Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

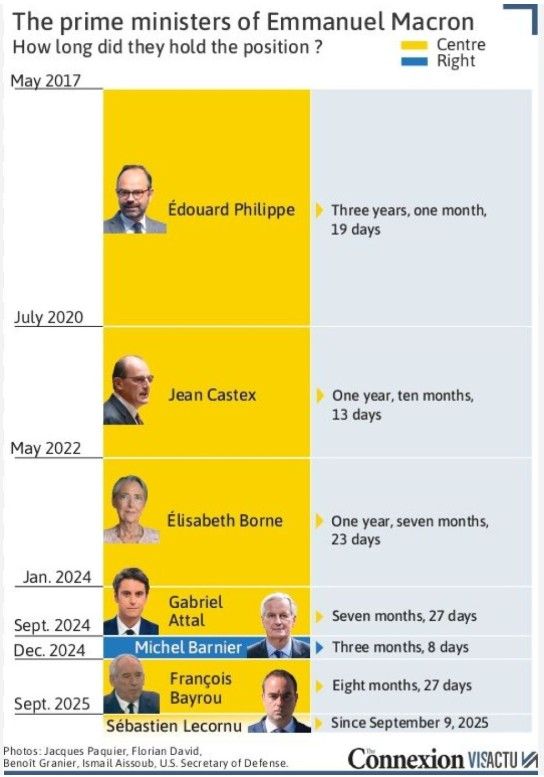

France changes its Prime Ministers more often than some people buy new underwear...

Source: Connexion VisActu

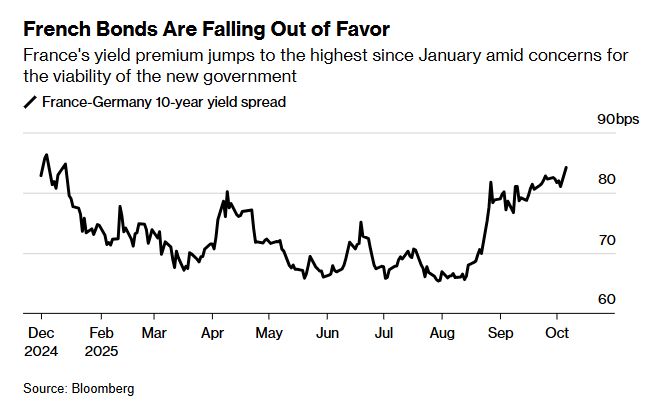

France bond risk hits Nine-Month high amid fears over government - Bloomberg

France’s new Prime Minister Sebastien Lecornu has resigned just weeks after his appointment, plunging the country into a fresh political crisis. Lecornu, France’s fifth PM in less than two years, had his work cut out to convince the country — and investors — that he could unite a fractious and divided parliament enough to get a 2026 budget over the line. With the prospect of a state budget being passed now in doubt, French markets reacted strongly to the news, with the yield on the 30-year government bond, or OAT, hitting a one-month high of 4.44% before retreating slightly. The yield on the benchmark 10-year bond rose to a 10-day high of 3.599%. Meanwhile, France’s CAC 40 index slumped 2.0% and the euro fell 0.7% against the dollar - CNBC

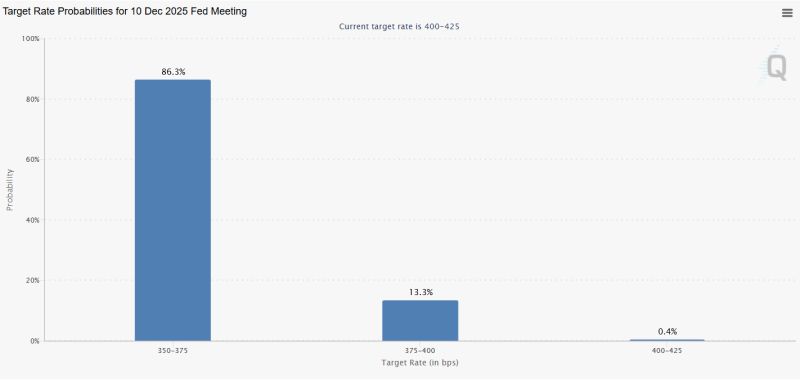

LATEST: December has an 86.3% of another rates cut.

That would make it 2 rates cuts before 2026. Source: Cointelegraph, CME Fed Watch

Key Upcoming Events This Week:

Tuesday - NY Fed Inflation Expectations data Wednesday - Fed meeting minutes release Thursday - Fed Chair Powell speech Friday - MI Consumer Sentiment & Expectations data, September Jobs Report (if govt shutdown ends) Source: investing.com

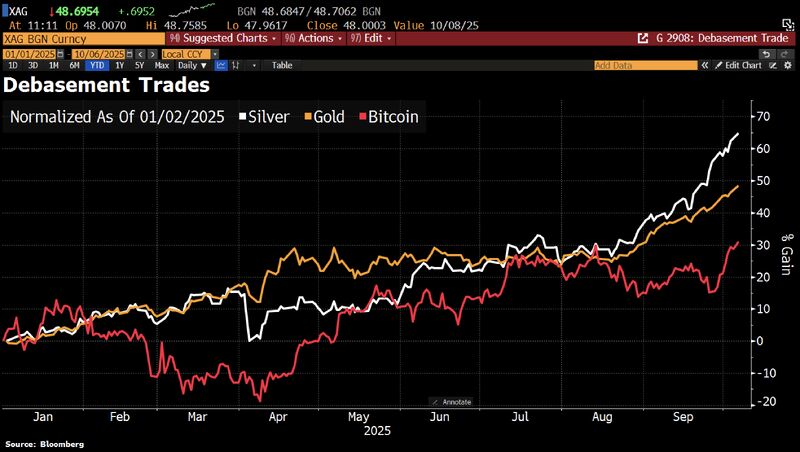

Debasement Trade propels Gold, Silver and Bitcoin as investors flock to the perceived safety of real assets while pulling away from major currencies.

The Yen tumbled on Monday as pro-stimulus lawmaker Sanae Takaichi was set to become Japan’s next PM. The dollar, which has weakened about 30% against Bitcoin this year, remains under pressure as the US government shutdown drags on. The euro has its own problems w/fresh political uncertainty brewing in France. Source: Bloomberg, HolgerZ

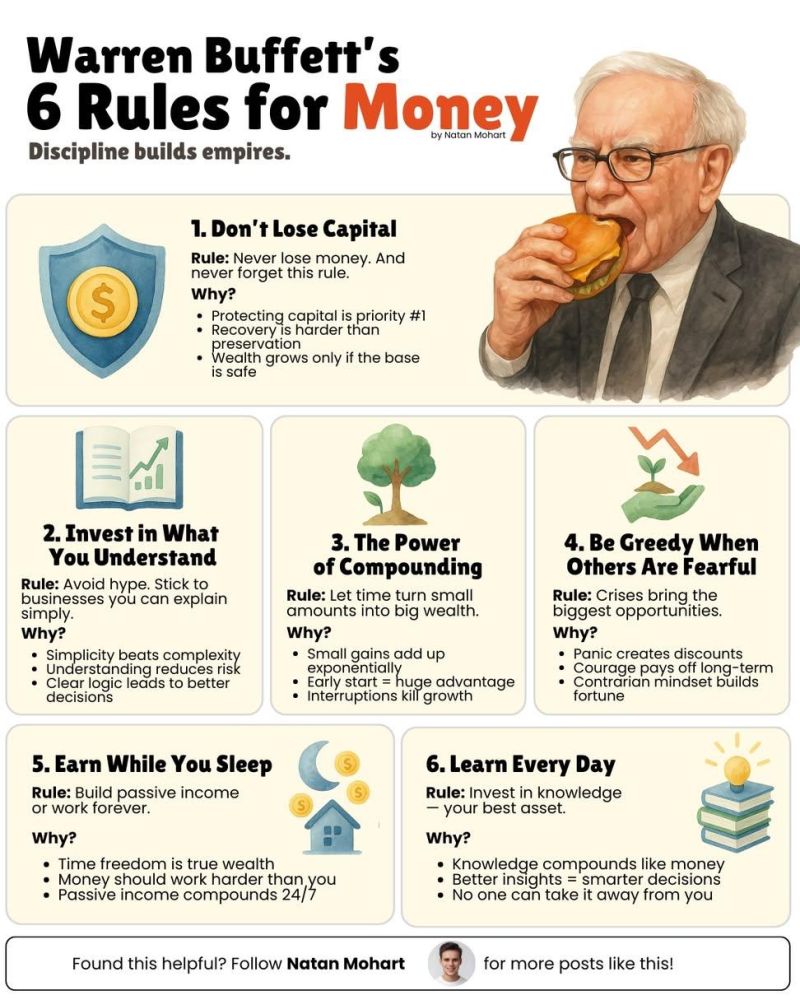

Warren Buffett's 6 rules for money

Source: Investment Books (Dhaval) @InvestmentBook1

As pointed out by Tavi Costa, mining stocks, despite their strong recent performance, are actually LESS expensive than before.

Indeed, P/E ratios have actually contracted, a sign that earnings are growing faster than share prices. ➡️ If gold prices hold steady or move higher, these companies could post some of the highest profit margins in the industry's history…. Source: Tavi Costa, Bloomberg

Foreign holdings of US equities have crossed above $20 trillion, a record high.

30% of the total US stock market is now held by foreign investors, the highest percentage on record with data going back to 1945. Source: Charlie Bilello, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks