Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

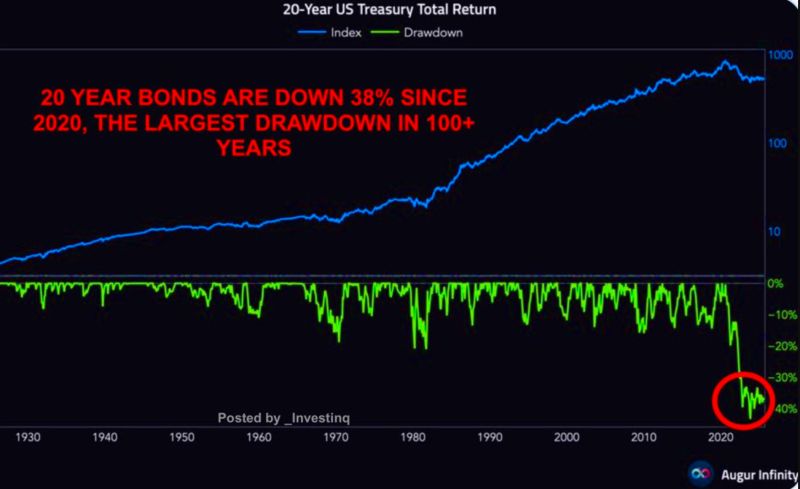

20-year US Treasuries are down ~38% since 2020, the worst drawdown in over a century

What was once seen as the world’s “safest” asset has instead delivered stock-like volatility. Deficits, inflation, and weak demand are forcing long yields higher. Source: stockmarket.news on X

Gold just hit all-time highs, 100 times the $35 it was in 1971 when Nixon closed the gold window

"The metal itself hasn’t changed; it’s still atomic number 79, the same as thousands of years ago. What changed is the dollar. Once it was tied to gold, now it floats, weakened by inflation and endless deficits. That’s why it takes over 100x more dollars to buy the same ounce". Source: StockMarket.News @_Investinq on X

Revolut employees are in line for big windfalls as the UK’s most valuable fintech allows staff to sell down their holdings in the company at a $75bn valuation

Revolut told staff on Monday that they would be allowed to sell up to 20 per cent of their shares to make way for other investors, according to people with knowledge of the matter and a document seen by the Financial Times. Source: FT https://lnkd.in/eRpjTMad

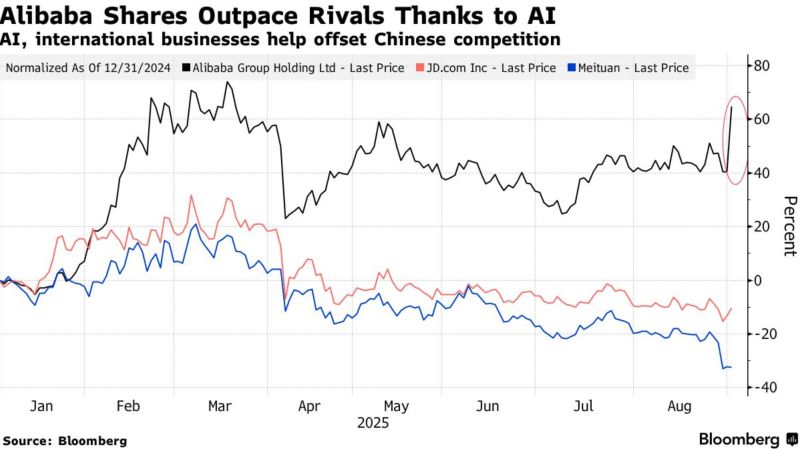

$BABA Alibaba shares are jumping +18%

The most since 2022, after China’s e-commerce leader posted a triple-digit percentage gain in AI-related product revenue as well as a better-than-anticipated 26% jump in sales from the cloud division. Alibaba’s rally also helped energize the broader AI sphere: Ernie developer Baidu gained as much as 5.8%, while Tencent Holdings also climbed. “Alibaba’s breakout reinforces a broader theme in Asia: while global tech remains preoccupied with geopolitics and valuations, parts of China tech are quietly REACCELERATING—driven not by hype, but by real revenue growth in AI and cloud,” said Charu Chanana, chief investment strategist at Saxo Markets. “This isn’t a broad-based rotation yet—but the divergence is real.” Source: Bloomberg, @neilksethi on X

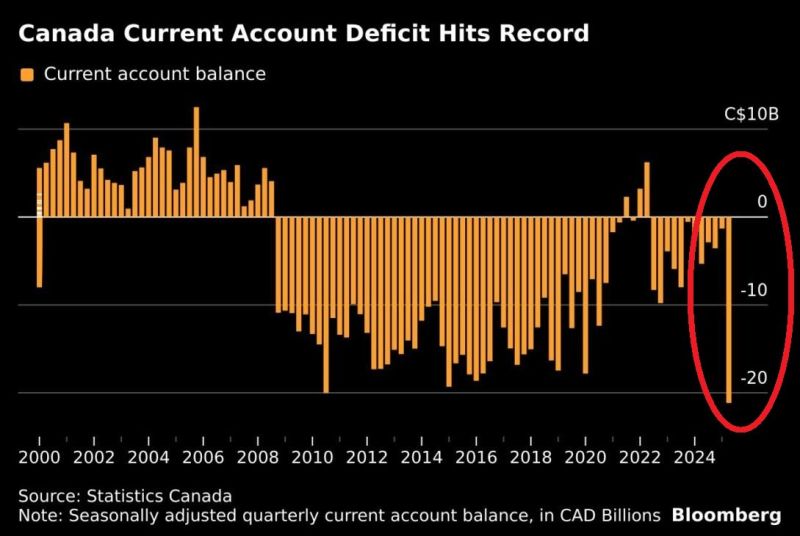

⚠️ Way more more money is flowing out of Canada than coming in

Canada’s current account deficit reached C$21.16 billion in Q2 2025, AN ALL-TIME HIGH. Additionally, trade deficit in goods widened to a record C$19.6 BILLION. US tariffs seem to be hurting Canada's economy. Source: Global Markets Investor, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks