Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

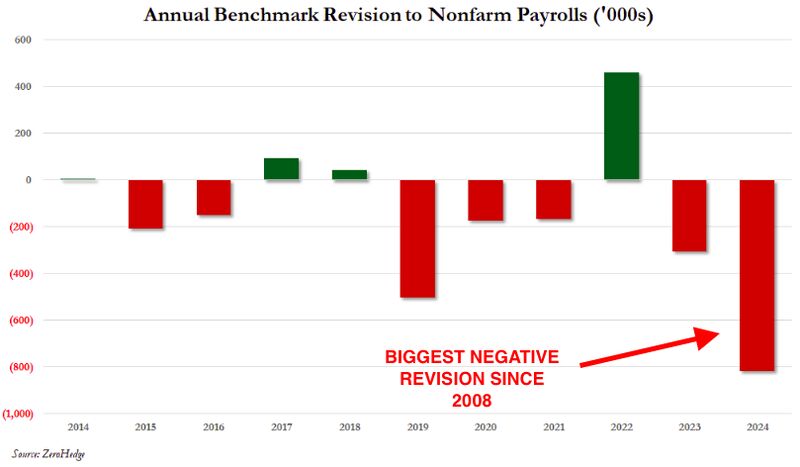

⚠️ The United States (US) Bureau of Labor Statistics (BLS) will publish the 2025 preliminary benchmark revision to the Establishment Survey Data on Tuesday, September 9

The preliminary revision will cover the 12-month period through March 2025 before the final benchmark revision is reported within the employment report of February 2026. The chart below puts the revisions in perspective: ➡️ 2024 just delivered the biggest downward benchmark revision since 2008 nearly -800k jobs erased. ➡️ That’s exactly why the BLS revision matters: if 2025 takes another -550k to -950k hit, it won’t just mark back-to-back historic revisions. ➡️ It will prove the labor market was overstated for years, not months. Source: StockMarket.News, zerohedge

What a year for ETFs ‼️

ETFs crack $800b in YTD flows, that's a $5b/day pace. That puts them on pace to hit about $1.2T this year, a new record. Source: Bloomberg, www.zerohedge.com

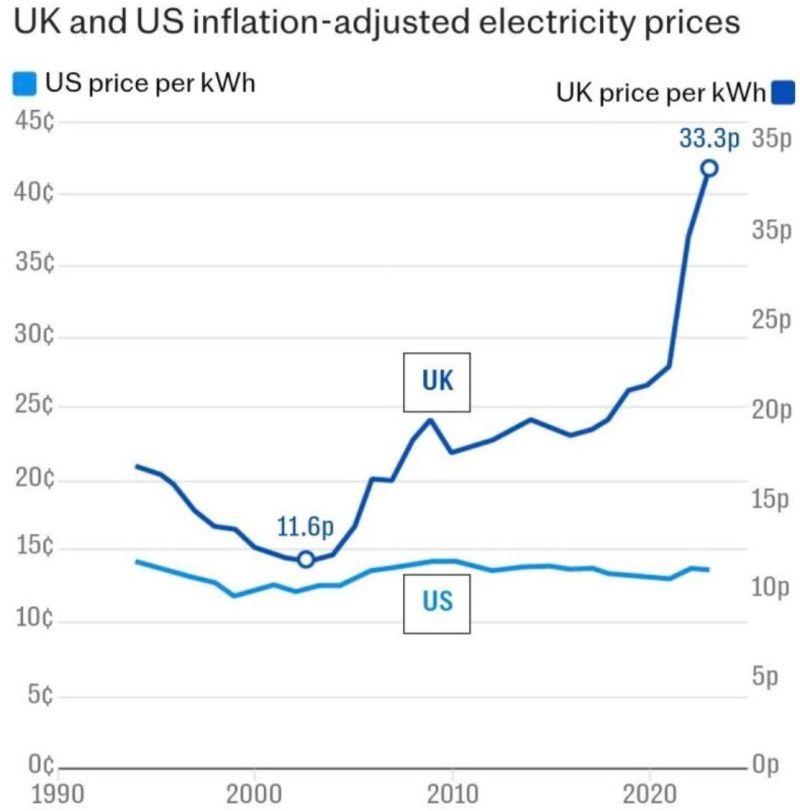

If you are in the manufacturing industry, do you produce in the U.S. or in the U.K.?

Source: Michel A.Arouet

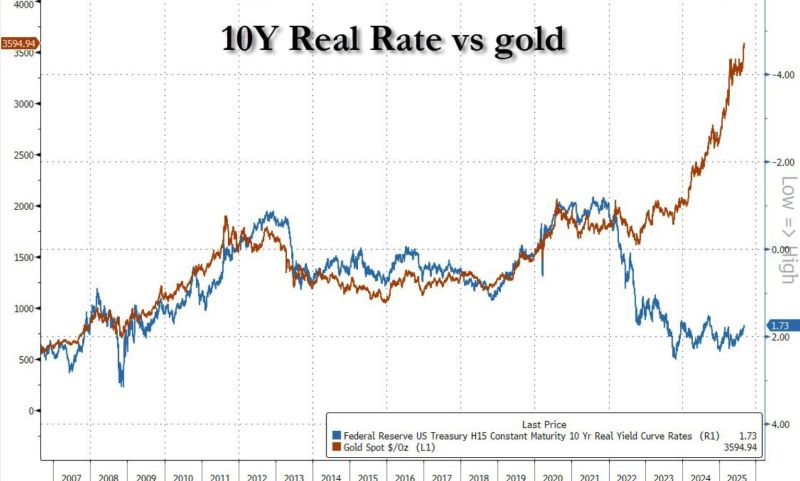

"The Ukraine war and the weaponization of the dollar was the straw that broke the camel's back"

Source: zerohedge

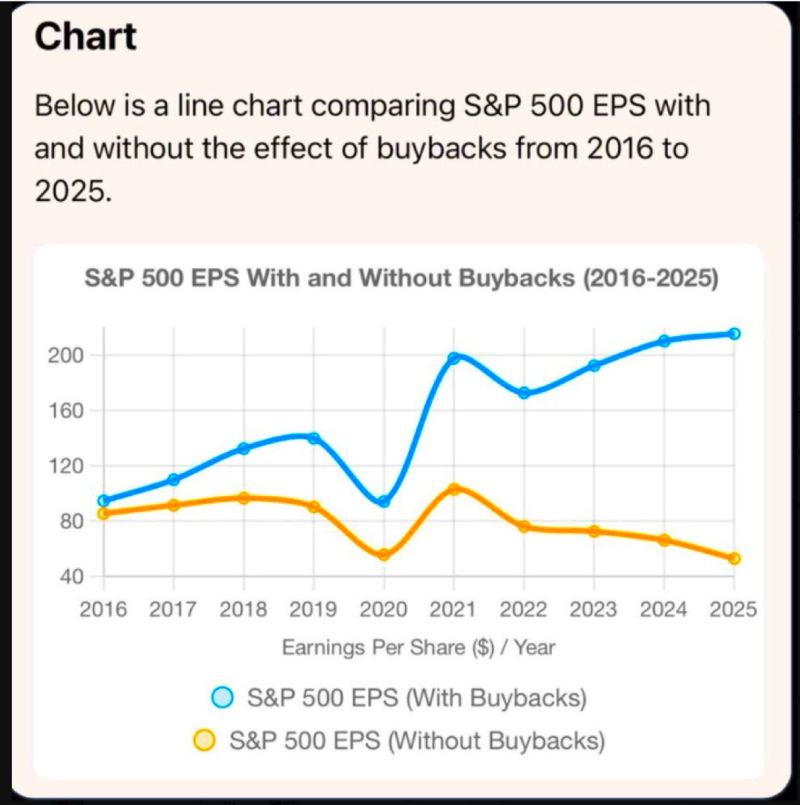

Buybacks are inflating earnings per share

By shrinking share counts, companies make profits look stronger on paper even when most firms show flat or declining growth. The top 10 companies are the only ones delivering real growth. Indexes keep climbing because of them, while the S&P 490 and the broader economy remain weak. This is one of the disconnect driving the market. Source: StockMarket.news

Treasury Secretary Scott Bessent said Sunday that he is “confident” that President Donald Trump’s tariff plan “will win” at the Supreme Court

But he warned his agency would be forced to issue massive refunds if the high court rules against it. If the tariffs are struck down, he said, “we would have to give a refund on about half the tariffs, which would be terrible for the Treasury,” according to an interview on NBC’s “Meet the Press.” He added, however, that “if the court says it, we’d have to do it.” Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks