Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

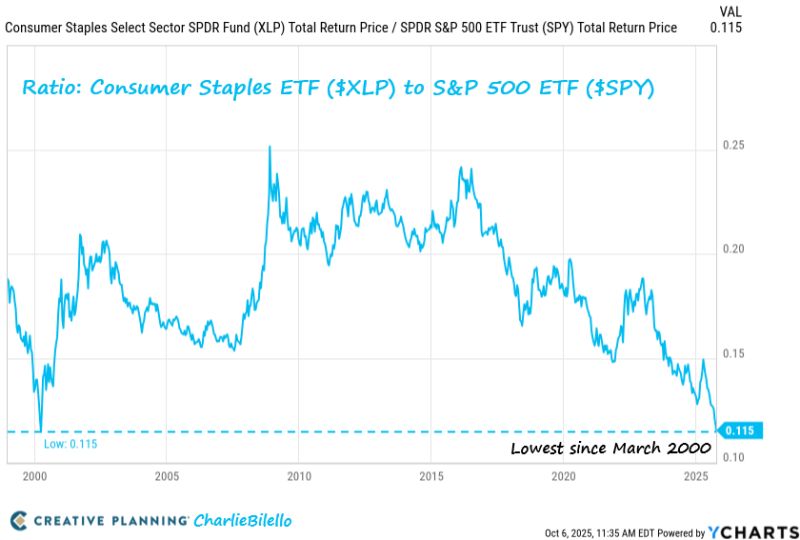

The Ratio of the Defensive Consumer Staples ETF to the S&P 500 has moved down to the lowest level since the dot-com bubble peak in March 2000.

$XLP $SPY Source: Charlie Bilello

NVIDIA now has a greater market cap than the entire German stock market and the entire Italian stock market…

Combined. Source: Peter Mallouk @PeterMallouk

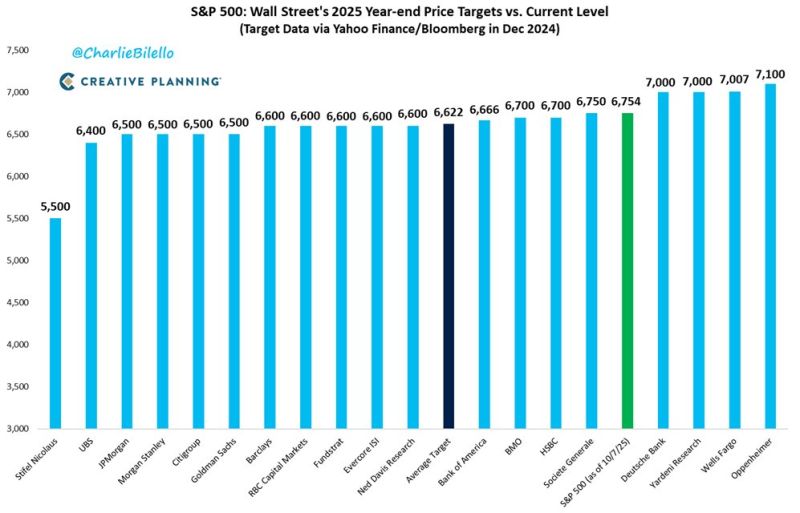

If the S&P 500 gains another 5% from here until December 31, it will exceed every single Wall Street price target for the 3rd consecutive year.

$SPX Source: Charlie Bilello

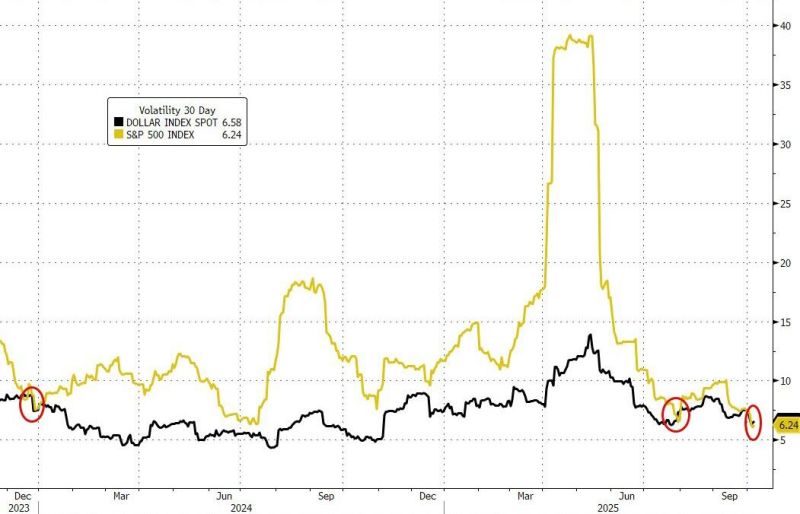

Over the last 1 month, the US dollar has been more volatile than the S&P500.

As Goldman Sachs Brian Garrett notes, this has happened twice in the last 7 years (Dec 2023 and Jul 2025)... Source: zerohedge

The OpenAI deal framework is very concentrated into a few companies

Source: Lance Roberts @LanceRoberts

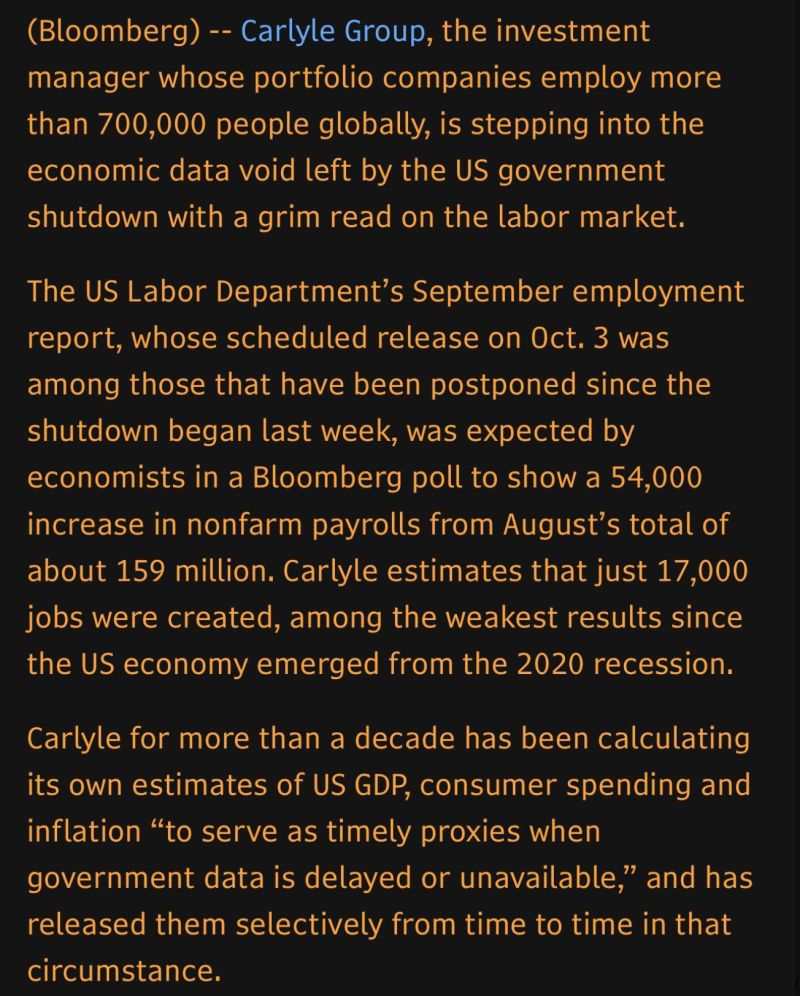

Carlyle Group says the US job market is absolutely finished.

Source: Bloomberg, Spencer Hakimian

Investing with intelligence

Our latest research, commentary and market outlooks