Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

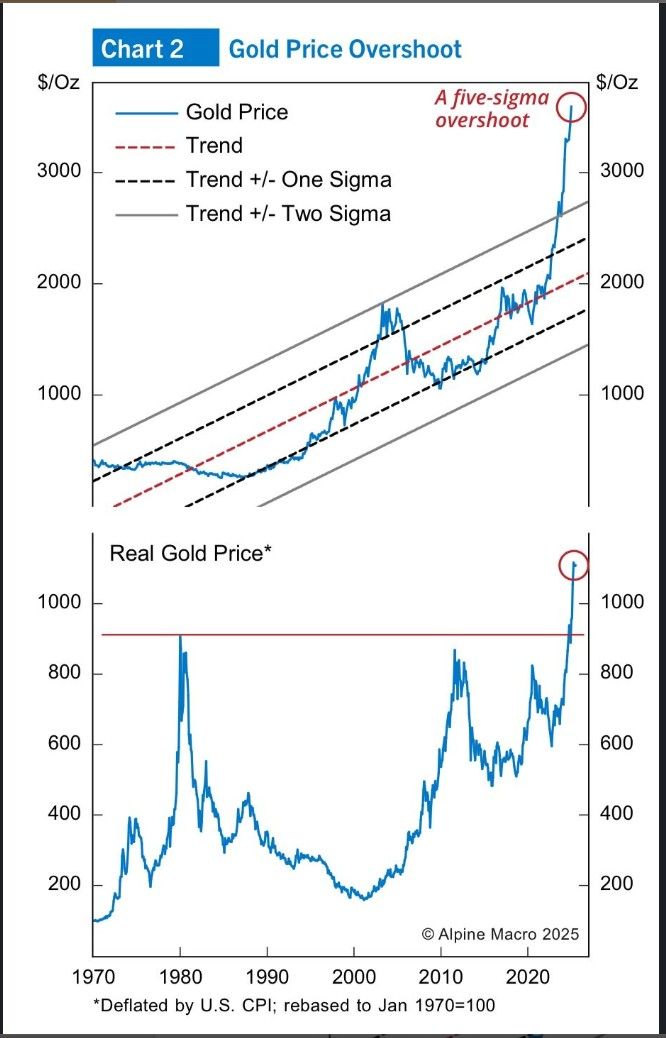

Gold is overshooting its time trend by 5 sigma

While the real gold price (after adjusted for U.S., CPI) is at the record highs, as this Alpine Macro chart shows. Source: Chen Zhao

China’s shipments to the U.S. plunged 33% in August

While overall exports growth slowed to its weakest level in six months, and President Donald Trump’s policy targeting trans-shipments weighed on exports and businesses, frontloading activity lost momentum. 👉Imports from the U.S. also dropped 16% from a year ago, customs data showed. 👉China’s total exports climbed 4.4% in August in U.S. dollar terms from a year earlier, customs data showed Monday, marking their lowest growth since February while missing Reuters-polled economists’ estimates for a 5.0% rise. That growth slowed from the prior two months, in part reflecting the statistical effect of a high base last year when China’s exports grew at their fastest pace in nearly one-and-a-half years. 👉Imports rose 1.3% last month from a year ago, missing Reuters estimates for a 3% growth. Imports rose for a third straight month after returning to growth in June, albeit still muted due to the persistent real estate slump, rising job insecurity, among other things. ➡️ China has increasingly relied on alternative markets, particularly Southeast Asia and European Union nations, Africa and Latin America, as U.S. President Donald Trump’s trade policy has pressured U.S.-bound shipments. Nonetheless, no one country has come close to the U.S. which remains China’s largest trading partner on a single-country basis, absorbing $283 billion of Chinese goods this year as of August. Exports to the EU stood at $541 billion over the same period. Beijing and Washington on Aug. 11 agreed to extend their tariff truce by another 90 days, locking in place U.S. tariffs of around 55% on Chinese imports and 30% Chinese duties on U.S. goods, according to Peterson Institute for International Economist. But bilateral talks appear to be struggling to reach a breakthrough, with a late-August visit to Washington by top Chinese trade negotiator Li Chenggang yielding little progress. Source: CNBC

The top 10 US stocks now have a combined market cap of 23 trn USD, bigger than China (16), the EU (13) or Japan (7)

If these 10 were a country, they’d be the world’s largest stock market (ex US). Source: Bergos AG, Econovis, Till Christian Budelmann

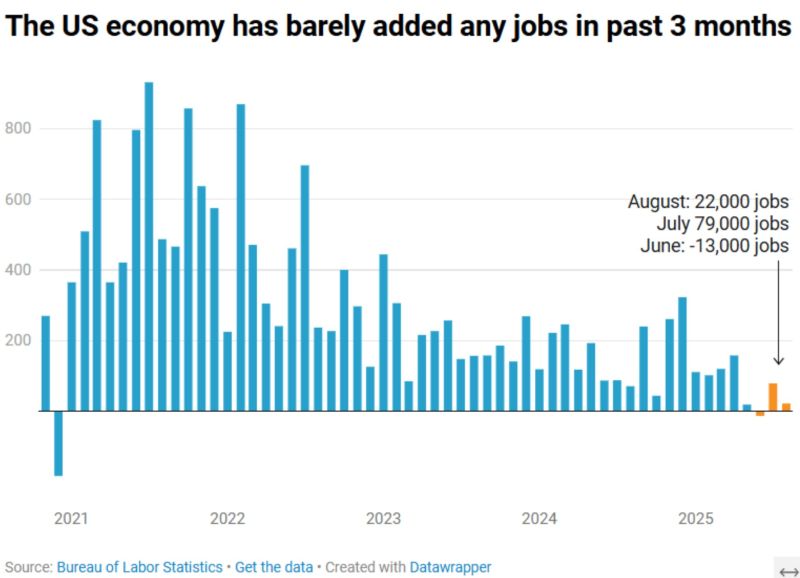

Scott Bessent now says the Biden-era jobs tally will be revised down by ~800,000 next week

Goldman Sachs is calling for a 550k–950k cut in the BLS benchmark revision. If it lands, the labor market narrative gets rewritten and it could swing the Fed between a 25bps trim and a 50bps shock in September. Source: StockMarket.News

‼️Hedge funds are shorting the S&P 500 futures at nearly a RECORD pace

Hedgefunds short exposure to the S&P 500 futures hit $180 BILLION, an all-time high. As a share of open interest, shorts hit ~27%, the highest in 2.5 years, only below March 2023 and September 2022. Source: Global Markets Investor

Breaking news

Tesla’s board has proposed a new pay package for chief executive Elon Musk worth $1tn over the next decade if he is able to hit a series of formidable targets. Musk will receive no salary or bonus under the plan unveiled on Friday, but would collect shares in instalments unlocked by increases in Tesla’s market value, combined with milestones including a huge increase in earnings and selling millions of cars, robotaxis and AI-powered robots. “Retaining and incentivising Elon is fundamental to Tesla . . . becoming the most valuable company in history,” chair Robyn Denholm said in a letter to investors. The package is “designed to align extraordinary long-term shareholder value with incentives that will drive peak performance from our visionary leader”. The board stressed that Musk’s incentives were aligned with investors’ interests and he will receive nothing if Tesla’s growth stalls. However, the sheer scale of the deal is likely to revive a fierce debate over the earnings of the world’s richest man. Source: FT

‼️ JUST IN: Another WEAK jobs report

The US economy added only 22,000 jobs in August ➡️ That’s much weaker than expected. 1) The unemployment rate rose to 4.3% --> Highest since October 2021. 2) June job growth was revised down to -13,000 (!). July was revised up slightly to 79k (from 73k). 🌈 Wages grew 3.7% in the past year (above 2.7% inflation). Source: Heather Long @byHeatherLong on X

Investing with intelligence

Our latest research, commentary and market outlooks