Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

President Trump says he is considering $1,000 - $2,000 stimulus checks for all taxpayers using tariff revenue.

Source; Geiger Capital on X

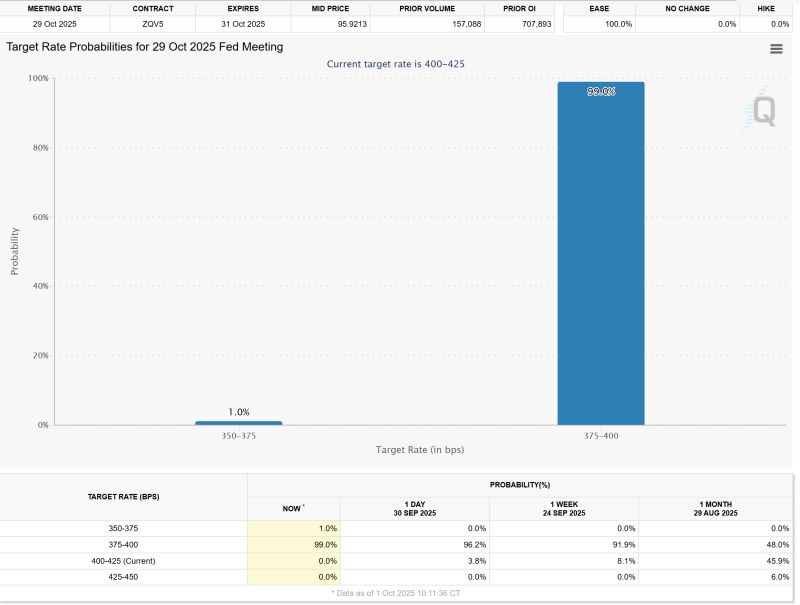

According to CME Fed watch tool, odds of a Fed rate cut in October are now 99%...

So done deal after the poor ADP payrolls numbers...

Kalshi is currently pricing in a 57% chance that the 🇺🇸 Government shutdown will last more than 10 days

Source: Kalshi

‼️Global central banks RATE CUT RUSH:

Central banks have slashed rates 168 times over the last 12 months, the fastest pace since the 2020 crisis. This is also the third-quickest pace over the last 25 years, behind the 249 rate cuts seen in the Great Financial Crisis. Source: Global Markets Investors, BofA

Nothing against Mexico, Singapore, or Oman; but...

Source: Michael Brown, Bloomberg

The move of the week!

Pharma stocks just had one of their strongest days in years, with large-cap names surging 9% after months of being stuck under political pressure. The move came from a wave of policy and industry news that reshaped how investors viewed the sector almost overnight. Here are the 3 catalysts: 1/ Trump’s announced a 100% tariff on imported branded and patented drugs. At first, markets braced for the worst. But as details came out, it became clear that the biggest U.S. players like Pfizer, Merck, Lilly, and J&J were largely shielded thanks to their heavy domestic production. Instead of being hurt, they were in position to benefit. 2/ Pfizer then cut a high-profile deal with the administration to lower Medicaid prices in exchange for tariff relief. That eased regulatory fears and sent a strong signal that other companies could strike similar deals, giving the market confidence that the sector had a workable path forward. 3/ The White House rolled out TrumpRx, a direct-to-consumer pharmacy platform designed to cut out middlemen and bring more predictability to drug pricing. Investors loved the idea of a simpler, more transparent system that reduces uncertainty around future profits. This trade goes into the "value with a catalyst" bucket... Source: Stockmarket.news, zerohedge

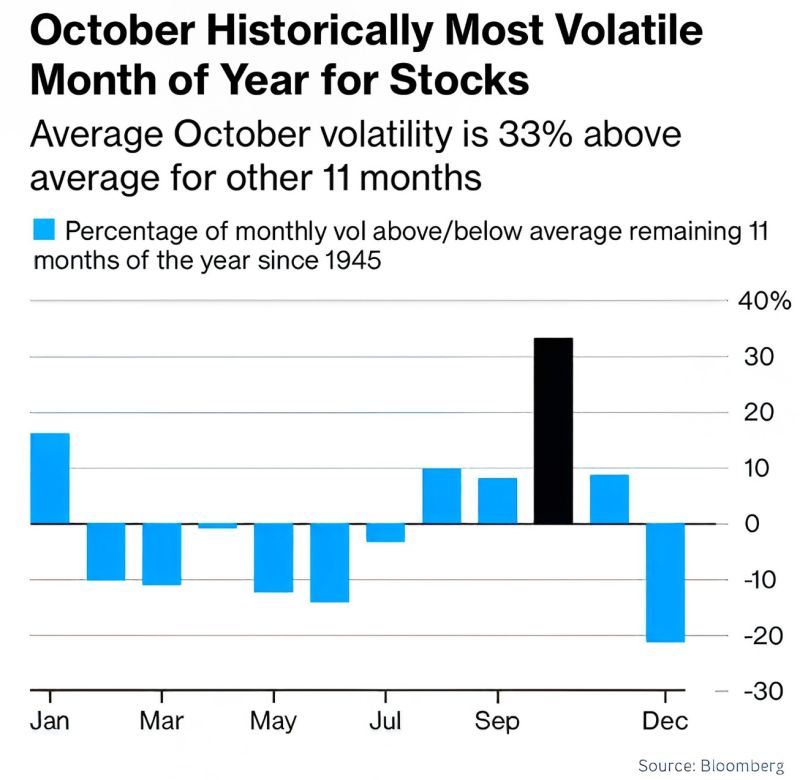

October is historically the most volatile month of the year for stocks.

Source: Brew markets

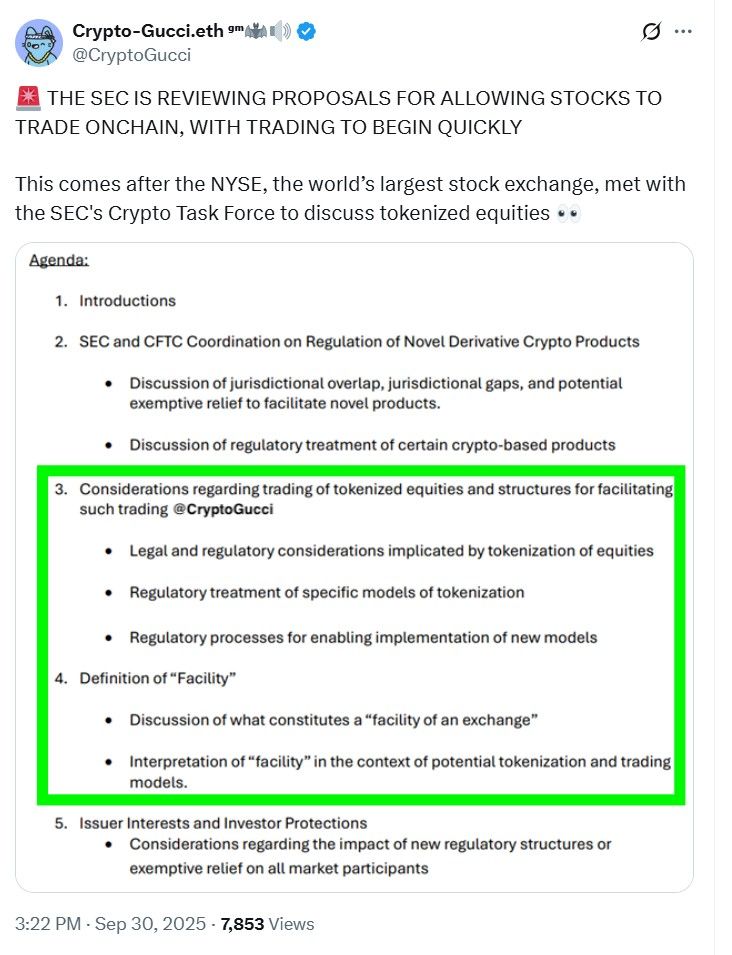

The U.S. Securities and Exchange Commission (SEC) is reportedly developing a plan to allow stocks to trade like crypto on the blockchain

It will treat shares of companies like Apple, Tesla, and Nvidia as digital tokens similar to how cryptocurrencies operate. While the initiative has gained support from crypto exchanges and fintech platforms, it faces pushback from traditional financial institutions that profit from the existing market structure. According to a report by The Information, the SEC is already consulting with market participants on regulatory changes that would make these tokenized securities possible. Source: cryptonews.com

Investing with intelligence

Our latest research, commentary and market outlooks