Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A beautiful quarterly candles chart of silver

Source: Tavi Costa, Bloomberg

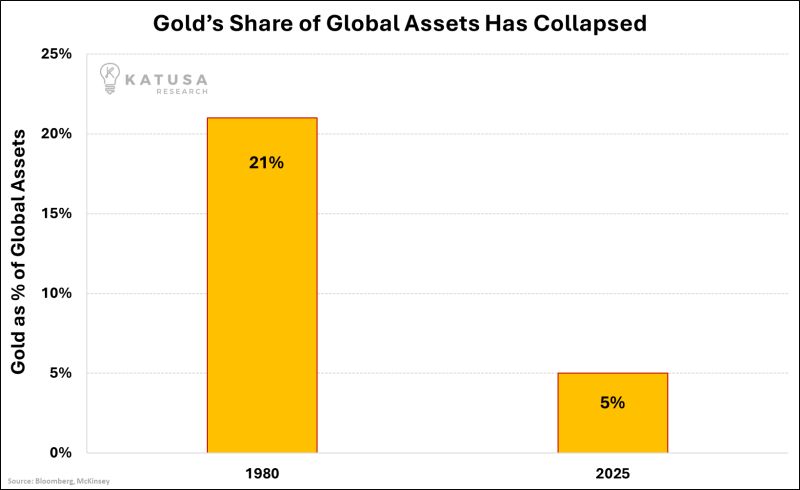

Gold was 21% of global assets in 1980. Today it's 5%

The financial universe got 4X bigger. Stocks, bonds, derivatives, crypto Sometimes the denominator is the story Source: Katsua Research

Government shutdowns all have the same cause:

Congress fails to approve new spending when previous spending bills expire. But their impact can vary based on timing, duration and quirks of the budget process that can make money available to some agencies but not others. Here's what shuts down in a shutdown - Bloomberg

On September 30, 2025, Nvidia will file its 13F form.

This report will list the companies Nvidia has invested in. Here are Nvidia’s current investment stakes: Source: graniteshares

US government shutdowns can last weeks...

The longer the shutdown, the higher the impact on GDP Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks