Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

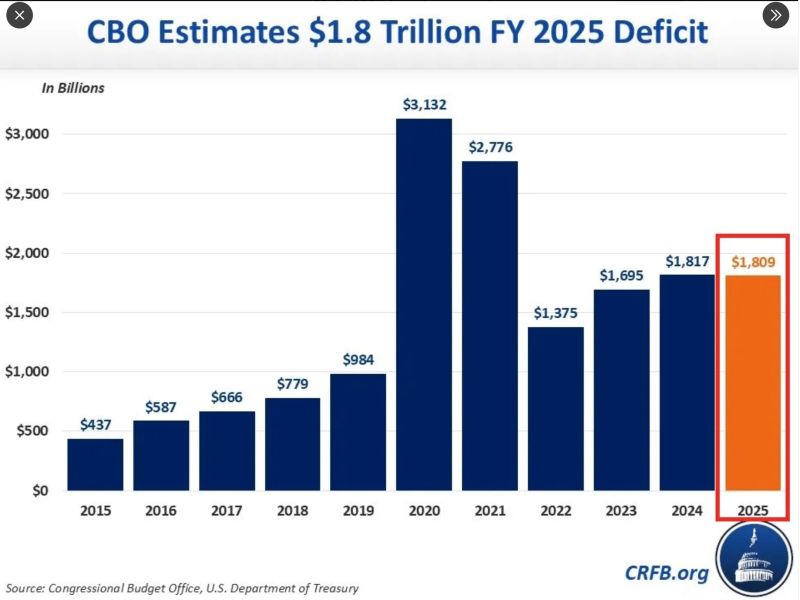

🔴 The US government posted a $1.8 TRILLION (6% of GDP) budget deficit in Fiscal Year 2025, which ended in September.

This matches the 3rd-largest budget gap in HISTORY. Revenues hit $5.2 trillion while spending $7.0 trillion. Source: Global Markets Investor

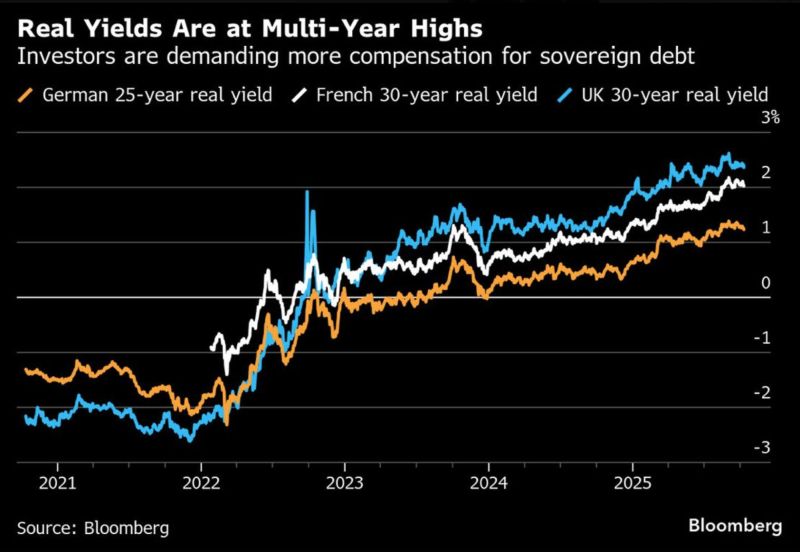

From Bloomberg:

“Bond holders want an ever-higher premium to hold the debt of developed-nation governments as turmoil in France and Japan underscores how politics is eclipsing central bank policy globally as a key market driver.” Source: Mohamed A. El-Erian @elerianm

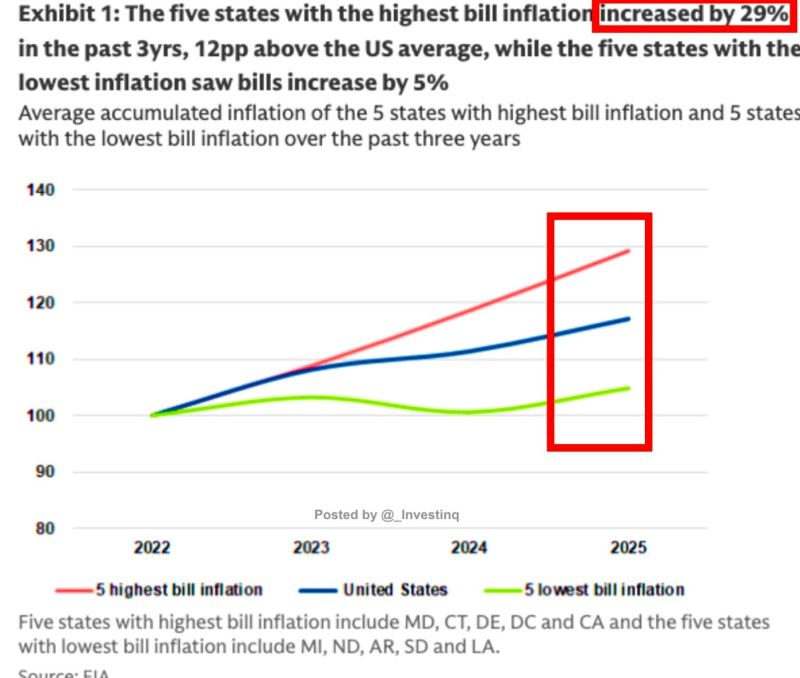

Power Bills Surge in Deregulated States:

Over the past three years, residents in Maryland, Connecticut, Delaware, D.C., and California have seen electricity bills jump 29%, about 20 percentage points higher than overall inflation and well above the national average. By contrast, regulated states like Michigan, North Dakota, Arkansas, South Dakota, and Louisiana experienced only about a 5% rise in power costs Source: StockMarket.News @_Investinq

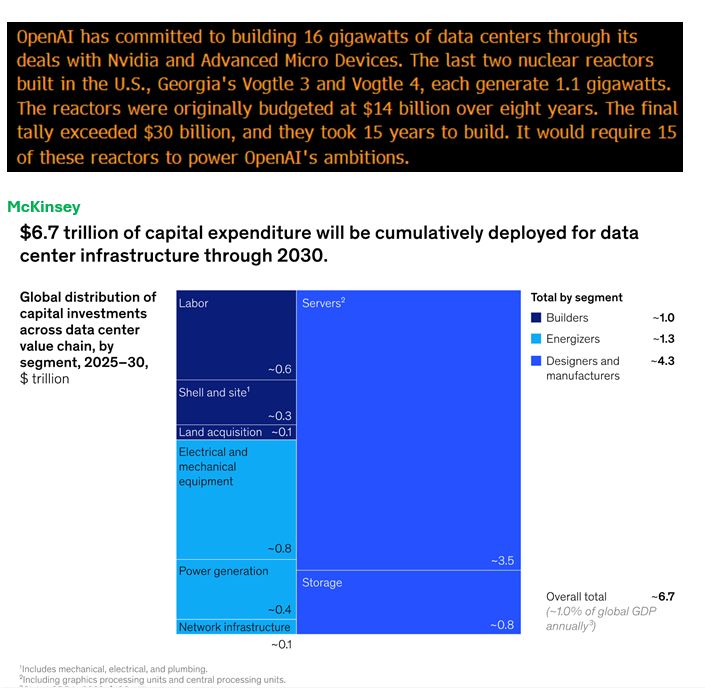

Quotes from Barron's & chart from McKinsey on AI CAPEX...

Source: Bloomberg, McKinsey, RBC

Silver is putting in an absolutely huge shooting star candle. We need a confirmation, but this one is very big so watch out!

The $50 resistance remains a big one. Source: The Market Ear

The U.S. just finalized a $20 billion currency swap deal with Argentina and is now directly buying Argentine pesos to help stabilize the collapsing currency.

This comes just a day after Argentina’s short-term yields exploded to 87% as President Milei burned through reserves to defend the peso before the October 26 elections. The new U.S. support marks a dramatic intervention aimed at restoring liquidity and easing pressure on Argentina’s financial system, which has been teetering on the edge after weeks of heavy dollar sales and record borrowing costs. Source: StockMarket.news

Mighty Dollar...

The dollar index $DXY is taking out range highs, closing well above the 50 and the 100 day moving averages. We haven't seen the DXY close "properly" above the 100 day since the dollar bear started earlier this year. Not good short term news for the gold and precious metals space. Source: The Market Ear

Investing with intelligence

Our latest research, commentary and market outlooks