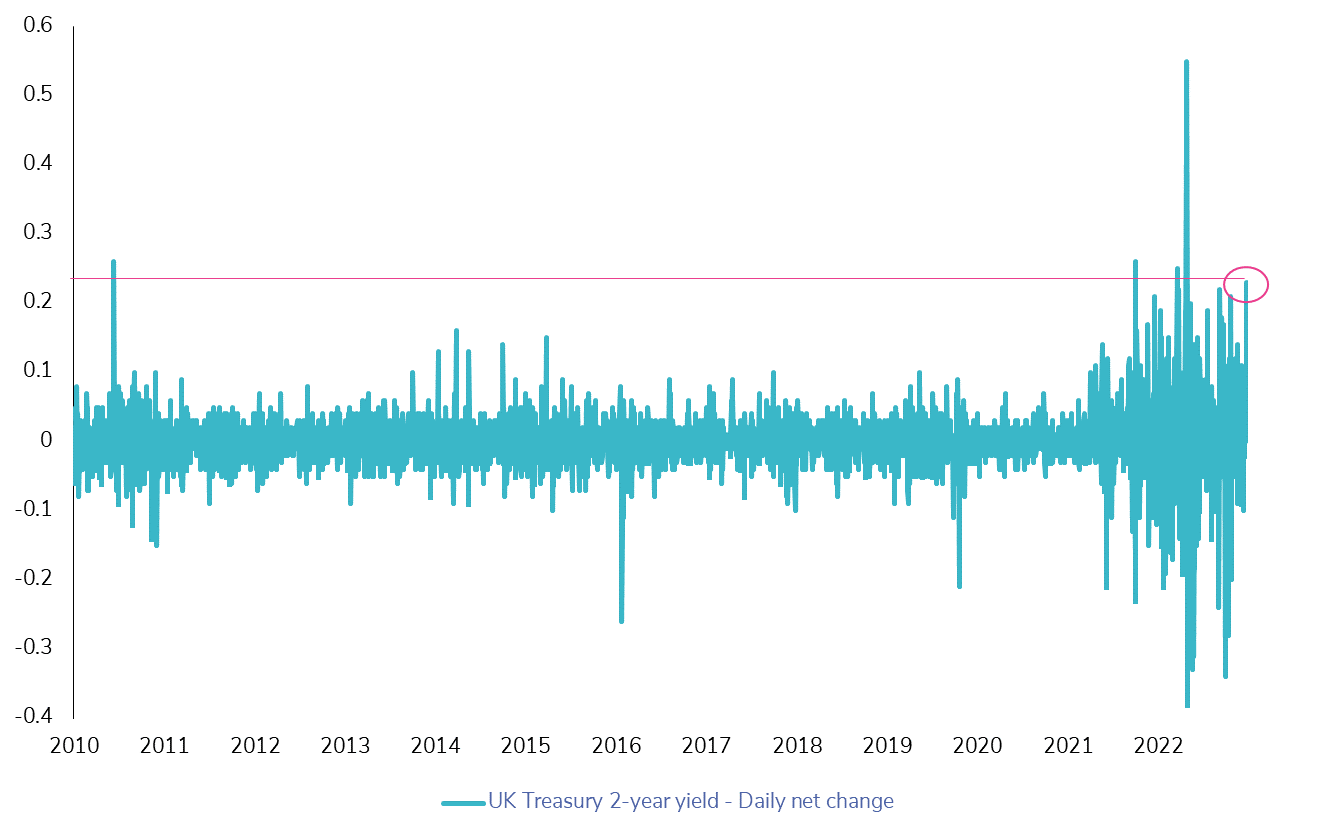

UK Bond Market Suffers Major Blow on Unforeseen Surge in UK CPI!

The UK bond market witnessed a substantial downturn due to an unexpected surge in Britain's core inflation rate, reaching its highest level in over three decades. This surprising release led to a sharp 25bps rise in the two-year UK Treasury yield. Consequently, market sentiment has shifted, with rate hike expectations now fully priced in for June, and projections even suggesting a potential 50bps increase. As a result, the terminal rate, anticipated for December 2023, is now hovering at almost 5.5%, a significant shift from less than 5% merely two days ago. Source: Bloomberg.

Investing with intelligence

Our latest research, commentary and market outlooks