Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

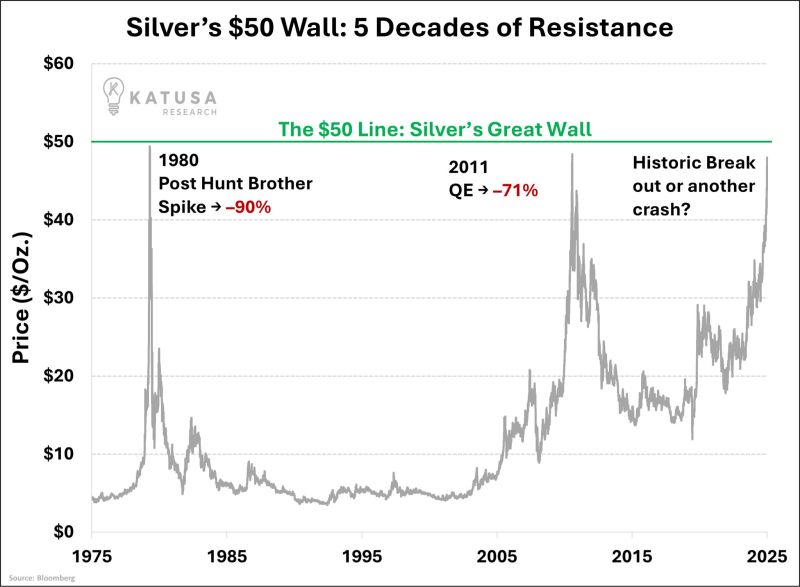

Silver’s approaching the level that destroyed it twice

1980 → down 90% 2011 → down 71% Will it be the breakout of a lifetime or another déjà vu? Source: Katusa Research

From the FT article on “Labour markets stuck in a ‘low hire, low fire’ cycle”:

“Labour markets in many leading economies are freezing up as uncertainty over trade, tax and artificial intelligence causes employers to put off hiring and firing and employees to stick with their jobs.”

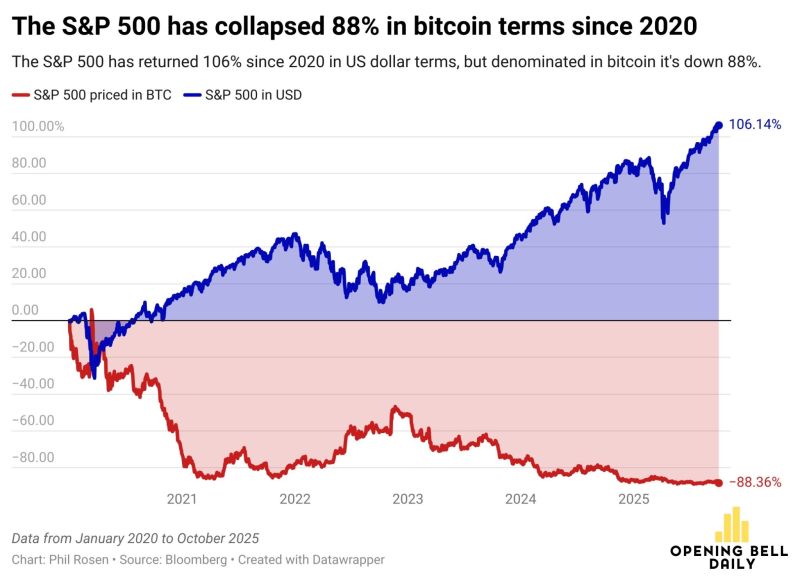

The S&P 500 is up more than 100% since 2020

But the index is actually down 88% when priced in a hard asset like bitcoin. Source: Anthony Pompliano 🌪@APompliano (H/t @philrosenn)

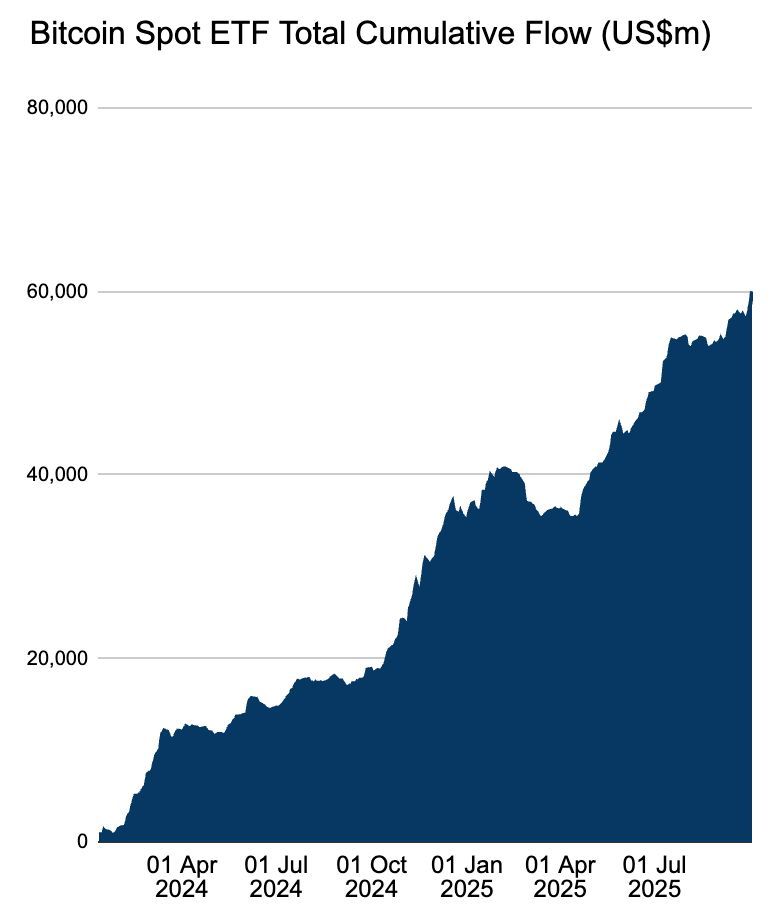

It's liquidity stupid!

Strong M2 growth in China, and to a smaller extent Brazil and India, add to the ongoing expansion of M2 in the United States and in Europe. Our Global M2 proxy continues to point to a broadly supportive liquidity environment for risk assets. The S&P 500 continues to follow the evolution of our Global M2 proxy with an 11-week lag. Bitcoin has desynchronized from our Global M2 proxy since mid-August but bounced up strongly last week. Will it catch up our Global M2 proxy (and rise toward 140k)? NB: liquidity is one risk assets driver among others. Past results do not guarantee future results

It seems that Russell 2000 small & mid caps ETF $IWM is joining the breakout party...

Source: Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks