Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

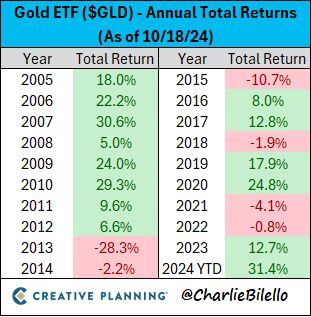

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Emancipation from the West and the quest for multipolarity is one one of the megatrend we are currently following.

The BRICS Summit in Kazan is one illustration of this trend. Narandra Modi on X: "With fellow BRICS leaders at the Summit in Kazan, Russia. This Summit is special because we welcomed the new BRICS members. This forum has immense potential to make our planet better and more sustainable". The “BRICspansion” is part of a plan to “reshape global governance into a ‘multipolar’ world order that puts voices of the Global South at the center of the world agenda. This megatrend have important consequences on the geopolitocal, macro and markets side. Among them: - De-dollarization and lower demand for US Treasuries - Reshoring, friendshoring, nearshoring - From "just-in-time" inventory to "just-in-case" inventory - Higher demand for commodities including precious metals - Structurally higher inflation

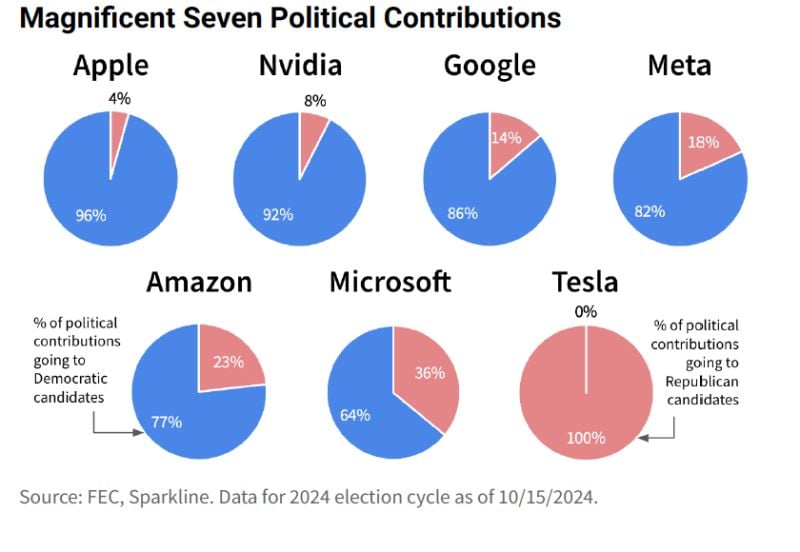

😱 The shocking chart of the day >>> Mag 7 political donations....one of these is not like the others...😱

Source: Meb Faber on X

“Discipline or regret: the choice is yours”

Source: Nigel D'Souza @Nigel__DSouza

JUST IN 🚨: Silver is going parabolic as it jumps to highest price in more than 12 years

Source: Barchart

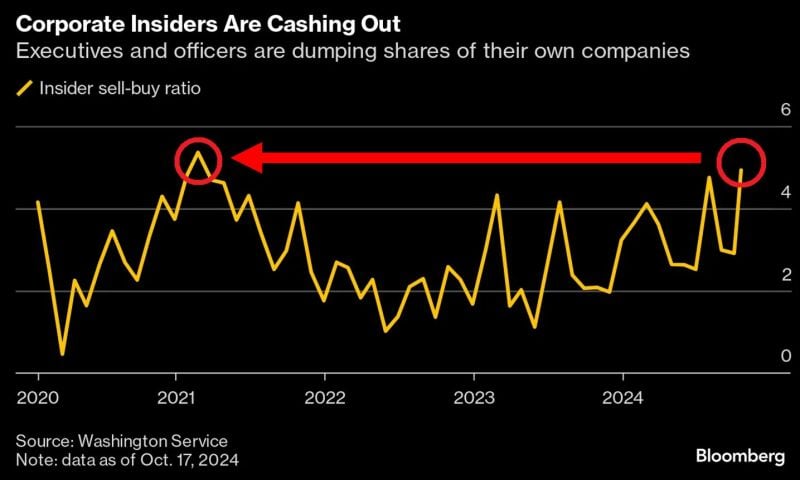

😱 US EXECUTIVES ARE SELLING STOCKS 😱

The insider sell-to-buy ratio jumped to the highest level since 2021. Source: Global Markets Investor, Bloomberg

*AMAZON $AMZN PREPARES FOR LAUNCH OF LOW-COST, TEMU-RIVAL DISCOUNT STORE $PDD

As initially reported back in June, Amazon is preparing for the launch of its new discount online storefront which will compete directly with Chinese e-Commerce rival 'Temu'. Strict "price caps" will be set for merchants, with shockingly low price limits, such as $8 for jewlery and $20 for sofas. Source: Stock Talk on X

Investing with intelligence

Our latest research, commentary and market outlooks