Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

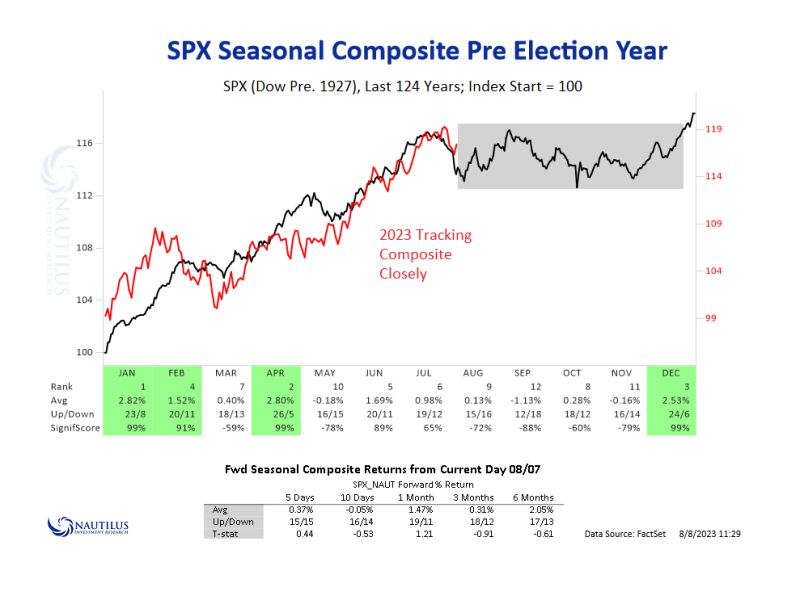

SP500 seasonality and 4-year cycle analysis suggests a consolidation before a year-end rally

Source: Nautilus Research

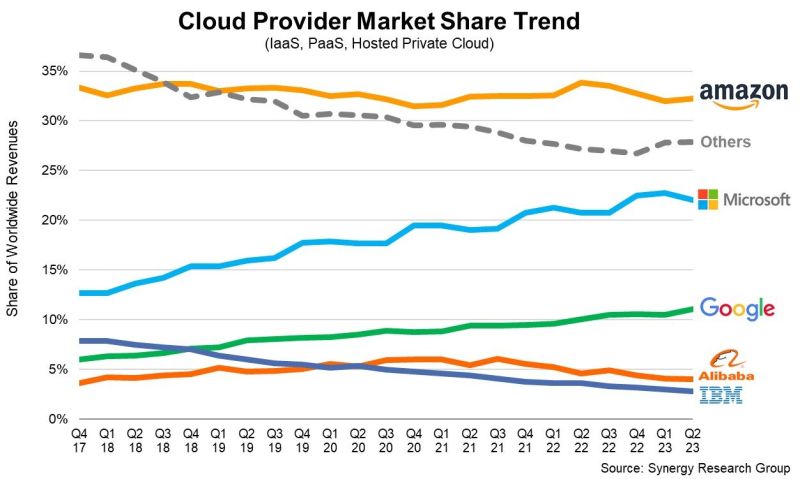

Cloud Infrastructure Services Market

$65 billion in spending in Q2 2023. → +18% Y/Y and +3% Q/Q. Market share: 🟧 $AMZN AWS 32%. 🟦 $MSFT Azure 22%. 🟩 $GOOG GCP 11%. Big 3 = 65% of the market. Estimates by Synergy Research Group. Source: App Economy Insight

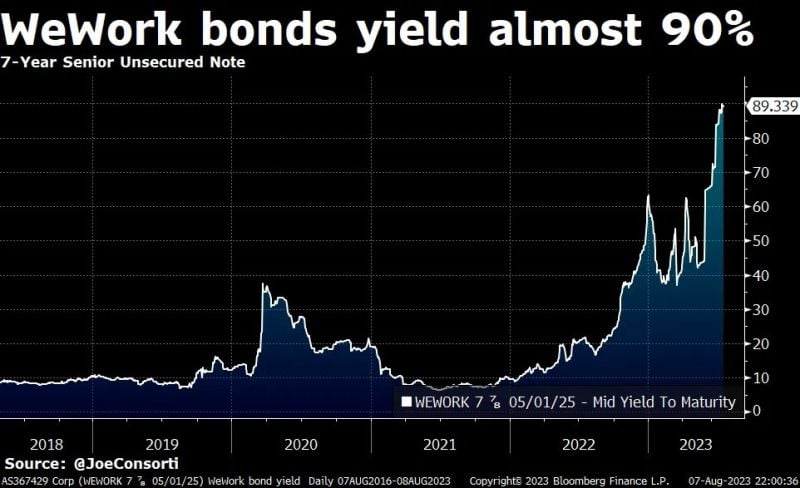

WeWork bonds yield almost 90%

When they mature in 2025, what will #wework do? Borrow again or sell its assets? tThere doesn't seem to be any 'soft landing' for US office space... Source: Joe Consorti, Bloomberg

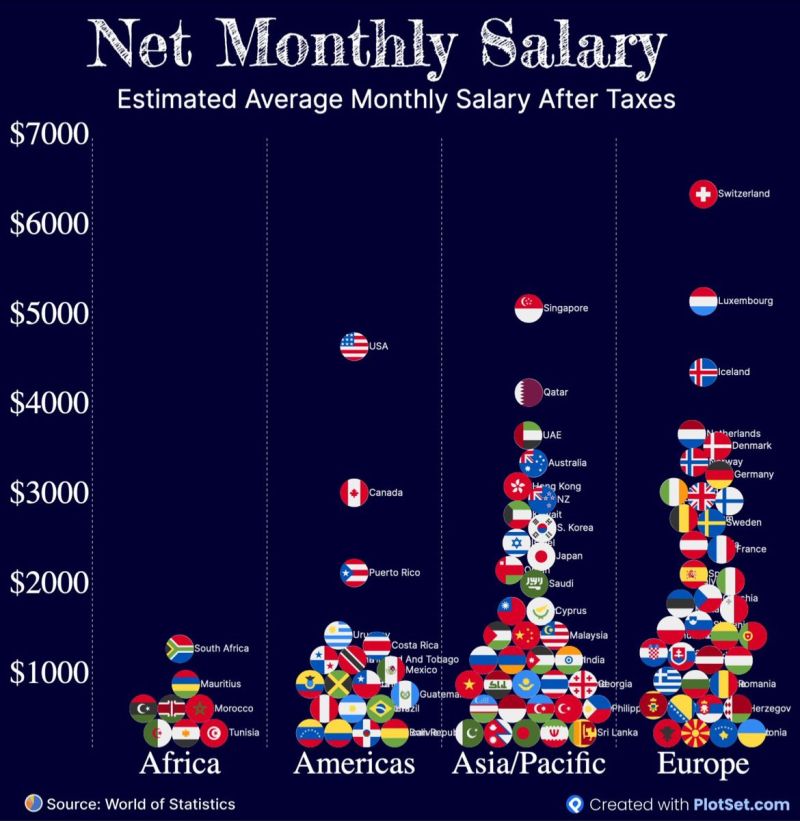

Average monthly salary after tax:

Source: World of statistics

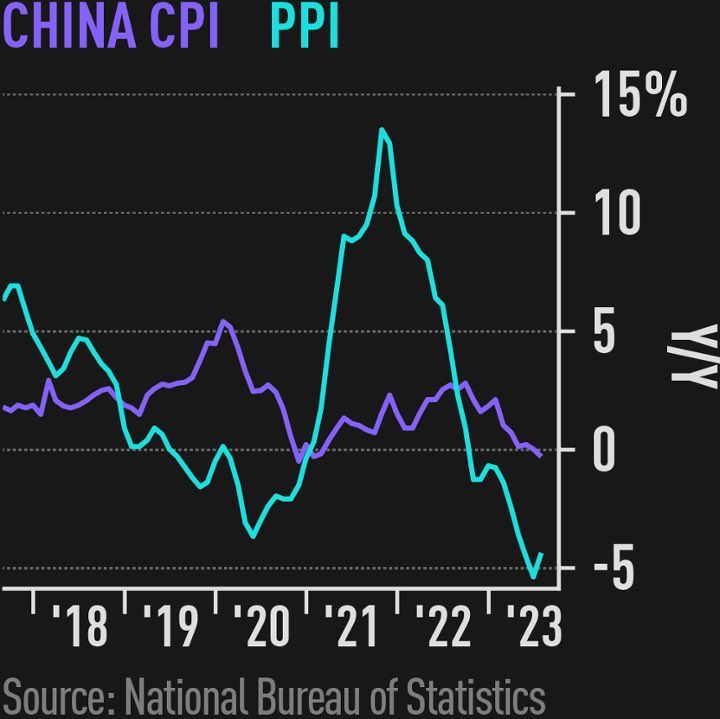

China's consumer and producer prices both declined in July for the first time since November 2020, a sign of deflation pressure amid weakening demand

CPI dipped 0.3% from a year earlier while PPI retreated for a 10th consecutive month, sliding 4.4%. "China is in deflation for sure," said Robin Xing at Morgan Stanley. "The question is how long." The statistics bureau attributed the CPI decline to the high base of comparison, saying the dip is likely to be temporary. Source: J-C Gand

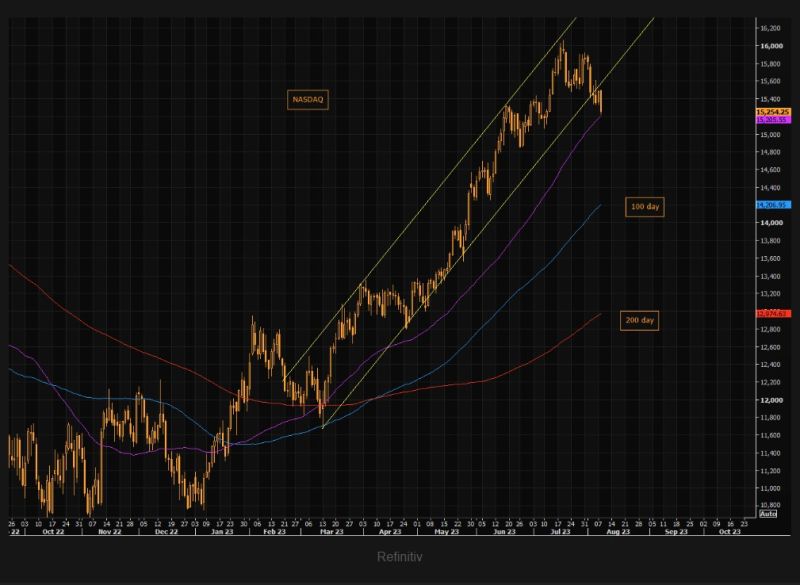

NASDAQ is currently trading right on the 50 day moving average

15200 is a short term level to watch, but the bigger support is at 15k. NASDAQ is now established "well" below the channel. Source: The Market Ear, Refinitiv

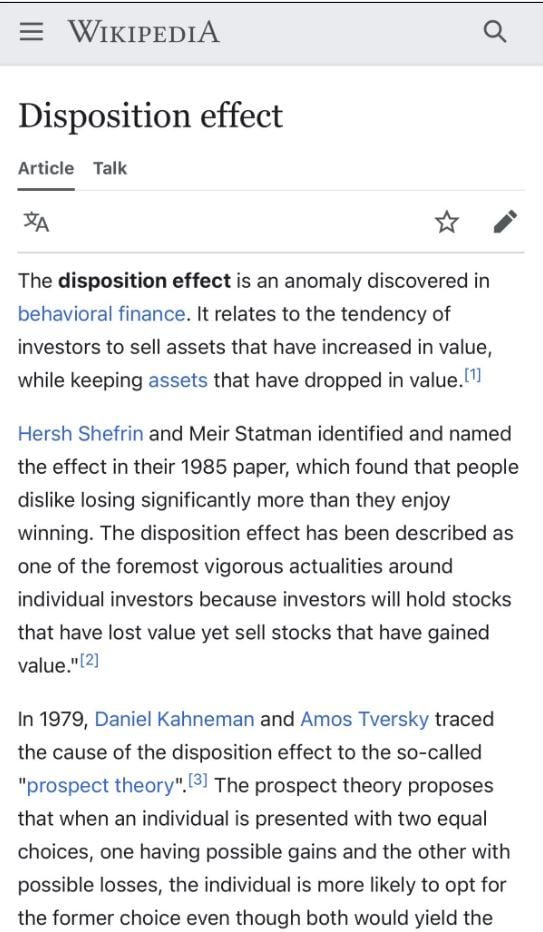

Have you heard about the "disposition effect" aka the tendency of investors to sell assets that have increased in value?

As momentum roll-over, can this #behavioralfinance bias trigger a sell-off of the "Magnificent 7" (Apple, Nvidia, etc.) in teh US and the GRANOLAS (LVMH, L'Oréal, etc,) in Europe?

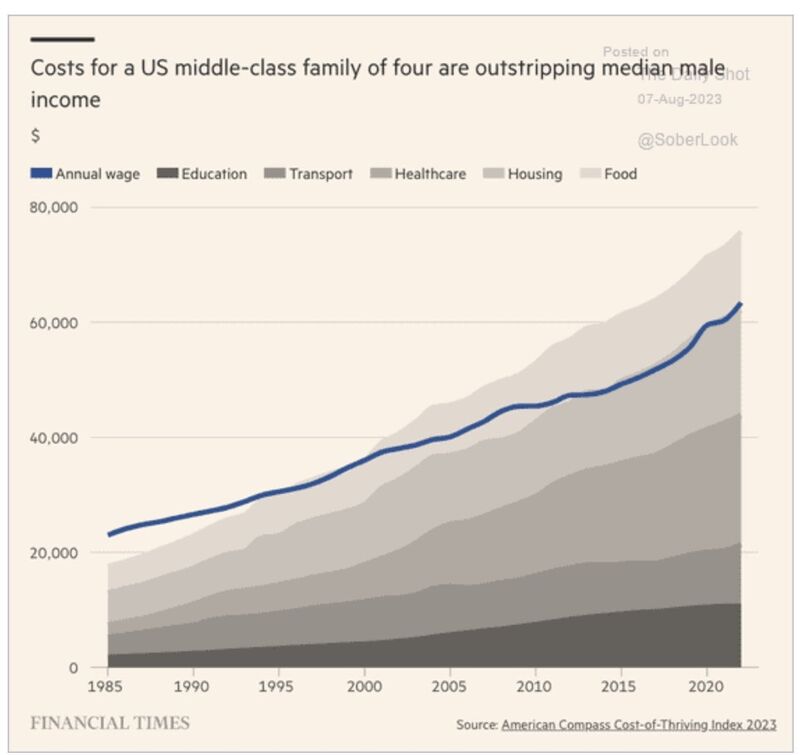

Financial demands of supporting a US family of 4 have surpassed what a single salary can adequately provide

Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks