Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

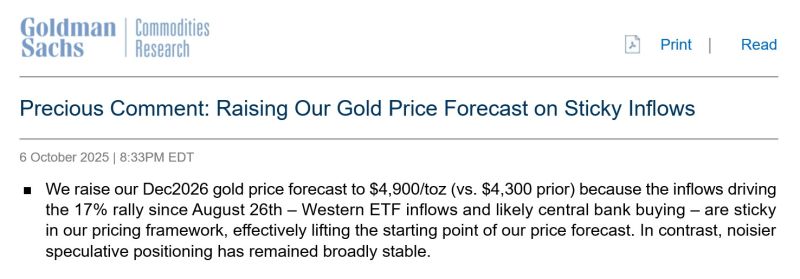

Goldman is raising their gold price Dec2026 forecast to $4,900 (prior $4,300)

Source: Goldman Sachs

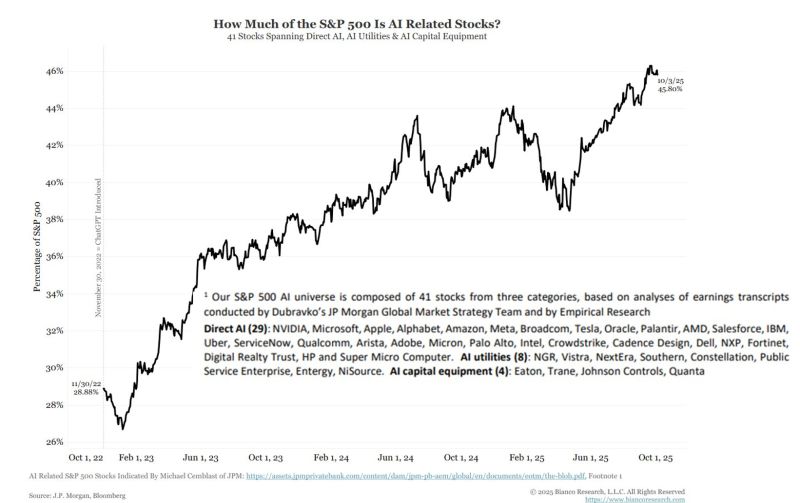

How much of the S&P 500 is AI related stocks?

JP Morgan has identified 41 "AI-Related" stocks. As this chart shows, they are now 45% of the S&P 500. Source: Bianco Research

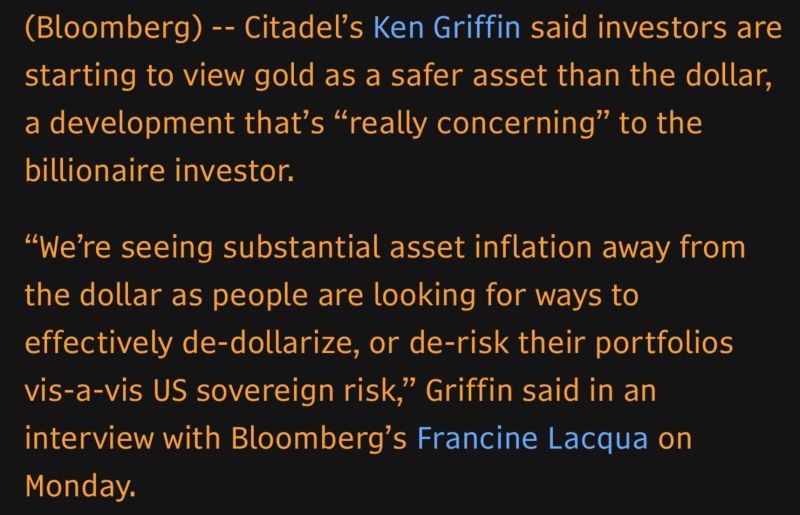

Ken Griffin says investors are flocking to gold and ditching the dollar to “de-risk their portfolios from U.S. sovereign risk.”

Source: Bloomberg

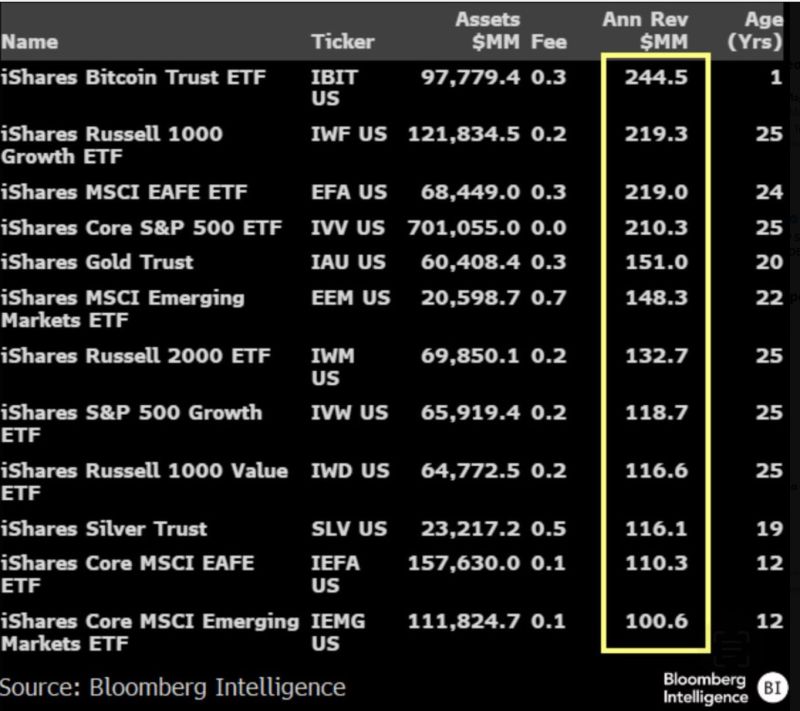

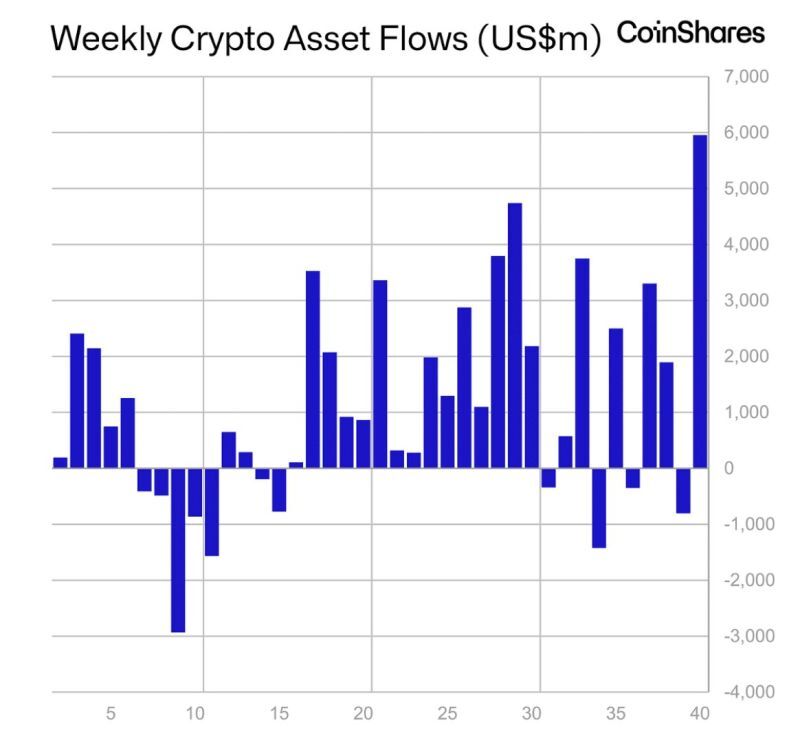

Crypto saw an inflow of nearly $6 Billion last week, the largest weekly inflow in history 🚨🚨

Source: Barchart, Coinshares

Investing with intelligence

Our latest research, commentary and market outlooks