Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

So now Europe is supposed to pay for Ukraine ?

Not a big surprise to see EU defense stocks plummeting today... Source: FT

On this day in 2004: Google went public at a valuation of $23 billion.

Today, it’s worth $2.5 trillion. Source: Jon Erlichman @JonErlichman on X

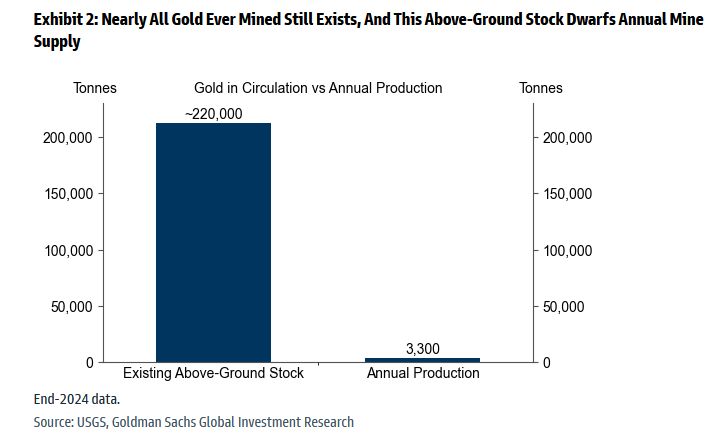

Gold is unlike other commodities – it is not consumed; it is stored.

Nearly all gold ever mined – about 220,000 tonnes – still exists, and this above-ground stock dwarfs annual mine supply. - From Goldman's primer on gold Source: zerohedge

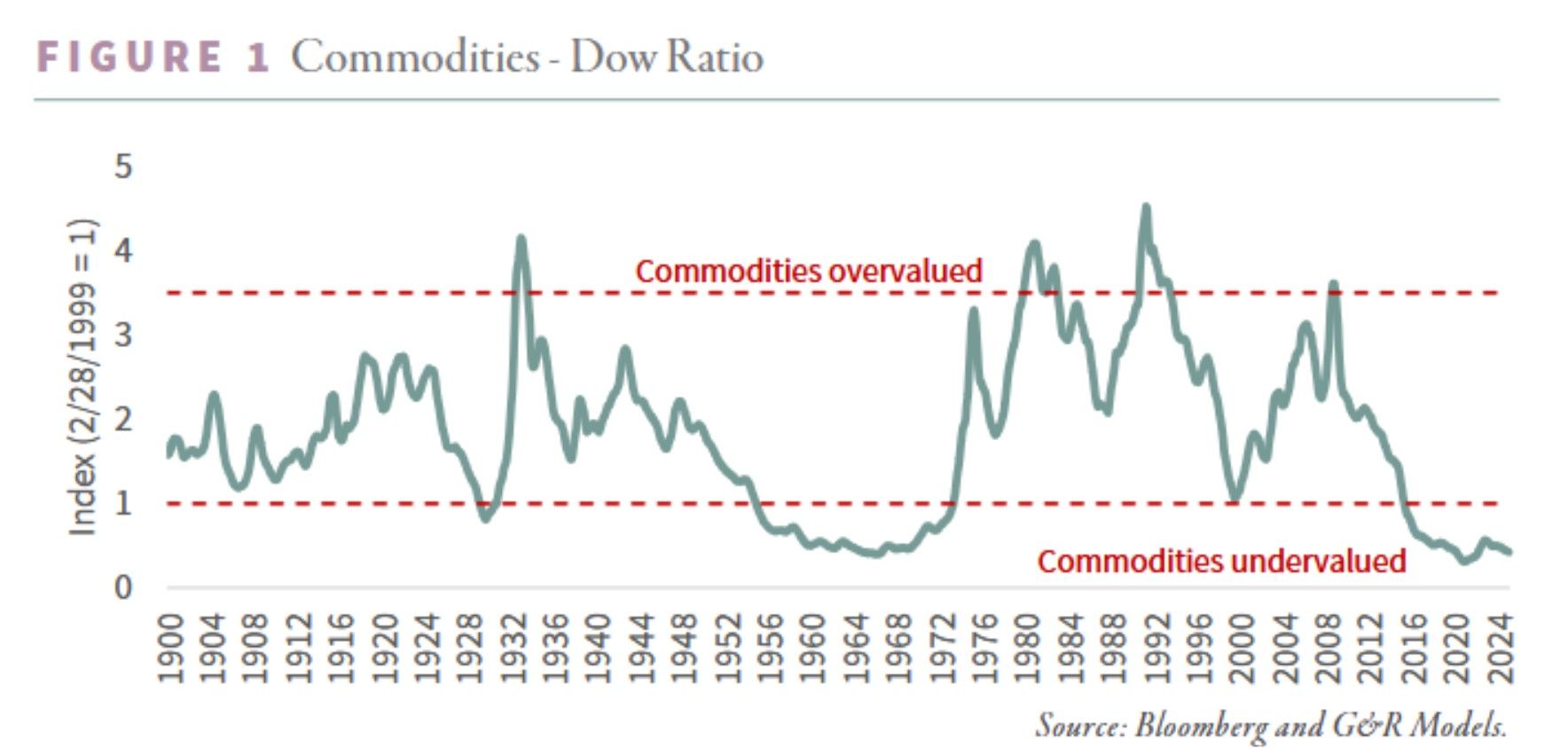

Not much improvement for the commodities-to-dow ratio

Dow Jones hit new all-time high while oil stays in a down trend. Source: Bloomberg, Finding Value Finance on X

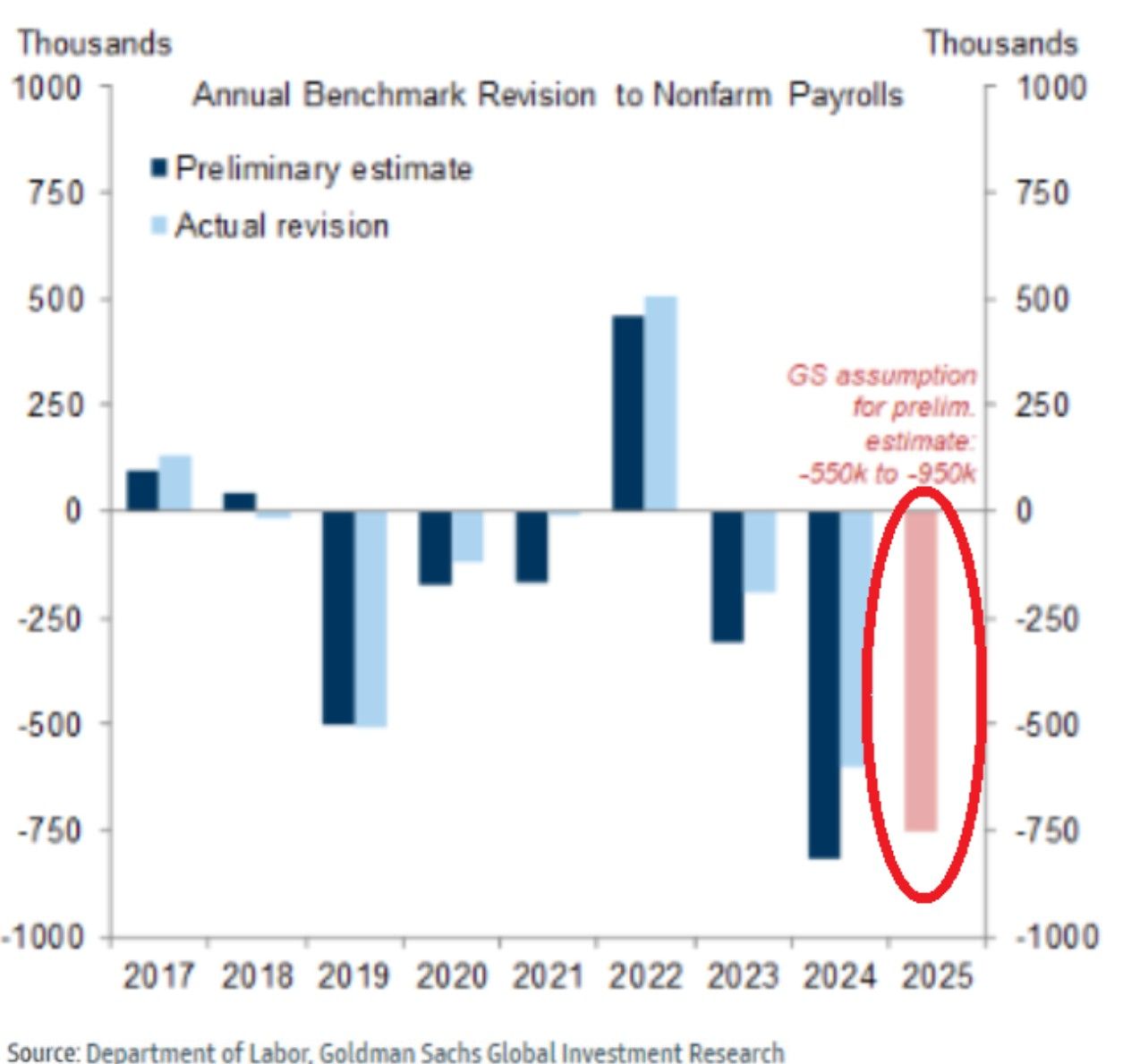

⛔ The BLS is set to revise down US job numbers by 550,000-950,000 for 12 months ending March 2025 on September 9, according to Goldman Sachs estimates.

That’d be the biggest 12-month downward revision in 15 YEARS. Total cut over 2 years would reach 1.5M jobs. Source: Goldman Sachs, Global Markets Investor

The ratings agency kept the U.S. at AA+/A-1+ with a stable outlook.

“The stable outlook indicates our expectation that although fiscal deficit outcomes won’t meaningfully improve, we don’t project a persistent deterioration over the next several years,” S&P said in its statement. The firm pointed to broad economic resilience, policy continuity, and strong revenue streams, including what it described as “robust tariff income” - as offsets to fiscal slippage stemming from legislative changes. While acknowledging concerns that tariffs could dampen business confidence, growth, and hiring while spurring inflation, S&P said revenue gains would help balance the ledger, WSJ reports. The agency’s decision comes against the backdrop of a $5 trillion increase in the debt ceiling and projections that net general government debt will approach 100% of gross domestic product, driven by “structurally rising non-discretionary interest and aging-related expenditure.” S&P cited several strengths underpinning the rating, including the resilience of the U.S. economy, effective monetary policy, and a deficit trajectory that, while elevated, isn’t accelerating. Yet the firm also noted risks... “Bipartisan cooperation to strengthen the U.S. fiscal profile - namely to meaningfully lower deficits and tackle budgetary rigidities - remains elusive,” S&P said. Below is a chart of USA sovereign credit risk Source: zerohedge

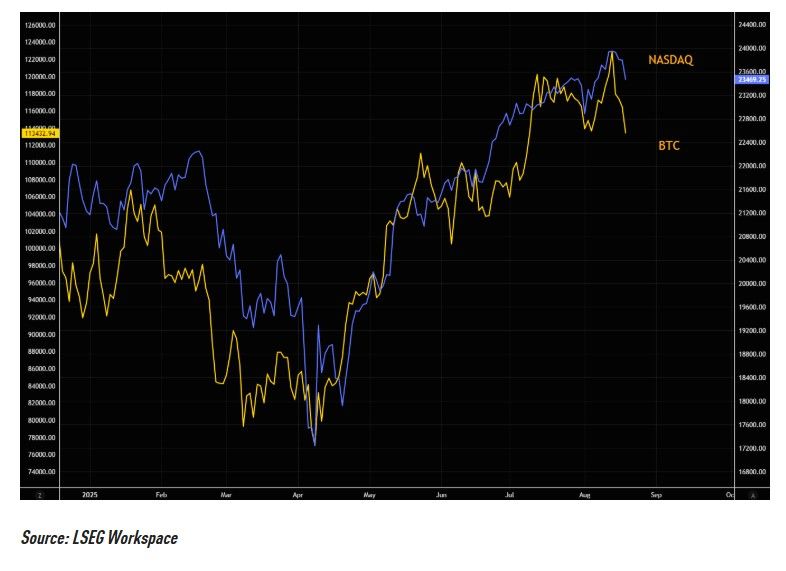

Nasdaq and Bitcoin often trade in the same direction

Source: www.zerohedge.com, LSEG workspace

Investing with intelligence

Our latest research, commentary and market outlooks