Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

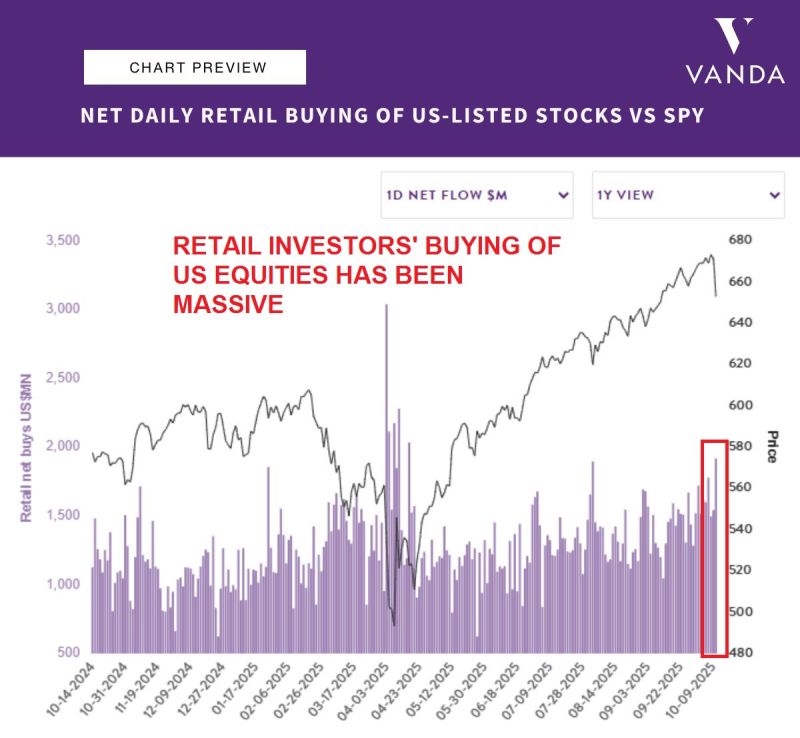

Retail investors bought nearly $2 BILLION of US stocks on Friday, Oct 10, following the market pullback.

This marks the BIGGEST buying day since the April 2025 sell-off and one of the largest on record. Mom-and-pop investors are still buying the dip. Source: Global Markets Investor, Vanda

US-China: some "positive" comments by Trump on Fox News overnight

“I'm not looking to destroy China” “China’s President XI is a smart man who is open for a deal” TRUMP CONFIRMS HIS MEETING WITH XI IS STILL ON. HE SAYS THINGS COULD CHANGE QUICKLY.

China’s gross domestic product expanded by 4.8% in the third quarter from a year ago, a slowdown from 5.2% in the second quarter, and the weakest in a year.

👉 Fixed-asset investment, which includes real estate, unexpectedly FELL by 0.5% in the first nine months of the year (Analysts polled by Reuters had forecast a 0.1% growth). This drop is alarming. The last time China recorded a contraction in fixed-asset investment was in 2020 during the pandemic, according to data going back to 1992 from Wind Information. The single-month September FAI declined by 9.8% based on estimates !!! 👉 Industrial production grew by 6.5% year-on-year in September, faster than the 5% forecast and 5.2% growth in the prior month. 👉 Retail sales rose 3% in September from a year ago, matching analyst forecasts. Source: CNBC, Augur Infinity

The performance gap between $QQQ and $BTC is widening again, and this time more dramatically.

Usually BTC and QQQ are mostly correlated until recently. Something has to give. Will QQQ go down to play catchup? Will BTC go up to play catchup? Will it be a blend of both? Source: Heisenberg @Mr_Derivatives

China Sept. used home prices -0.64% m/m; drop faster than Aug.

China Sept. new home prices -0.41% m/m; drop faster than Aug. China's largest asset by a factor of 2 continues to disintegrate... Source: zerohedge, GS

Liquidity back to normal? Standing Repo facility (SRF) usage from $8.35BN to $0

Note however that SRF dropping to zero doesn’t mean liquidity is back to normal. It just means no one tapped it today. The stress can still be there, just shifted elsewhere. Time will tell.

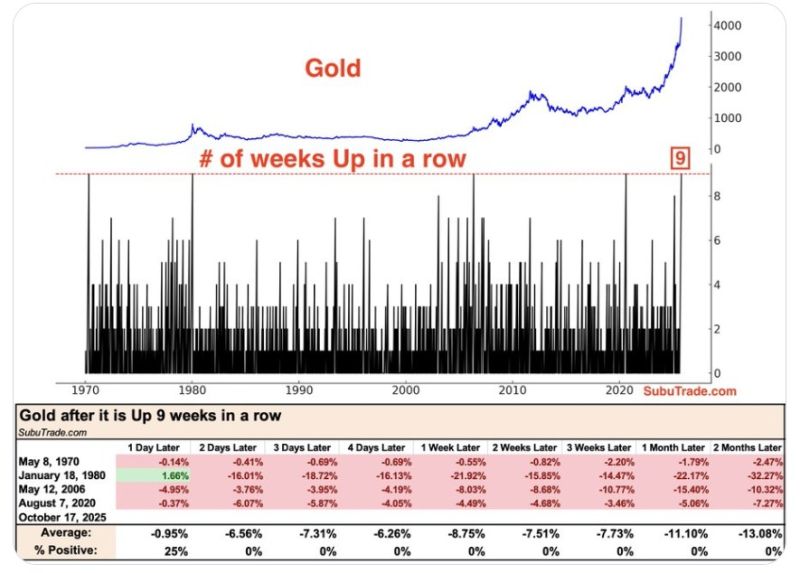

Gold is Up 9 weeks in a row.

Gold has never gone up 10 weeks in a row before. Source: Subu Trade on X

Investing with intelligence

Our latest research, commentary and market outlooks