Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

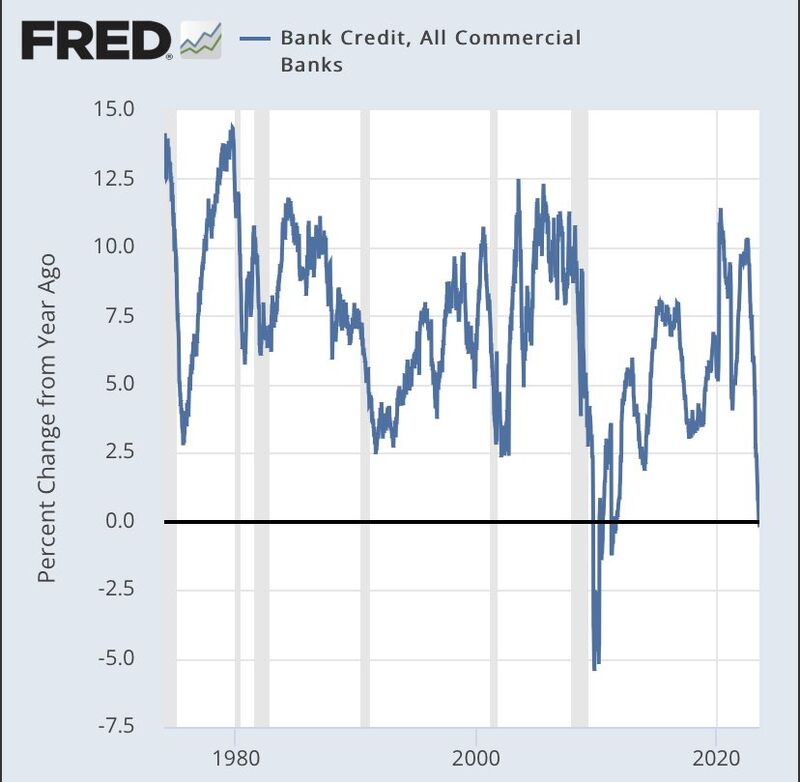

US Bank credit YoY is now -0.2% YoY. First time negative since 08 (Keep in mind that in the US about 25% of credit is securities and the other 75% loans)

Source: FRED, Adem Tumerkan

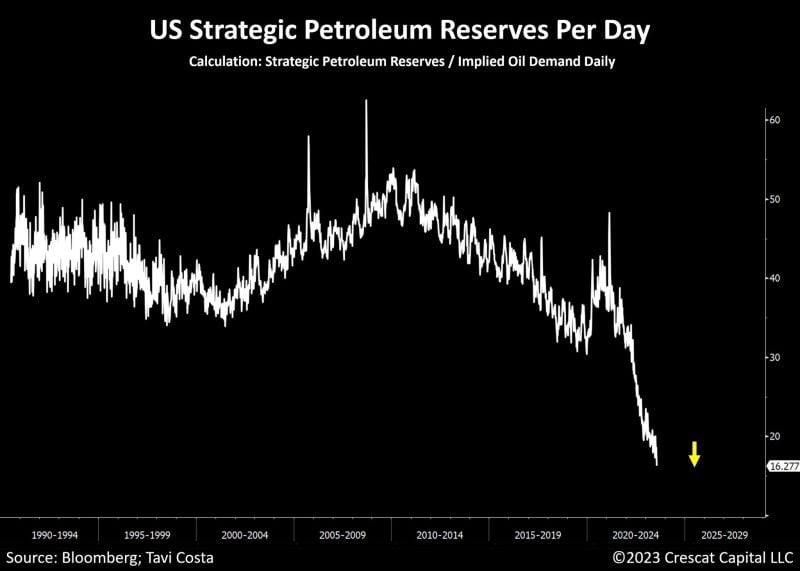

With the recent surge in oil demand, the US government is now left with a petroleum reserve sufficient for only 16 days

Source: Tavi Costa, Bloomberg

Hedgeye cartoon on the Fitch downgrade

source: Hedgeye

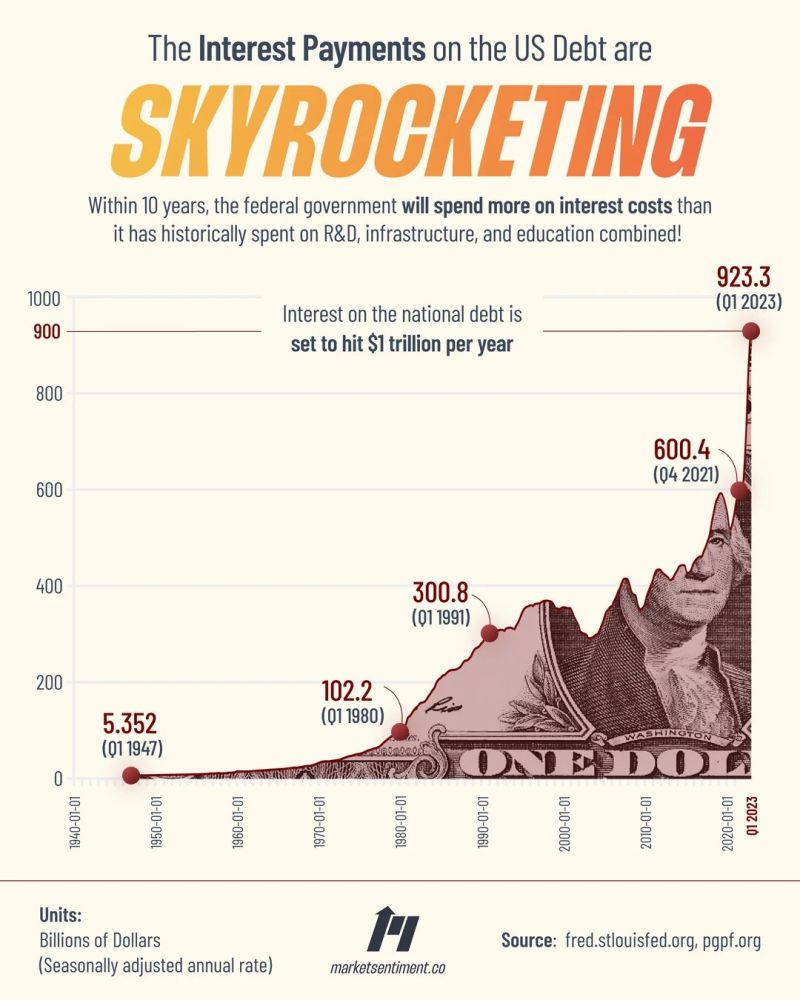

Interest payments on US government debt are soaring

source: Markets & Mayhem

Fed QT accelerates. Fed balance sheet shrank $91bn in July, -$759bn from peak, biggest drop ever to $8.2tn, lowest level since July 2021

Fed has now shed 22.3% of the Treasury securities it bought during pandemic QE. Fed's total assets now equal to 30.6% of US's GDP vs ECB's 53%, BoJ's 130%. Source: HolgerZ, wolfstreet.com

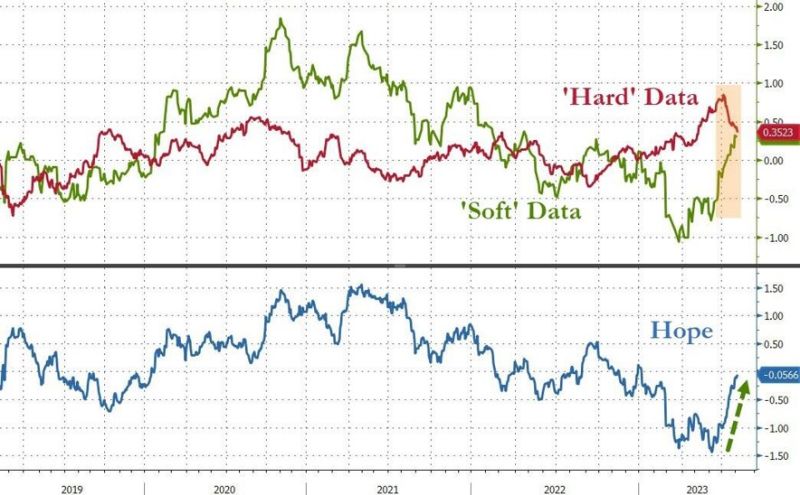

The Citi US Economic Surprise Index is at the highest levels since early 2021

That being said, there has been some divergence recently between "hard" and "soft" data. Indeed, 'Hope' has been in charge of macro data recently with 'soft' survey data surging back in its mean-reverting manner as 'hard' real data has been fading (led down by industrial, personal finance, and housing data)... Source: Bloomberg, www.zerohedge.com

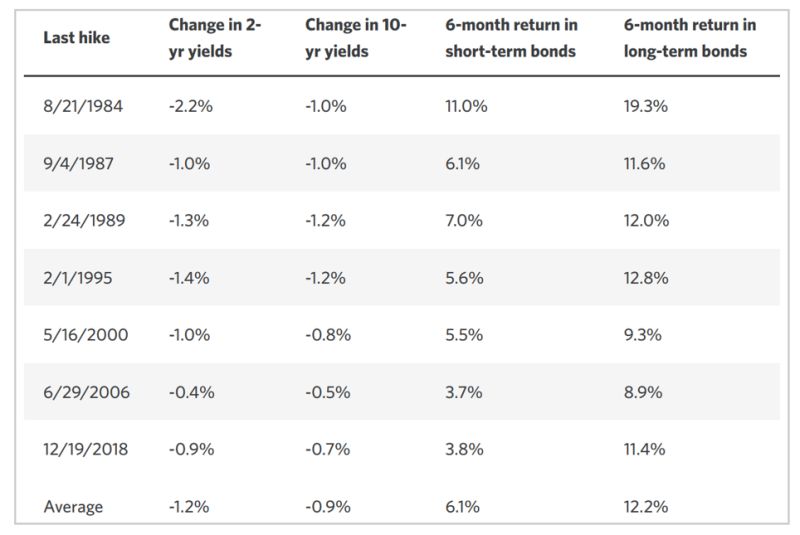

Before dumping your government bonds think twice

Over the past 40 years, US treasury yields have always declined six months after the last Fed hike. Source. Edward Jones

Another big week ahead for us earnings

$PLTR $DIS $BABA $RIVN $AMC $UPST $SMCI $UPS $LCID $LLY $TWLO $PLUG $MARA $TTD $NVO $DDOG $RBLX $NVTA $CELH $SOUN $IONQ $TSN $GOLD $SWKS $WYNN $LAZR $MGNI $APPS $CHGG $ARRY $SONY $DNA $BRK.B $MPW $TOST $PARA $LYFT $BROS $LI $SWAV $FIVN $CYBR $CPA $CGC $VTRS $PENN $RNG $NVEI $CLOV $OKE Source: Earnings Whispers

Investing with intelligence

Our latest research, commentary and market outlooks