Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Belated "Nixon closing the gold window anniversary" post

SPX priced in gold (blue) v. SPX priced in USD (red) since August 1971 when Nixon closed the gold window. Source: Luke Gromen @LukeGromen

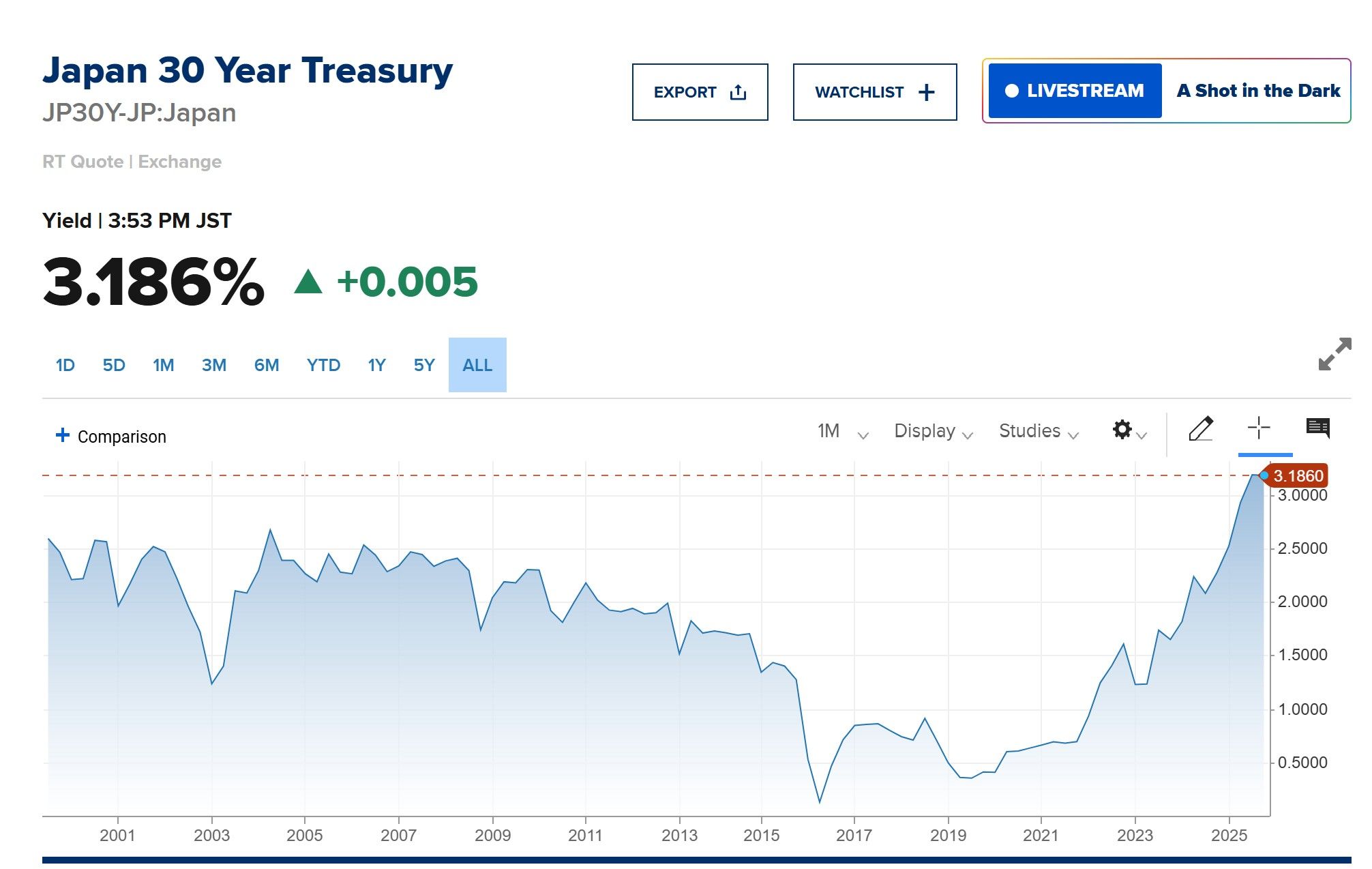

Japan’s 30-year bond yield has spiked to 3.18% - the highest level on record.

A preview of what’s coming for the US if we they don’t get our deficit/debt spiral under control ? Source: CNBC

“Friendflation" is the growing cost of maintaining social connections and participating in our friends’ lives.

43% is the proportion of Americans who find it ‘difficult’ to have a wealthier friend 55% is the proportion of British adults who don’t feel comfortable talking about their financial situation, according to a study by the Money and Pensions Service "It may be true, as the adage goes, that money can’t buy you friends. But, it turns out, it comes in pretty handy if you want to keep them". Source: FT

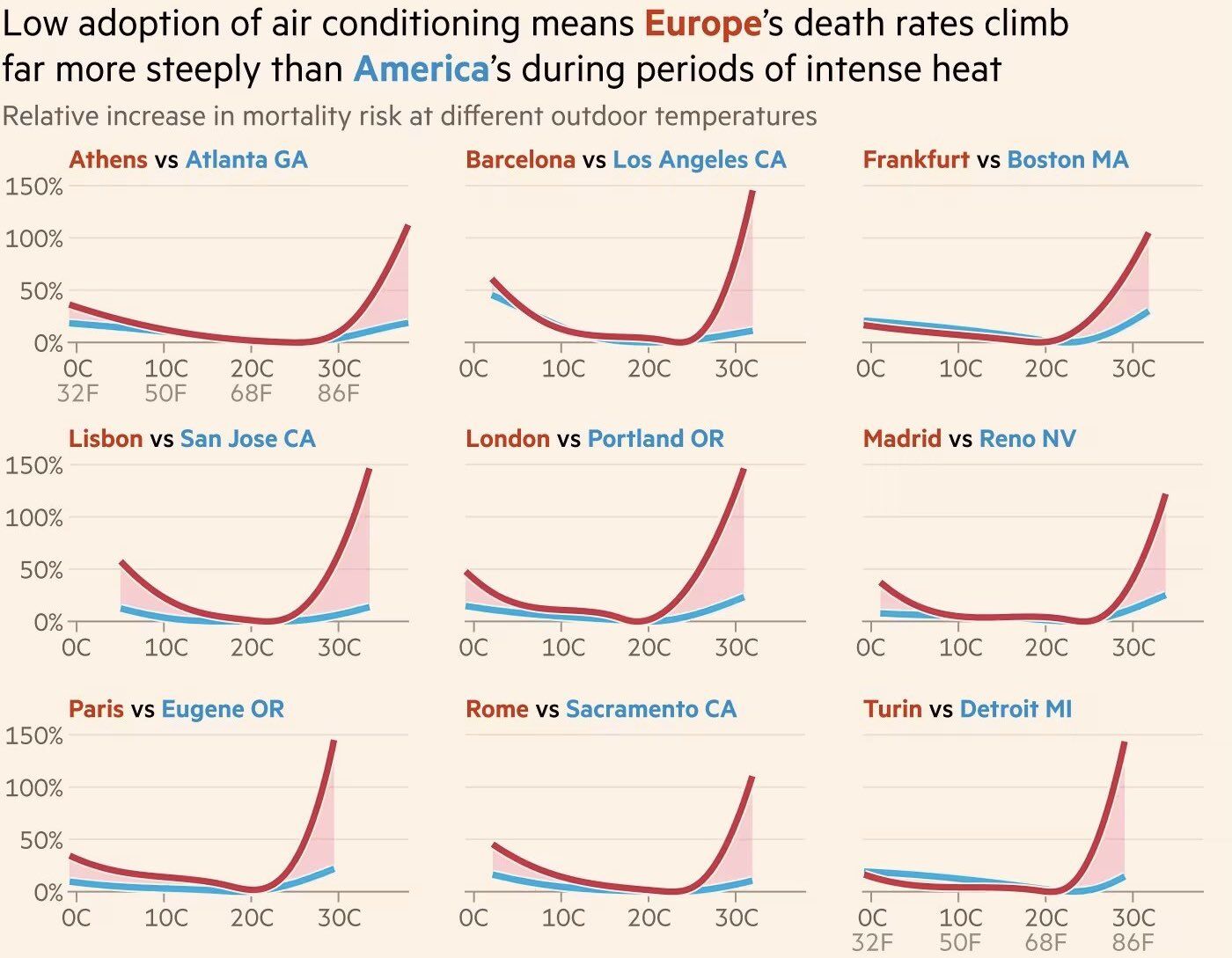

Interesting comparison between Europe vs US with regards to the use of air conditioning and the death rate during heatwaves.

EU commission: " The adoption of air conditioning in Europe has been a topic of concern due to its potential impact on health and safety during heatwaves. In Europe, the number of deaths during heatwaves has been significantly higher compared to the United States, with a mean of 83,000 deaths annually relative to 20,000 deaths in North America. This disparity is attributed to the lower adoption of air conditioning in Europe, which is less common than in the US. The lack of air conditioning in many European homes forces residents to rely on less effective cooling methods, such as electric fans, ice packs, and cold showers, which can lead to increased exposure to extreme heat and heat-related illnesses".

US Treasury 10y/30y yield curve is at the highest level since September 8, 2021.

Source: Augur Infinity

🔴 Donald Trump calls on Federal Reserve governor Lisa Cook to resign ‼️

The demand comes hours after Bill Pulte, a staunch ally of the US president, published a letter claiming the central bank official had ‘falsified bank documents and property records to acquire more favorable loan terms. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks