Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

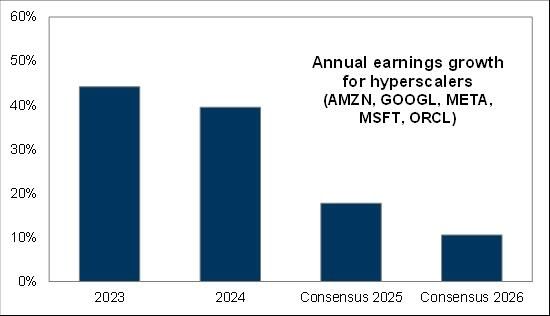

Hyperscaler growth is set to slow meaningfully over the next year

Will AI CapEx follow? Chart: Goldman Sachs thru Markets & Mayhem

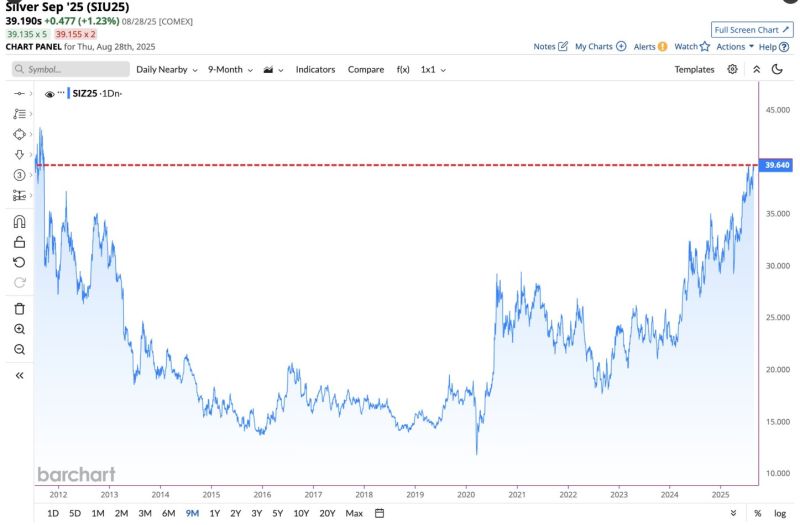

In case you missed it... silver hits highest closing price in almost 14 years 📈📈

Source: Barchart

Credit spreads have rarely been this tight.

So why are investors in corporate bonds undeterred despite the significant tightening in risk spreads (chart below)? Two reasons: 1) Higher yields ("risk free" component + spreads 2) More and more investors see corporate bonds as less risky than sovereign bonds Source chart: Bloomberg

JPMorgan analysts believe Bitcoin ($BTC) is trading below its fair value as its price volatility falls to historic lows, narrowing the asset's risk-adjusted gap with gold.

Volatility in Bitcoin has slid from nearly 60% earlier this year to roughly 30%, the lowest level on record. Analysts led by Nikolaos Panigirtzoglou said this dynamic implies a fair value near $126,000, a target they expect could be reached by year-end, according to The Block. A major driver of the decline in volatility has been corporate treasuries, which now hold over 6% of Bitcoin's total supply. JPMorgan compared the phenomenon to the post-2008 bond market, where central bank quantitative easing dampened swings by locking assets into balance sheets. Source: Yahoo Finance, Coindesk

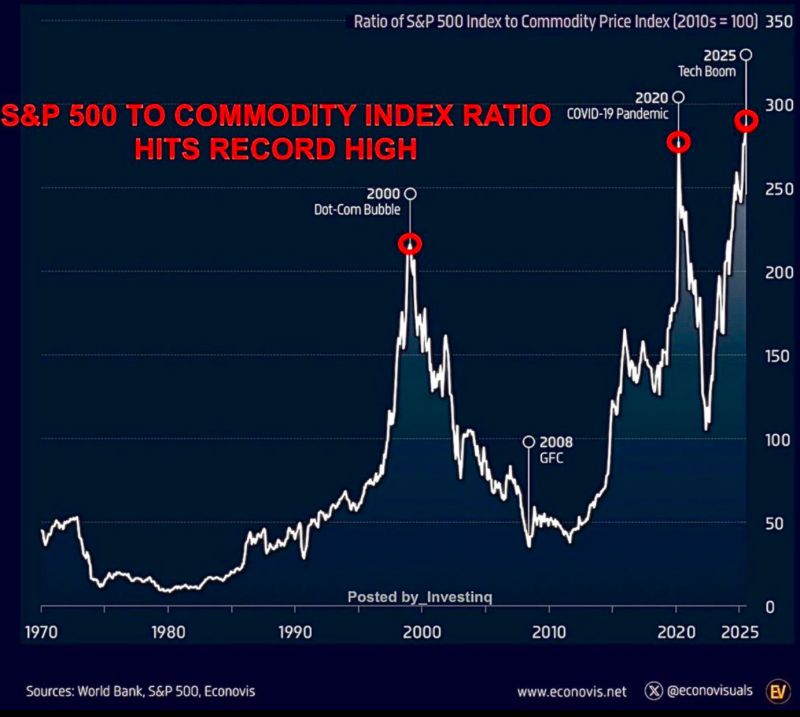

A new all-time-high for sp500 to commodities ratio

Source: Worldbank, Econovis

😨 New European car registrations of Tesla vehicles totaled 8,837 in July, down 40% year-on-year, according to the European Automobile Manufacturers Association, or ACEA.

🏆 BYD recorded 13,503 new registrations in July, up 225% annually. 🚨 Elon Musk’s automaker faces a number of challenges in Europe, including intense ongoing competition and reputational damage to the brand. Source: CNBC

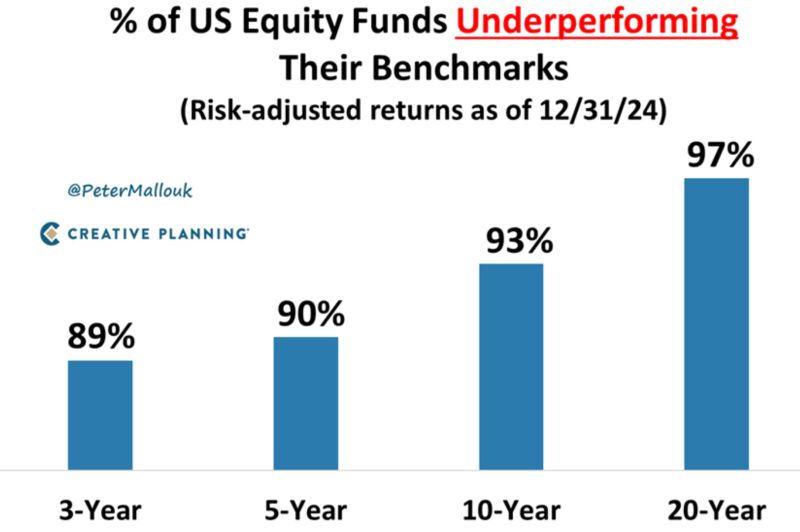

"Don't look for the needle in the haystack. Just buy the haystack!" - Jack Bogle

Source: Peter Mallouk @PeterMallouk

Analysts are raising their Nvidia $NVDA targets across the board

• JPMorgan: $170 → $215 • Rosenblatt: $200 → $215 • Benchmark: $190 → $220 • BofA Securities: $220 → $235 • Citi: $170 → $215 • Jefferies: $200 → $205 • KeyBanc: $215 → $230 • DA Davidson: $135 → $195 • Trust Securities: $210 → $228 Source: Stocktwits

Investing with intelligence

Our latest research, commentary and market outlooks