Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

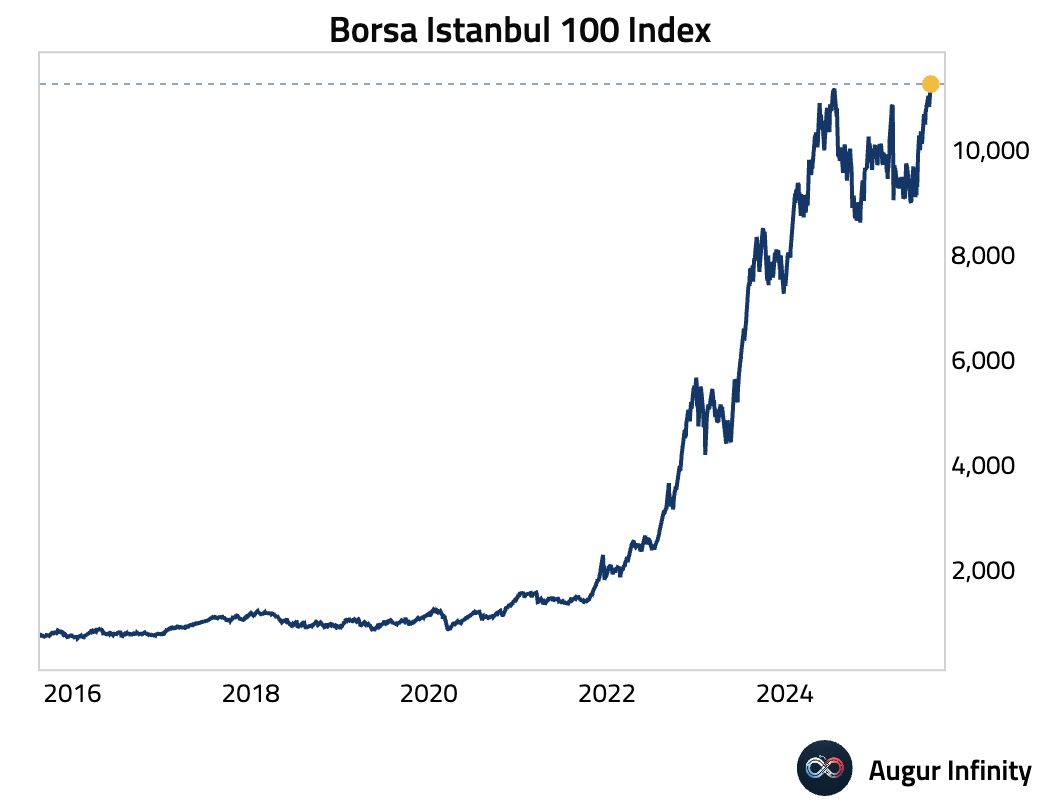

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Shorting the market is not an easy sport...

Below S&P 500 returns following Michael Burry’s stock market warnings... Source: Peter Mallouk

A friendly reminder of bitcoin seasonality

Source: Ryan Rasmussen @RasterlyRock, Bitwise Asset Management

September rate cut odds have plunged to 57% on Polymarket over the past few days—did Powell’s speech leak?

Source: Tom @TradingThomas3

The economic slump in Germany worsened in Q2.

GDP fell by 0.3% in Q2 QoQ, worse than the initial estimate of -0.1%, mainly due to a sharp drop in capital investment, which declined 1.4%. Consumer spending rose by 0.1% QoQ, contributed less than previously thought, while government spending rose 0.8% QoQ. The size of the German economy is currently still slightly below its 2019 level, ING's @carstenbrzeski has calculated: "It looks increasingly unlikely that any substantial recovery will materialise before 2026," he says. Source: Bloomberg, HolgerZ

Nvidia has asked some of its component suppliers to stop production related to its made-for-China H20 graphics processing units, as Beijing cracks down on the American chip darling.

The directive comes weeks after the Chinese government told local tech companies to stop buying the chips due to alleged security concerns, the report said, citing people with knowledge of the matter. Nvidia has reportedly asked Arizona-based Amkor Technology, which handles the advanced packaging of the company’s H20 chips, and South Korea’s Samsung Electronics, which supplies memory for them, to halt production. Samsung and Amkor did not immediately respond to CNBC’s request for comment. A separate report from Reuters, citing sources, said that Nvidia had asked Foxconn — officially known as Hon Hai — to suspend work related to the H20s. Foxconn did not immediately respond to a request for comment. Source: CNBC

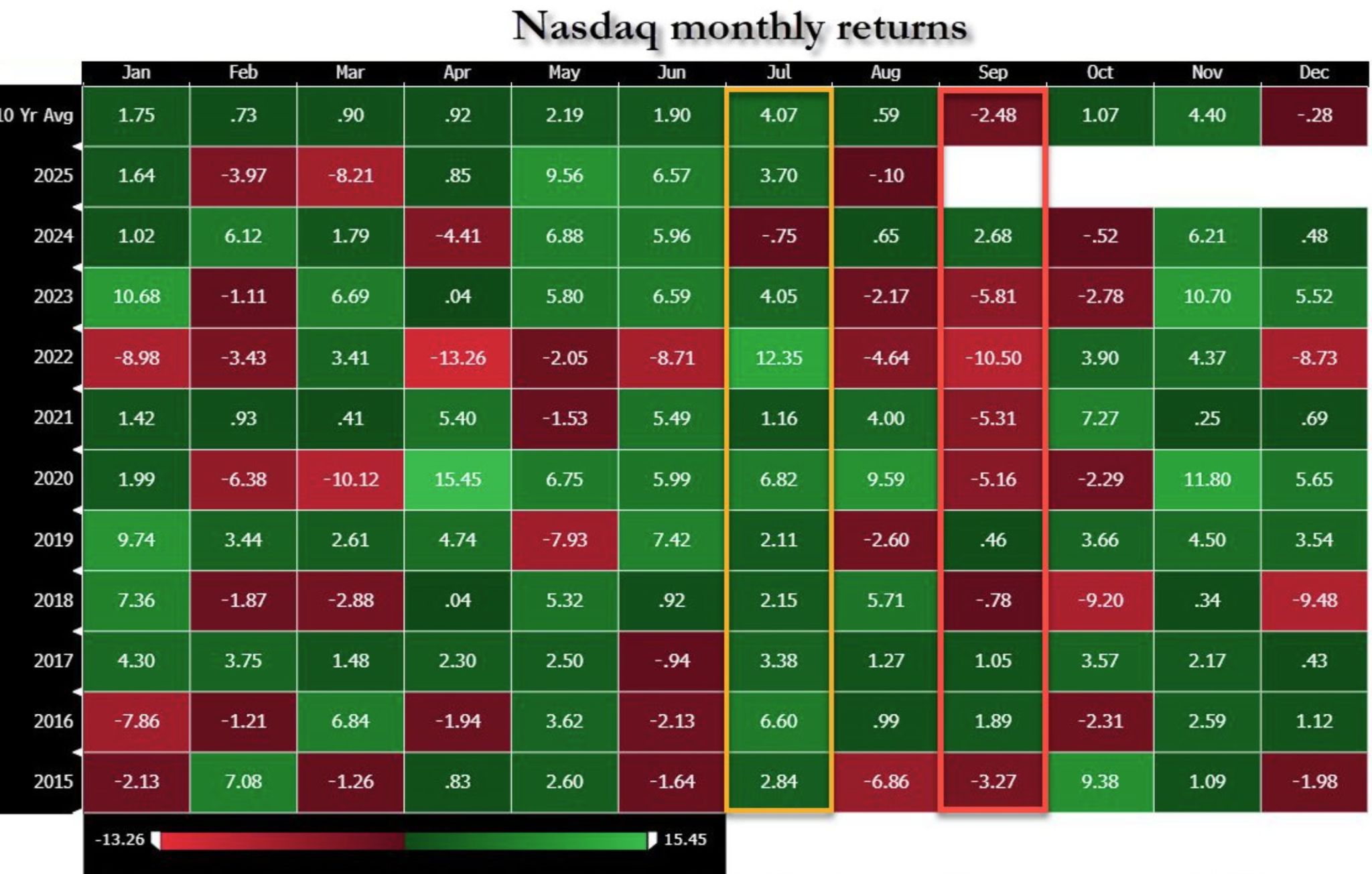

July Nasdaq seasonals were great. September's are not.

Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks