Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

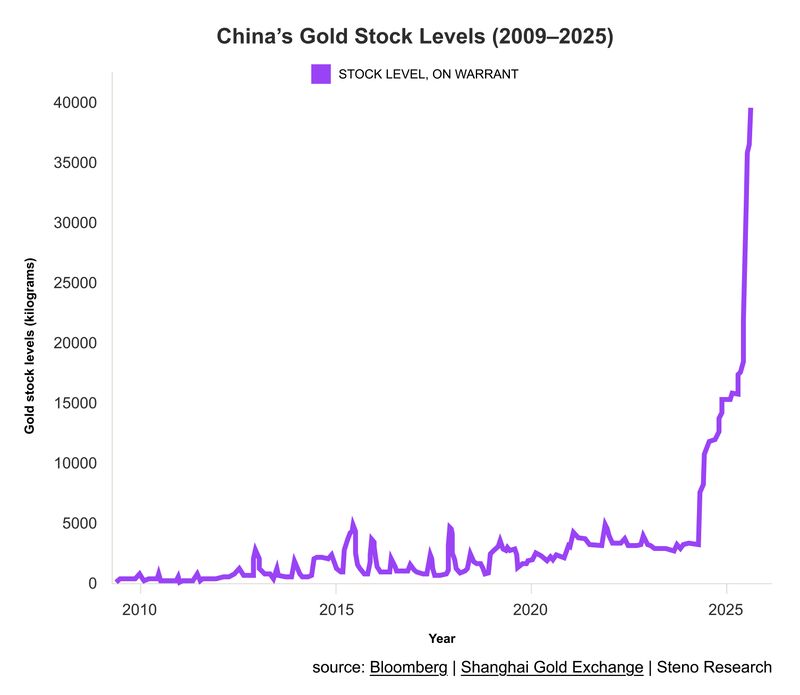

When geopolitical & socio-economic tensions rise, both people & nations turn to hard assets.

One big buyer in particular has been Beijing. China has been swapping Treasuries for gold for years, lifting reserves to over 74m ounces. 👉 This is a reflection of both state policy and popular sentiment: hedging against dollar risk, sanctions, and China’s own shaky property and stock markets. Source: Chamath Palihapitiya @chamath, Steno Research, Bloomberg

Gold is now above $4,000/oz, and who would’ve thought silver would remain this cheap relative to gold?

Source: Tavi Costa, Macro Trends

The United States has approved several billion dollars worth of Nvidia’s chip exports to the UAE, as per Bloomberg.

Nvidia is hitting all time highs. Source: The National News, it@amitisinvesting

Without data centers, GDP growth was 0.1% in H1 2025, Harvard economist says.

The US economy growth is a tale of 2 worlds with a "K-shape". On one hand, genAI / tech spending and upper income consumers. They are in great shape. On the other hand, all the rest (low/mid income, manufacturing, etc.). They are struggling Will deregulation, fiscal & monetary stimulus + low oil prices help to make growth more balanced? Or will it end boosting even more the upper part of the K???? How long can it last?

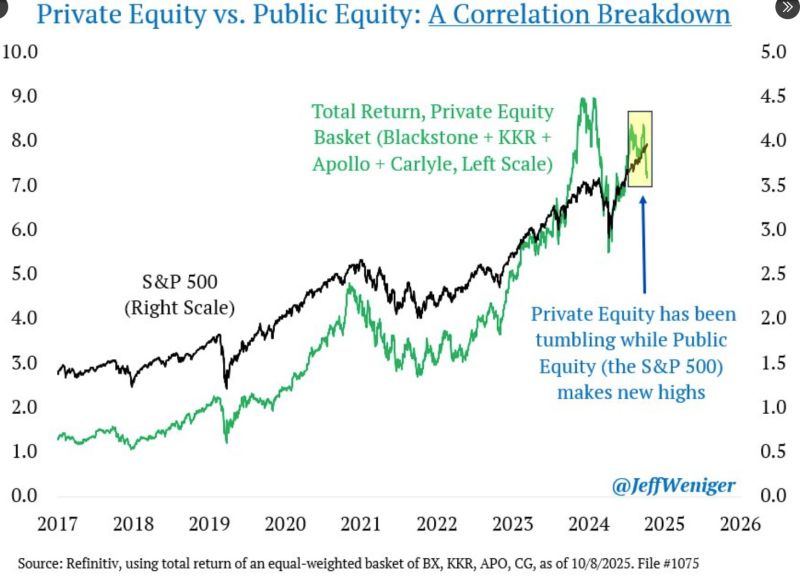

A correlation breakdown:

Private equity stocks (Blackstone, KKR, Apollo, Carlyle) dropped 14.5% in just 3 weeks, while at the same time the S&P 500 just hit another high. What does it mean? Source: Jeff Weniger, Refinitiv

In August '25, German industrial production collapsed 4.3% m/m.

Germany is headed for the third consecutive recession year. To Dr Polleit, the "Great Reset" is destroying industrual production and economic growth in Germany. ➡️ Polleit is a German economist affiliated with the Austrian School of economics, and president of the Ludwig von Mises Institut Deutschland. Mises Institute. He is strongly skeptical of state intervention, central banking, fiat money, and what he sees as coercive economic planning ➡️Polleit general critiques on Germany are the following: 👉 Heavy regulation, strong state involvement 👉Germany’s ambitious transition from fossil fuels to renewables may cause disruptions in energy supply, cost volatility, grid stresses, and increase production costs 👉Export dependence and global competition 👉Monetary and fiscal pressures reduce real returns on capital and discourage long-term investment. 👉Uncertainty and investment risk 👉With more government programs, state investment, subsidies, and oversight, private actors may be crowded out or discouraged. Polleit would claim that entrepreneurship and innovation decline. 👉Central planning or incentive distortions lead to misallocation of capital. Polleit warns that “green subsidies” or mandated transitions may favor politically connected actors rather than the most efficient ones. 🚨 Hence, under Polleit’s logic, Germany — already having high regulation, energy transition burdens, export dependency, and significant state involvement — would be particularly vulnerable to further growth suppression from Great Reset-type policies. He would argue that growth is slowly being “destroyed” by compounding layers of regulatory, monetary, and fiscal drag. Source: Thorsten Polleit @ThorstenPolleit on X

Investing with intelligence

Our latest research, commentary and market outlooks