Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Jeff Weniger went through all the cycles back to 1974.

In the 12 months after the first rate cut, Consumer Discretionary went on to beat the market in 75% of the observations. Poor performers included Energy and Utilities, which beat the market in only 17% and 25% of the 12-month windows, respectively. Source: Jeff Weniger

Lot of talk how valuations are 'high'.

Here's another reminder there is virtually no correlation between P/E multiples and what the S&P 500 does the next year (R-squared of -0.01). Source: Ryan Detrick, Carson

What’s fluffy, has big ears, and has seen its stock outpace the likes of Nvidia, Palantir, and Microsoft?

It’s Build-A-Bear Workshop, of course. The almost 28-year-old mall staple where one can stuff, name, dress, and accessorize a cuddly toy has seen its stock price soar more than 2,000% over the last five years, as reported by the Washington Post on Monday, outperforming some of the hottest names in AI and technology. Indeed, a theoretical $100 invested into BBW stock at the start of 2021 would be worth ~$1,600 today — about $200 more than the theoretical value of the same amount of Nvidia stock. Since its sales plunged in 2020, Build-A-Bear has only gone from strength to strength. The company reported its best Q1 results ever in May, with revenue rising 11% to $128.4 million, having emerged as a post-pandemic winner after tapping into a lucrative market: grown adults. Source: Chartr

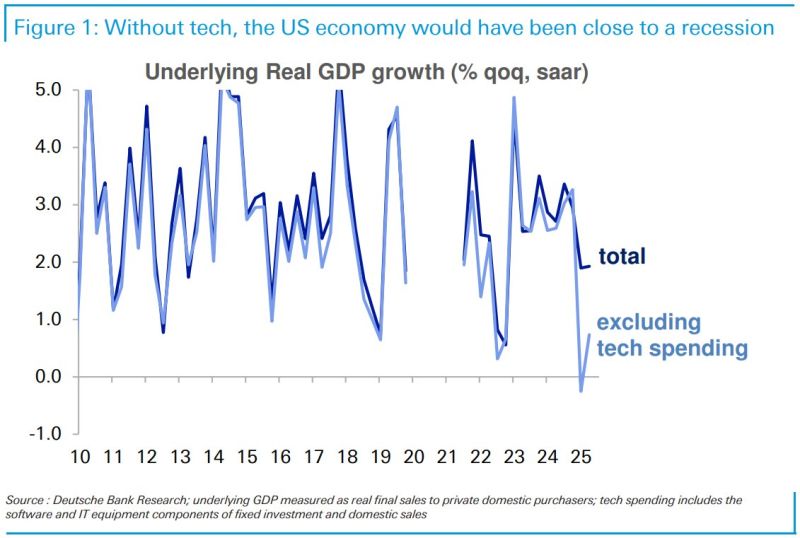

Without tech spending, the US would have been close to, or in, a recession earlier this year:

DB's Saravelos. "Perhaps Nvidia, which employed only 36,000 people at the last update earlier this year, holds the keys to all global macro in 2026:" Source: DB, Lisa Abramowicz

President Trump rolled out a new round of tariffs:

•25% on all heavy trucks •30% on upholstered furniture •50% on kitchen cabinets, bathroom vanities, and related products •100% on branded or patented pharmaceuticals unless the company is building its manufacturing plant in the US Source: StockMarket.news

AI is carrying the market:

Since ChatGPT’s launch in Nov 2022, AI-related stocks have delivered 181% gains in key names, while the rest of the S&P 500 has managed just 25%. More importantly, AI has powered 75% of total index returns, nearly 80% of earnings growth, and an incredible 90% of all capex growth. Without AI, the S&P’s rally would look far more modest. Source: StockMarket.news, JPAM

Investing with intelligence

Our latest research, commentary and market outlooks