Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

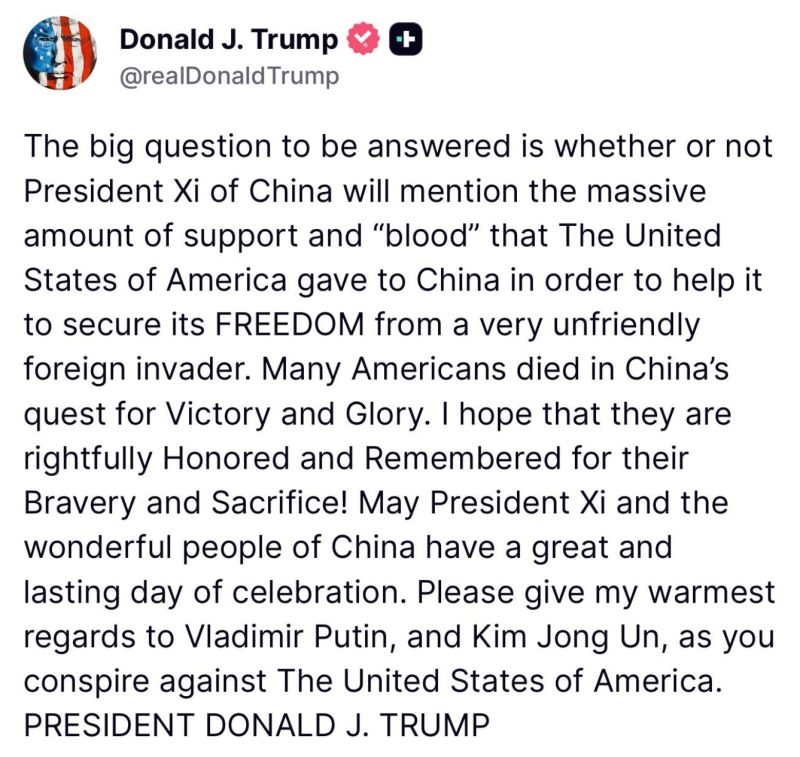

BREAKING: Trump tells Xi Jinping to 'please give my warmest regards to Vladimir Putin, and Kim Jong Un, as you conspire against The United States of America.'

Source: The Spectator Index @spectatorindex on X

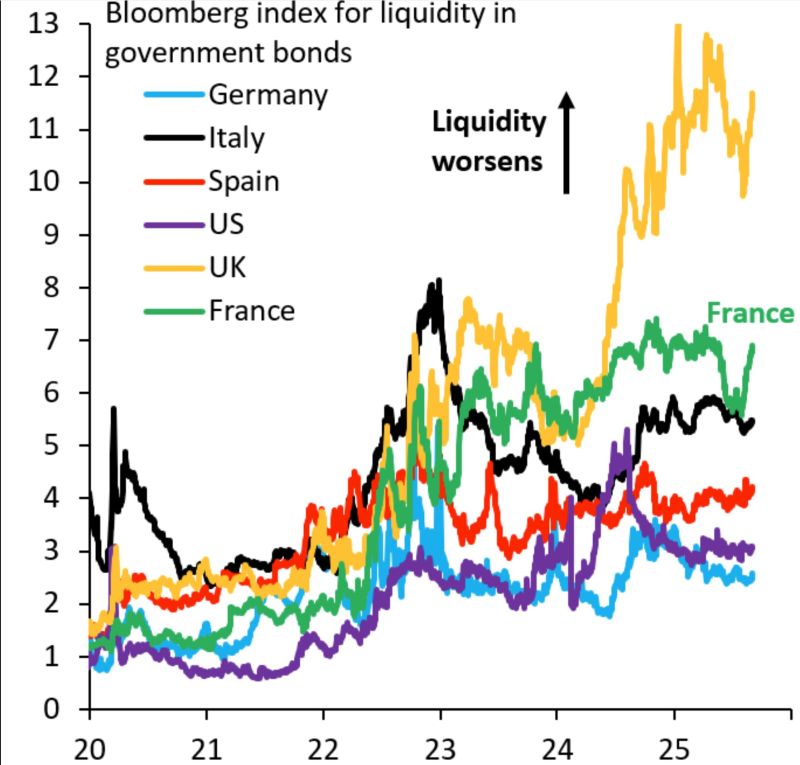

This is Bloomberg's measure of bond market liquidity, which compares actual yield curves to synthetic smooth yield curves for each country

The more kinks you have in the yield curve, the higher this index and the worse is liquidity. UK off the charts, France rising rapidly... Source: Robin Brooks

Based on forward P/E, US equities are trading at a 53% premium relative to the rest of the world

Source: Augur Infinity

The UK faces the doom loop of rising borrowing costs, growing deficits and a government facing a lot of bad choices to raise revenues

Yields on 30-year gilts have reached their highest levels since 1998. Source: Lisa Abramowicz @lisaabramowicz1, Bloomberg

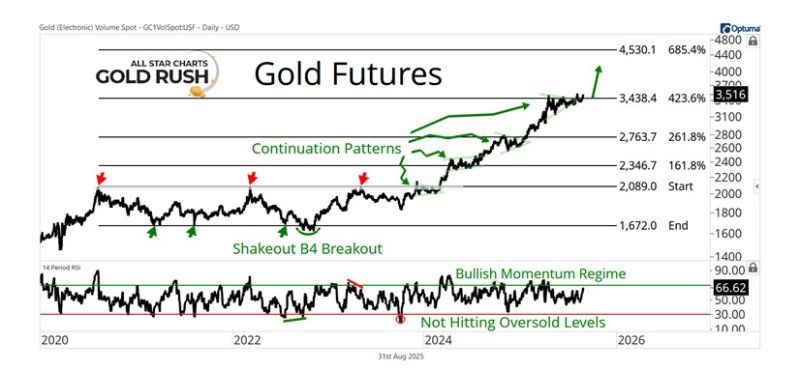

What's next for gold?

Here's the technical analysis view from J-C Parets: "After spending months coiling beneath the 423.6% Fibonacci extension, Gold futures are now resolving higher. This has been the pattern time and time again. Gold pauses at an extension level, builds energy, then launches to the next target. Every one of those continuation patterns has marked the beginning of another leg higher, and this one looks no different. As long as this breakout sticks, we think 4,500 is next". Source: All Star Charts team

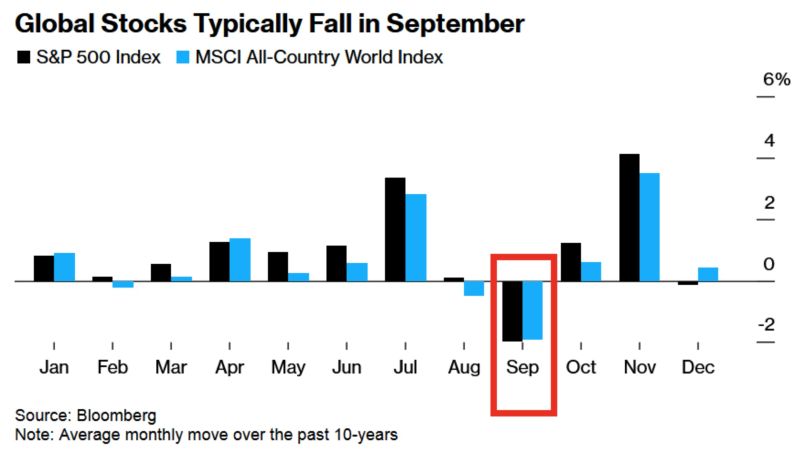

September is historically the WORST month for US and global stocks

The S&P 500 and MSCI All-Country World Index have averaged a –2% return in September over the past decade. Stocks fell in 4 out of the last 5 Septembers, with the steepest drop in 2022 — exceeding 9%. Source: Global Markets Investor @GlobalMktObserv, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks