Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

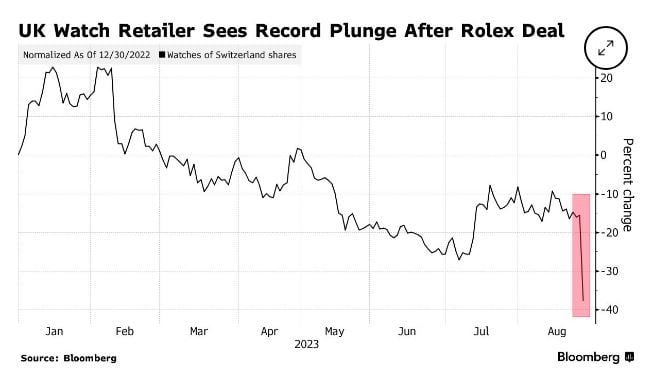

Watches of Switzerland shares plunge by a quarter after Rolex buys retailer Bucherer

The UK’s biggest seller of Rolex watches lost nearly a third of its value on Friday after the Swiss brand bought Bucherer AG, taking its first major step into retailing. Watches of Switzerland Group Plc shares fell as much as 30%, wiping out almost £500 million ($629 million) in market capitalization. Rolex unveiled the surprise move to buy Bucherer late Thursday, prompting analysts to question what the deal means for Watches of Switzerland’s future relationship with the brand. Peel Hunt’s Jonathan Pritchard noted that Rolex accounts for half of the company’s sales, and cut his rating on the stock to hold from buy. Rolex executives assured the UK’s biggest retailer of the brand that it will continue to be allocated watches by the same distribution system, Watches of Switzerland Chief Executive Officer Brian Duffy said in an interview. Source: Bloomberg

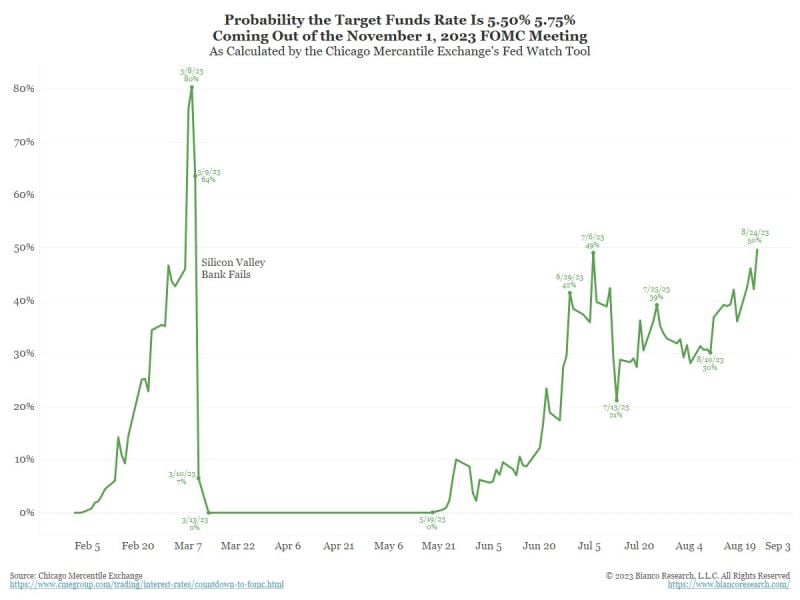

Going into Jackson Hole, the probability of a September hike is just 20%, well below 50%, so not likely. But, as shown below, the probability of a hike in November (see below) is now 50/50

What will it be when Jay is done? Source: Jim Bianco

Chinese stocks slid in early Friday trading, an indication of entrenched investor pessimism even after authorities urged the nation’s top financial institutions to help stabilize a struggling market.

The CSI 300 Index of shares in Shanghai and Shenzhen dropped as much as 0.7% shortly after the opening bell, extending its slump this month to 7.7% and keeping it as one of the world’s worst performers this year. A key gauge of Hong Kong-listed Chinese firms declined a maximum 1.3%. The selling came after the China Securities Regulatory Commission used a seminar Thursday with executives from the country’s pension fund, some large banks and insurers to ask them to boost support for the market. The market’s indifference isn’t necessarily a surprise, given regulators have held similar meetings regularly in the past and they have rarely had a significant impact. Source: Bloomberg

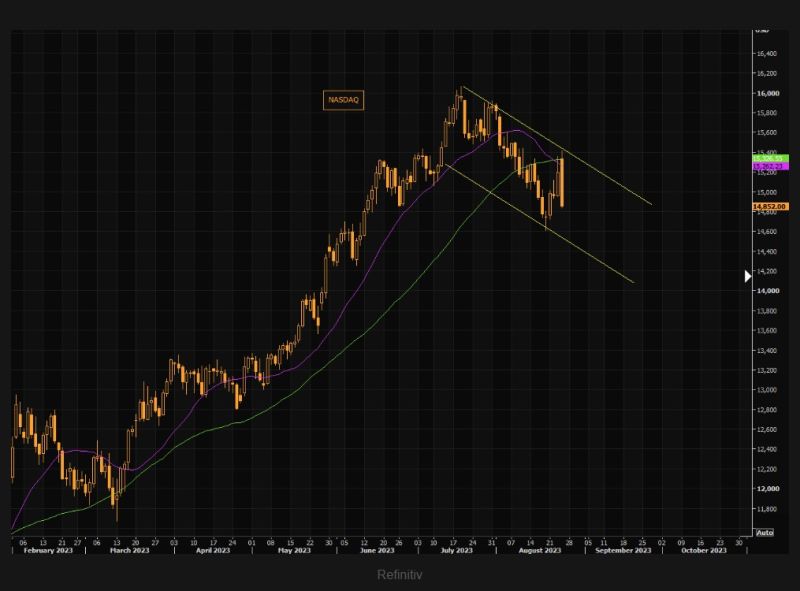

NASDAQ's bearish cross. The 21 day has now crossed the 50 day moving average.

NASDAQ futures putting in the biggest down candle in a long time and it looks like we have a new short term trend channel to watch. Source: TME

Images of Powell arriving at Jackson Hole have just surfaced. $SPY

Source: TrendSpider

The BRICS economic coalition of emerging markets has decided to extend membership invitations to six nations.

The BRICS alliance — which presently reunites Brazil, Russia, India, China and South Africa — is set to invite Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates to join, Ramaphosa said in a speech published on the X social media platform, previously known as Twitter. The new composition of BRICS will control 80% of world oil production. The same goes for the sharp GDP growth of the new BRICS countries. It will amount to 30% of world GDP and exceed $30 trillion. Source: Sprinter, MoneyRadar

Investing with intelligence

Our latest research, commentary and market outlooks