Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

From the FT >>>

XTX Markets, Alex Gerko’s money-printing forex high-frequency trading heavyweight, posted a job ad last week for a rolling 12–14 week AI Research Internship with a salary of $35,000 a month + a “generous sign-on bonus”! Admittedly, it’s aimed at a pretty high standard of prospective intern. Candidates are required to be pursuing an advanced degree, “ideally Ph.D., in computer science, electrical engineering, mathematics, or a related quantitative field” with at least a year until their graduation. They also need “solid” programming skills and “a proven publication record in leading machine learning and AI venues”. But still, it looks like the race for super-star interns keeps getting fiercer Source: FT Link to article >>> https://lnkd.in/gWeCPJK7

The U.S. Justice Department has launched a criminal mortgage fraud probe into Federal Reserve Governor Lisa Cook

It has issued grand jury subpoenas out of both Georgia and Michigan, according to documents seen by Reuters and a source familiar with the matter. The investigation followed a criminal referral from Federal Housing Finance Agency Director Bill Pulte, and is being conducted by Ed Martin, who was tapped by Attorney General Pam Bondi as a special assistant U.S. attorney to assist with mortgage fraud investigations involving public officials, along with the U.S. Attorneys' offices in the Northern District of Georgia and the Eastern District of Michigan, according to the person, who spoke anonymously since the matter is not public. Source: Reuters

Crypto treasury stocks slide as Nasdaq moves to tighten oversight of firms using raised funds to buy crypto:

• $SBET -9% • $BMNR -7% • $MSTR -3% Source: Shy Boloor on X

🚨 Goldman Sachs has doubled down on its optimistic forecast for gold, maintaining a structural bullish view on the precious metal

The investment bank predicts gold will reach $3,700 per ounce by the end of 2025 in its base case scenario, with further growth to $4,000 by mid-2026. Goldman’s analysis indicates that a recession could accelerate ETF inflows and drive prices even higher to $3,880. More dramatically, extreme risk events such as challenges to Federal Reserve independence or shifts in U.S. reserve policy could potentially catapult gold prices to $4,500 by year-end 2025. Source: www.goldsilver.com https://lnkd.in/eCau26HP

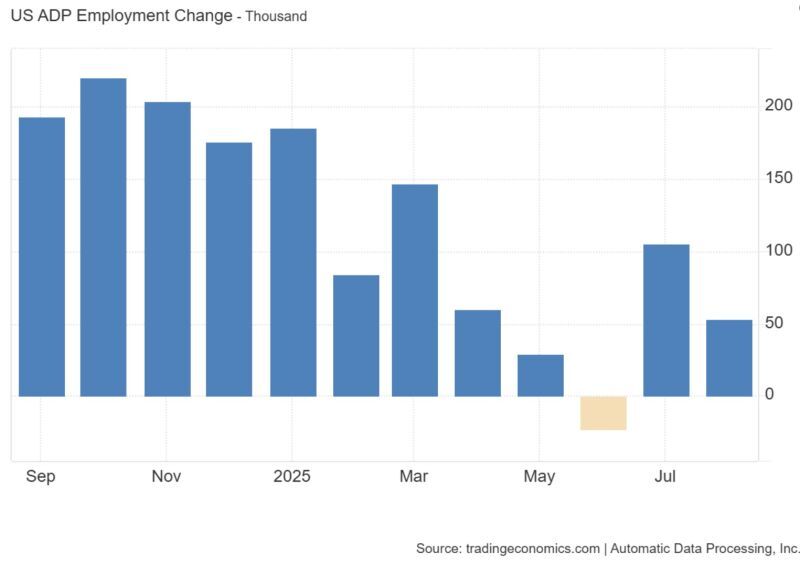

ADP: US private payrolls rose just 54K in August, down from 106K in July

That's below consensus estimates of 68k, that’s well below the 2010–2025 average of 148K. For context: the series hit a record 1.25M in Aug ’21 and plunged to -6.1M in April ’20.

Essays of Warren Buffett

10 things we can learn. Source: The Investing for Beginners Podcast @IFB_podcast

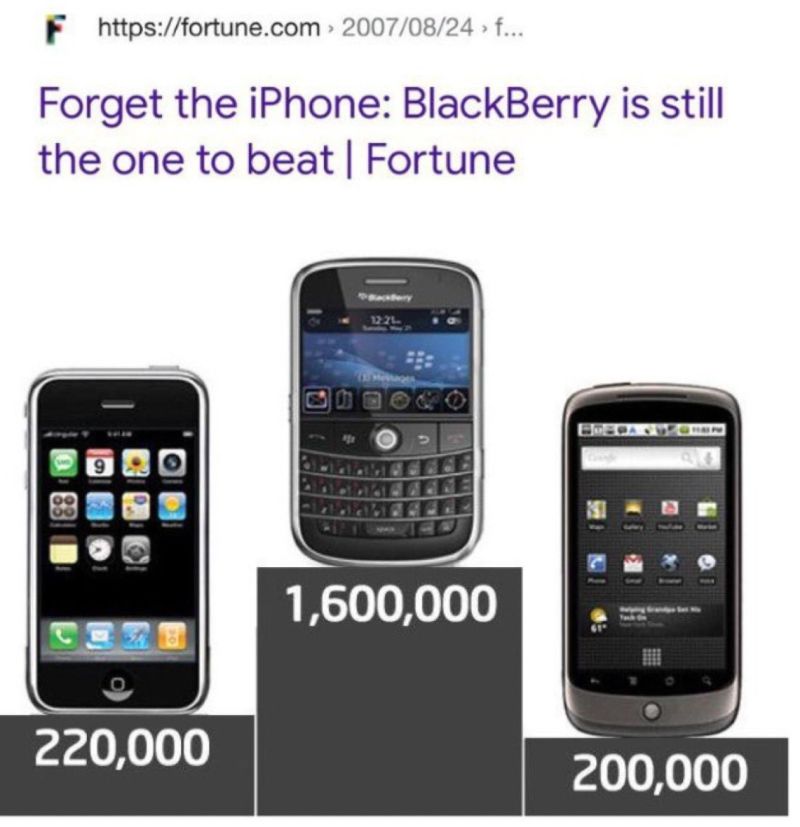

In 2007, BlackBerry was worth more than Amazon, AMD, Netflix, Nvidia and Salesforce combined

Barry Ritholtz: How little do we know about the future? A great way to figure that out is to look to our past, to see what we previously thought about what the future will hold. To wit: 26 years ago, the image above came from the cover story of Fortune magazine: “There’s a lot of buzz in the smartphone business lately, with Apple’s (AAPL) iPhone turning the mobile world upside down and Nokia’s (NOK) upcoming phone announcement providing a new challenge. Despite all the hype, though, Research in Motion’s (RIMM) BlackBerry is still the most formidable force in U.S. smartphones. This statement, of course, is gadget heresy. Popular opinion holds that the iPhone is today’s must-have device, and none of the others stand a chance. But while the iPhone is revolutionary, it’s not yet positioned to truly challenge RIM’s foothold in the smartphone market.” Source: Jon Erlichman @JonErlichman

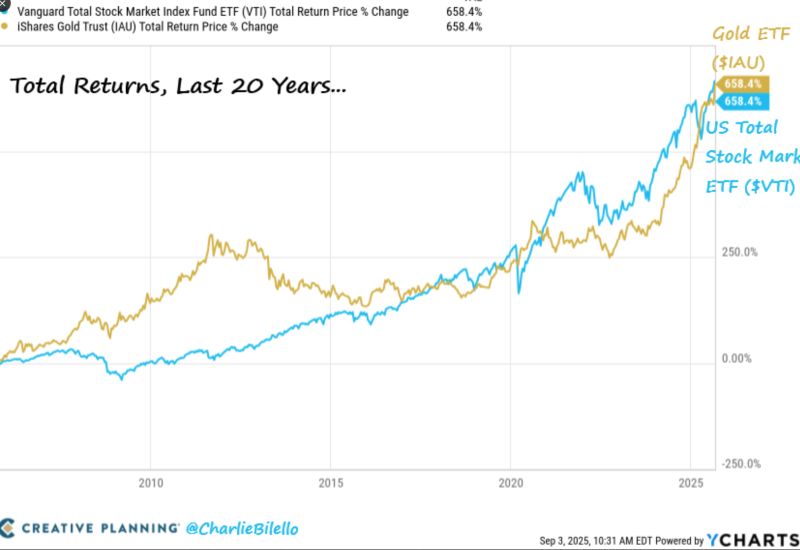

Total Returns over Last 20 Years:

US Stock Market $VTI: +658.4% / Gold $IAU: +658.4%, Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks