Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Tariffs, Courts & Treasuries

A U.S. federal appeals court has ruled that the Trump administration misused emergency powers to impose tariffs that have been bringing in roughly $30 billion per month. If upheld, the decision could force Washington to repay importers and remove the steepest trade taxes in a century. The case is now on an expedited track to the Supreme Court, with a key October 14 deadline looming. What’s at stake? - Congress relied on these tariff revenues to help offset this year’s tax cuts. A rollback could leave a deeper fiscal hole, unsettling Treasury buyers. - Importers say nothing changes until the court outcome, but market uncertainty is rising. - Steel and aluminum duties (1962 Act) and other tariffs (1974 Trade Act) are not affected — the dispute centers on the 1977 emergency powers. Trade policy and fiscal stability are deeply intertwined.

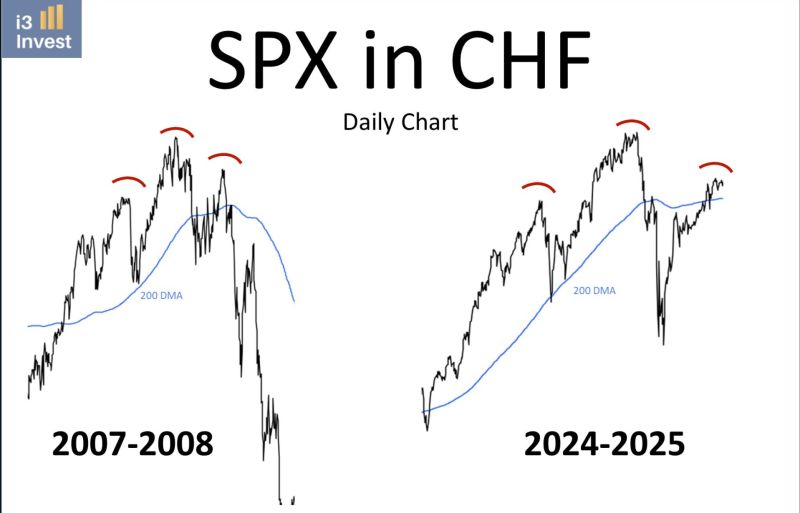

Something to be worried about

The chart of the S&P 500 expressed in a strong currency (Swiss franc) does not look the same as in Dollars. Source: i3 invest

Google can keep its popular Chrome browser, a federal judge has ruled

Alphabet $GOOGLE shares are up 8% AFTER-MARKET. Source: Brew markets, CNBC

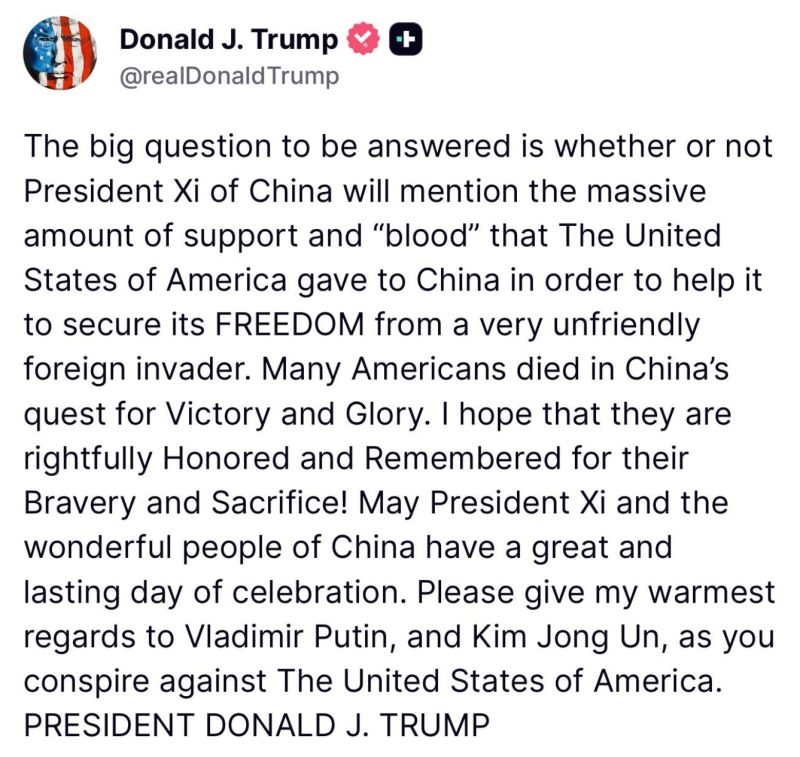

BREAKING: Trump tells Xi Jinping to 'please give my warmest regards to Vladimir Putin, and Kim Jong Un, as you conspire against The United States of America.'

Source: The Spectator Index @spectatorindex on X

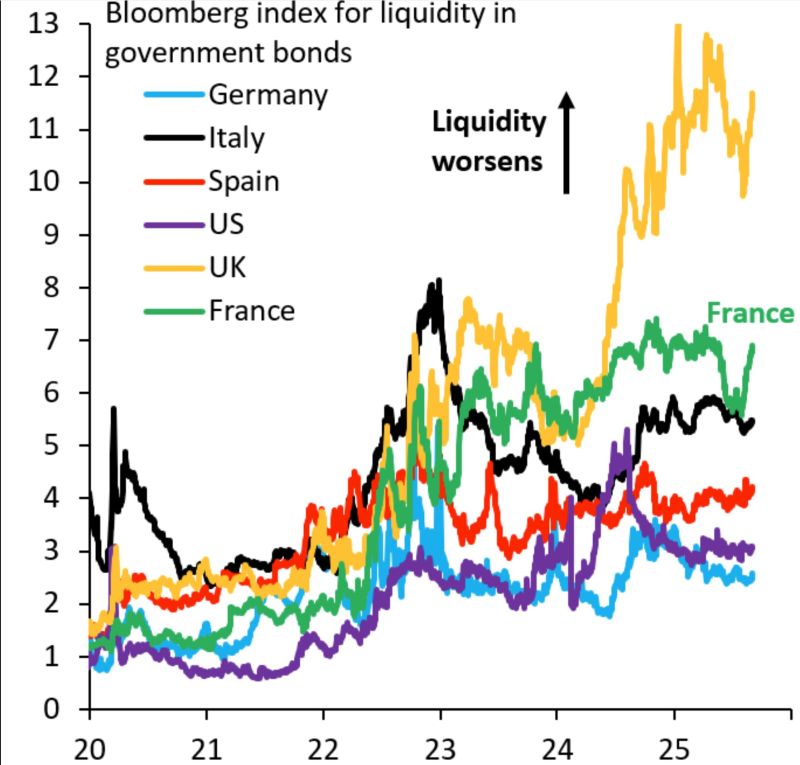

This is Bloomberg's measure of bond market liquidity, which compares actual yield curves to synthetic smooth yield curves for each country

The more kinks you have in the yield curve, the higher this index and the worse is liquidity. UK off the charts, France rising rapidly... Source: Robin Brooks

Based on forward P/E, US equities are trading at a 53% premium relative to the rest of the world

Source: Augur Infinity

Investing with intelligence

Our latest research, commentary and market outlooks