Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

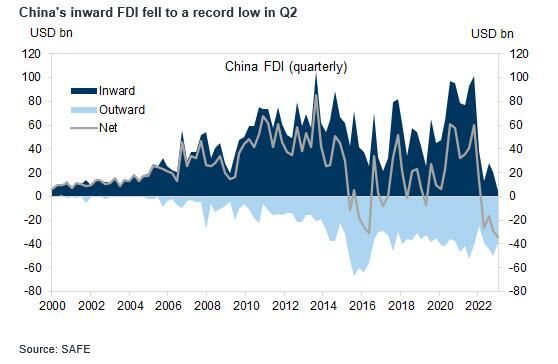

China's Inward Foreign Direct Investment Falls To The Lowest Level On Record...

Indeed, Inward FDI fell further in Q2: The preliminary Q2 Balance of Payments (BOP) data released last week showed China's current account still enjoys a healthy surplus, but the financial account continues to see notable net outflows. In particular, inward Foreign Direct Investment (FDI) fell to the lowest level since the series started in 1998. Source: SAFE, www.zerohedge.com

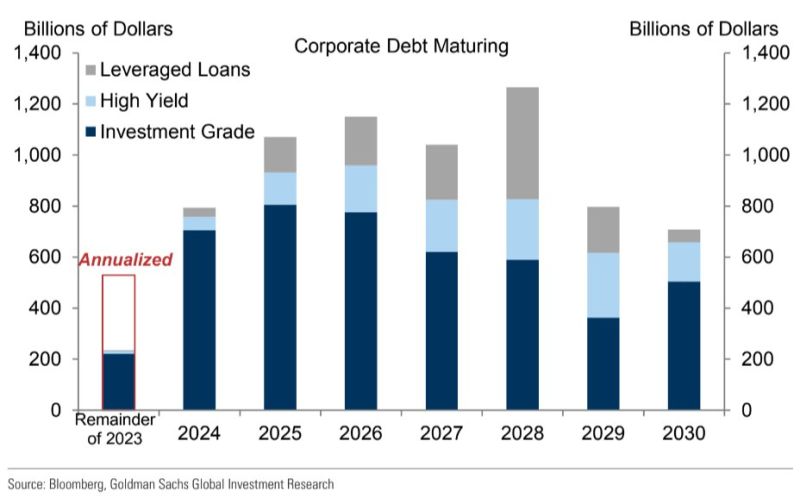

The US Corporate Debt Maturity Wall

$230bn ($525bn Annualized) of Corporate Debt Matures in the Remainder of 2023 $790bn matures in 2024 $1,070bn matures in 2025 Source: Ayesha Tariq, Goldman Sachs

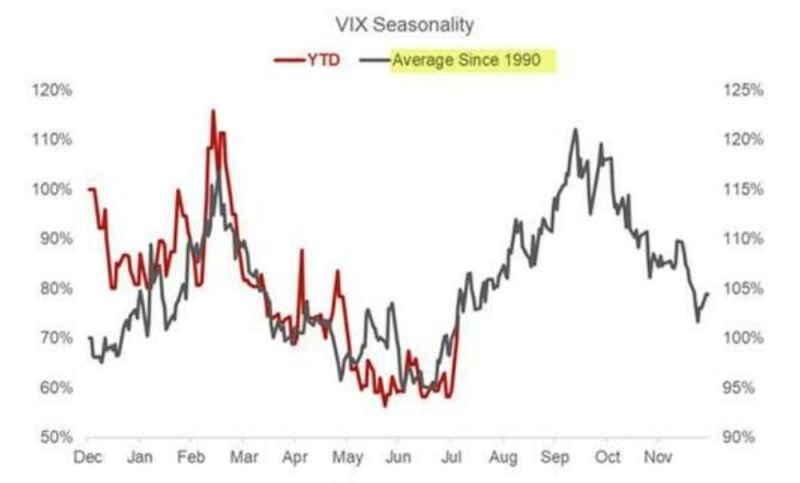

VIX seasonality suggest some volatile months ahead for stocks

Vix Seasonality

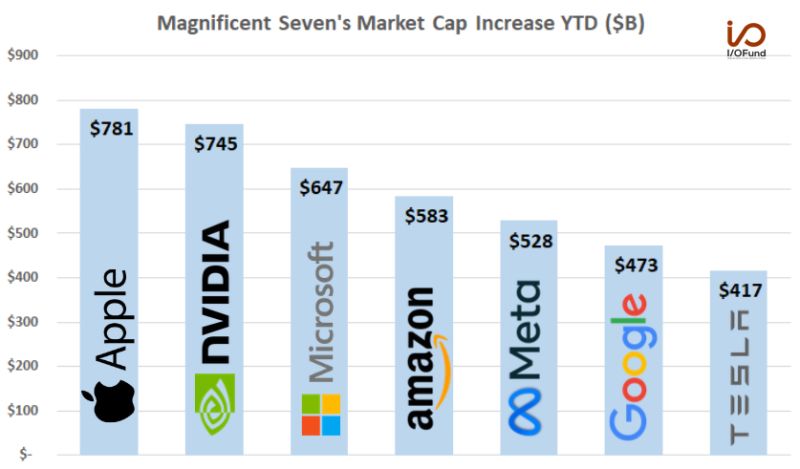

The Magnificent Seven have added nearly $4.2T in market cap this year, led by Apple’s $AAPL $781B increase and Nvidia’s $NVDA $745B rise

Microsoft $MSFT, Amazon $AMZN, and Meta $META all have added over $500B as well. Will it last? Source: Beth_Kindig

This could be a problem for sugar prices which already hit 12-year highs back in May

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks