Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

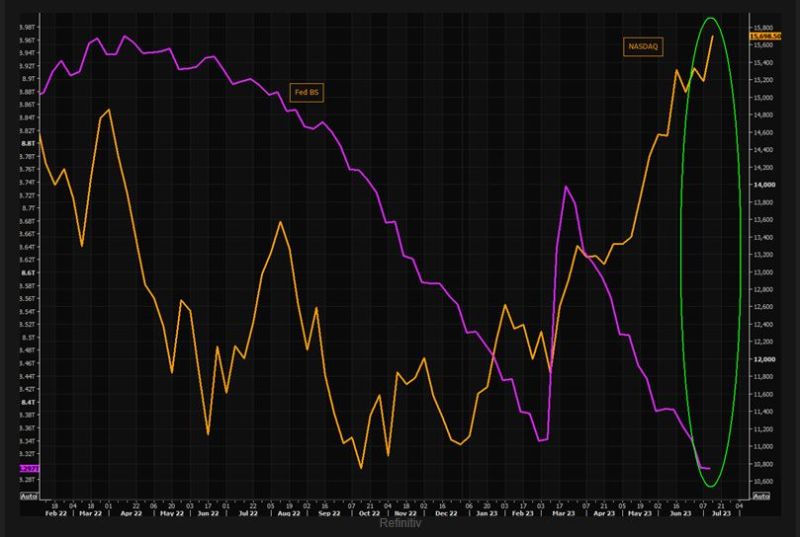

NASDAQ is trading in the upper part of the steep trend channel

NASDAQ is trading in the upper part of the steep trend channel. Note the shooting star candle today, a classical candle that should be observed closely post strong short term trends. One candle doesn't make a "case", but watch for a possible confirmation session. Source: TME, Refinitiv

The Biden administration announced it would automatically cancel education debt for 804,000 borrowers

The Biden administration announced it would automatically cancel education debt for 804,000 borrowers, for a total of $39 billion in relief. The debt cancellation is a result of the administration’s fixes to repayment plans, which included updated counts of borrowers’ payments. Source: CNBC

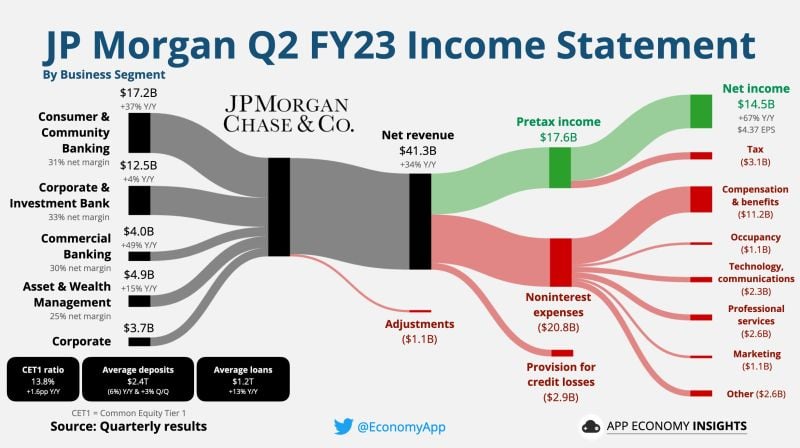

$JPM JP Morgan Chase Q2 FY23 numbers

$JPM JP Morgan Chase Q2 FY23 numbers • Net revenue +34% Y/Y to $41.3B ($2.5B beat). • Net Income $14.5B. • EPS: $4.37 ($0.61 beat). • CET1 ratio of 13.8%. $2.7B First Republic bargain purchase gain in Corporate. Source: App Economy Insights

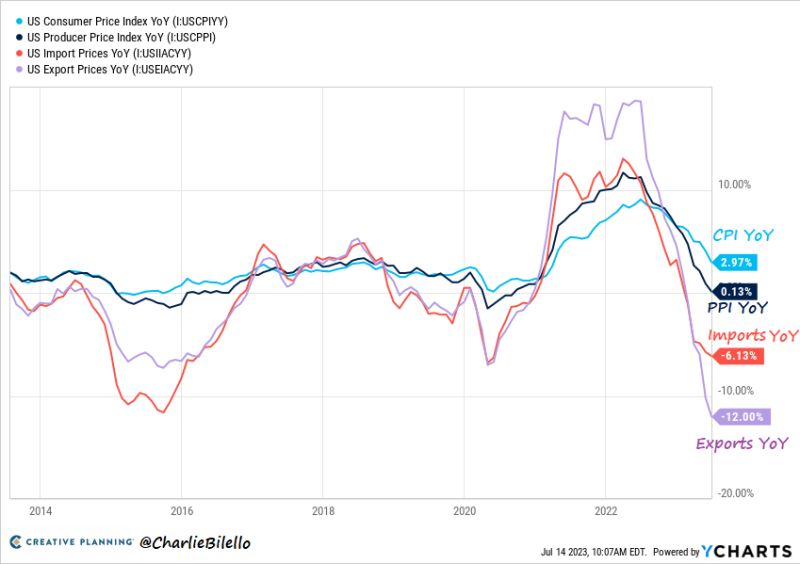

Disinflationary trends in the US

Disinflationary trends in the US 1) CPI Inflation: 3.0%, Lowest since March 2021. 2) PPI Inflation: 0.1%, Lowest since August 2020. 3) Import Prices: -6.1%, Lowest since May 2020. 4) Export Prices: -12%, Lowest on record. Source: Charlie Bilello

The NASDAQ (in yellow) has been massively decoupling from the FED balance sheet (in purple)

Source: The Market Ear, Refinitiv

S&P 500 peak in January 2022 vs. peaks in October 2007 and March 2000...

Source: Charlie Bilello

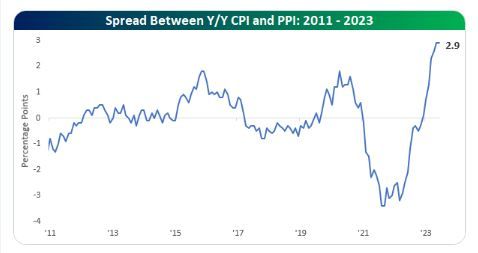

The spread between US CPI and PPI is a good omen for corporate profit margins

The spread between US CPI and PPI is a good omen for corporate profit margins. This is key to widening profit margins. Companies are able to boost the prices they charge consumers more and more relative to their input cost. The spread between y/y CPI and PPI remains at the widest levels since the current incarnation of PPI started in 2011. Source: Bespoke, Lisa Abramowicz

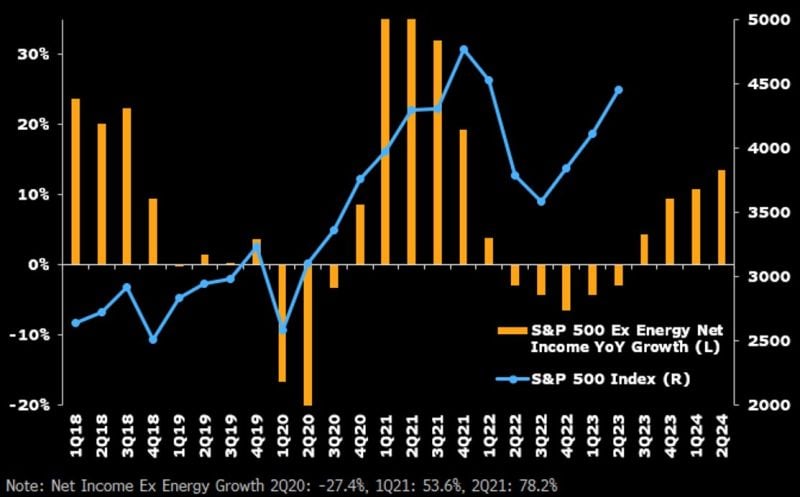

The sp500 has been anticipating the improvement in earnings (ex-Energy) expectations so far. Can these expectations be met?

Source: Bloomberg (Gina Martin Adams for the #chart)

Investing with intelligence

Our latest research, commentary and market outlooks