Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Magazine covers happen to be quite effective as contrarian indicators (i.e peak pessimism usually takes place at the bottom; peak optimsim at the top).

Could The Economist cover page on #china (Xi's failing model) coincide with a bottom for Chinese equities? China stocks surged on Monday after authorities announced a package of measures over the weekend to boost investor confidence, including halving the stamp duty on stock trading. China’s blue-chip CSI 300 Index jumped roughly 3% in early morning trade, on course for its best day since November, while the Hang Seng benchmark advanced more than 2%.

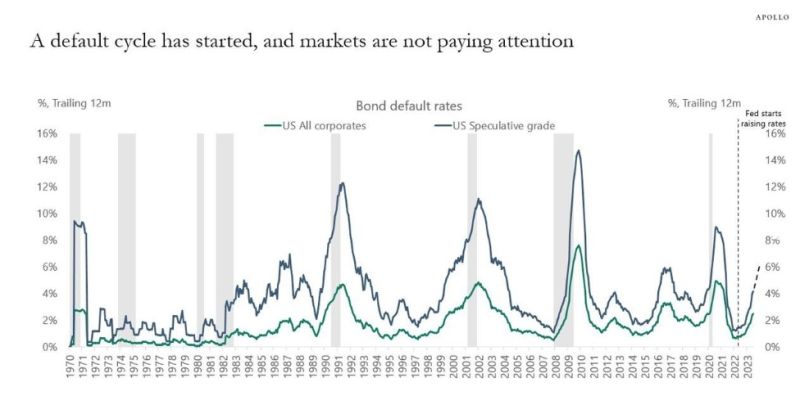

As Torsten Slok from Apollo posted this weekend, a US corporate default cycle has started the markets are not paying attention

Source: Vignesh Vijayakumar

JACKSON HOLE: A RISK MANAGEMENT SPEECH

FACTS: The overall tone of Chair Powell’s Jackson Hole speech was relatively hawkish but not as hawkish as some feared on the back of recent strong data. It was also less hawkish than last year. The main message is that The Fed is definitely on hold but leaning on a more hawkish stance should data don’t show more progress in inflation / growth cooling down. OUR TAKE: The big event is now behind us, and we didn’t learn anything new. Powell believes that monetary policy is tight, but he opens the door to an even tighter one. With regards to macro data, they are going into the right direction but there is a risk of further upside, i.e interest rates path remains very data dependent which means that markets will now turn its attention to PCE inflation and US jobs data (next week). The Fed is likely to stay nervous as long as they see evidence of a serious break in job growth below the 200K pace. We are not there yet, which means that in the coming weeks, we will likely see macro volatility leading to market volatility. Our view remains that central bankers want first and foremost to avoid the big mistake (rather than targeting a pre-defined target). In the previous decade, central bankers wanted to avoid the deflation trap, hence the over-printing. This time, they want to avoid the risk of another round of inflation. Hence the temptation of over-tightening. MARKET REACTION: Rate-hike expectations initially moved lower but then reverted higher after investors actually read and listened to his speech. 2Y yields are back to July highs and equity markets are whipsawing.

“I am so clever that sometimes I don't understand a single word of what I am saying.” — Oscar Wilde

Source: Philosophy Quotes

The U.S. has accumulated as much debt in the last 10 years as in the entire 100 years before that

From 1923 - 2013: $16 trillion , From 2013 - 2023: $16 trillion Source: FRED

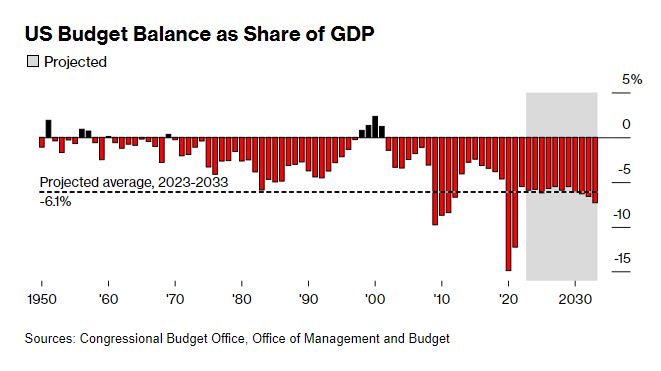

US Budget Deficits Are Exploding Like Never Before

Some economists and investors warn that the Biden administration’s fiscal spending—it’s pouring hundreds of billions of dollars into programs to bolster domestic manufacturing of electric cars and semiconductors, and to repair roads and bridges—could rekindle inflation and make it hard for the Fed to dial back its rate hikes. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks