Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The US president said he was nominating the 'Highly Respected Economist' EJ Antoni from the right wing Heritage Foundation to chair the agency

After firing the former commissioner for a gloomy jobs report he claimed was 'rigged' https://on.ft.com/3UkAOWG Source: FT

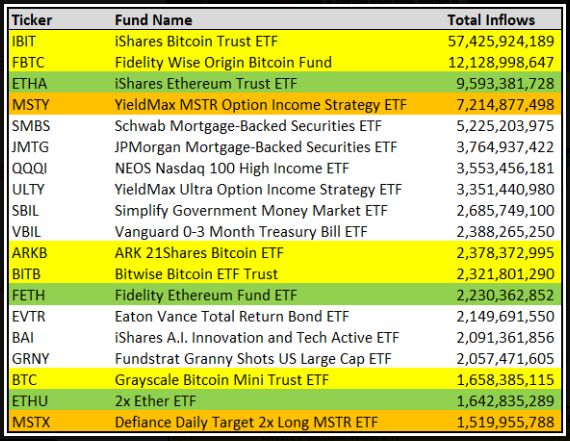

Out of all the 1,300+ ETFs that launched since the start of 2024 here are the top 20 that have gotten the most inflows

👑 $IBIT - iShares Bitcoin ETF 🥈 $FBTC - Fidelity Wise Origin Bitcoin Fund 🥉 $ETHA - iShares Ethereum ETF 4. $MSTY - Yield Max MSTR Option Income ETF 5. $SMBS - Schwab Mortgage Backed Securities ETF 6. $JMTG - JP Morgan Mortgage Backed Securities ETF 7. $QQQI - NEOS Nasdaq 100 High Income ETF 8. $ULTY - YieldMax Ultra Option Income ETF 9. $SBIL - Simplify Government Money Market ETF 10. $VBIL - Vanguard 0-3 Month Treasury Bill ETF Source: ETF Tracker @TheETFTracker thru @NateGeraci

In proportion to population the millionaires exodus from the UK is unprecedented

Main beneficiaries (in proportion of population): UAE, Italy, Switzerland, Singapore, Portugal and Greece Source: Michel A.Arouet

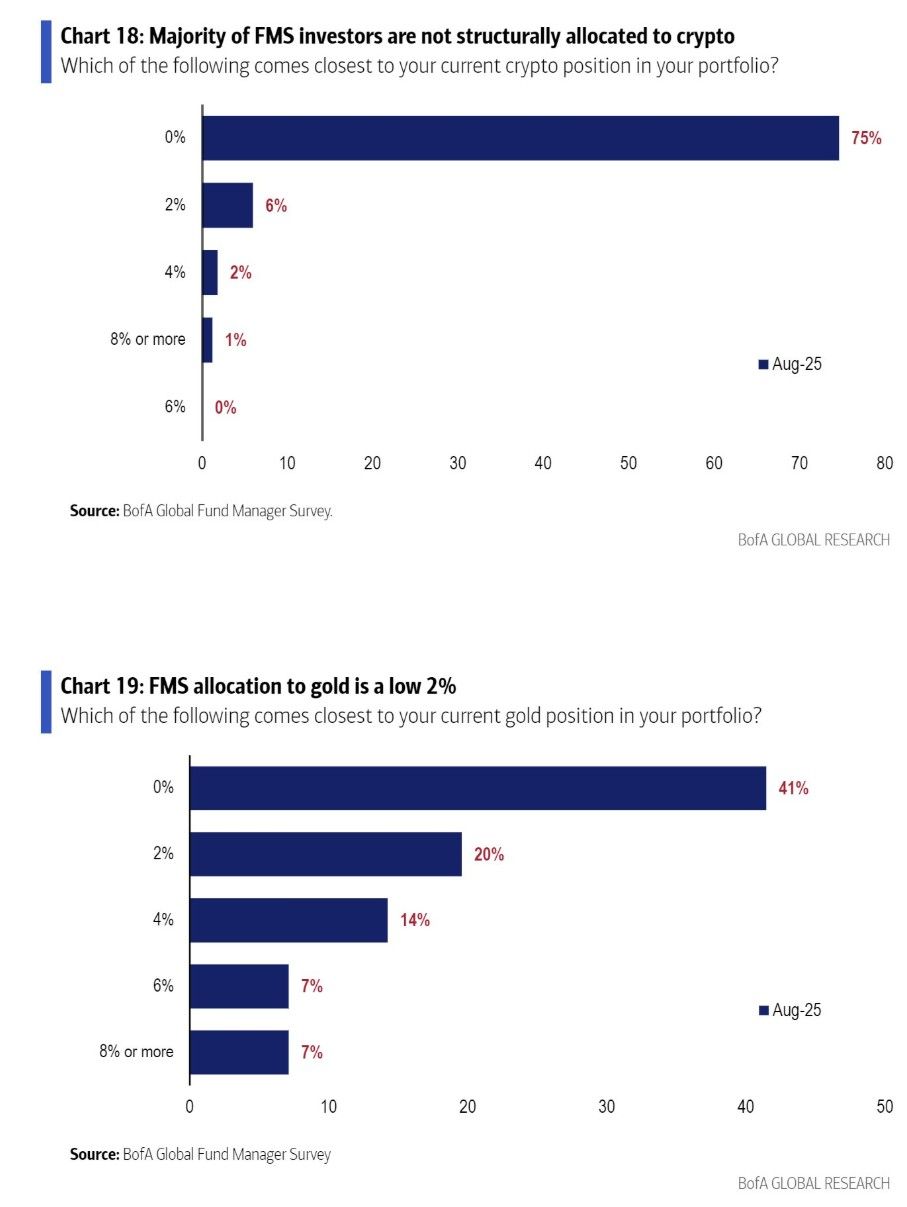

Incredible charts by BofA...

Bitcoin and gold are the two best best performing assets YTD and over the last few years... However, fund managers are massively under-exposed to those 2 store of values... Indeed, 75% of fund managers have no exposure at all to cryptos. And even more surprisingly, 41% of fund managers have no exposure at all to gold... The least we can say is that they don't look as crowded trades... Source: BofA thru Callum Thomas

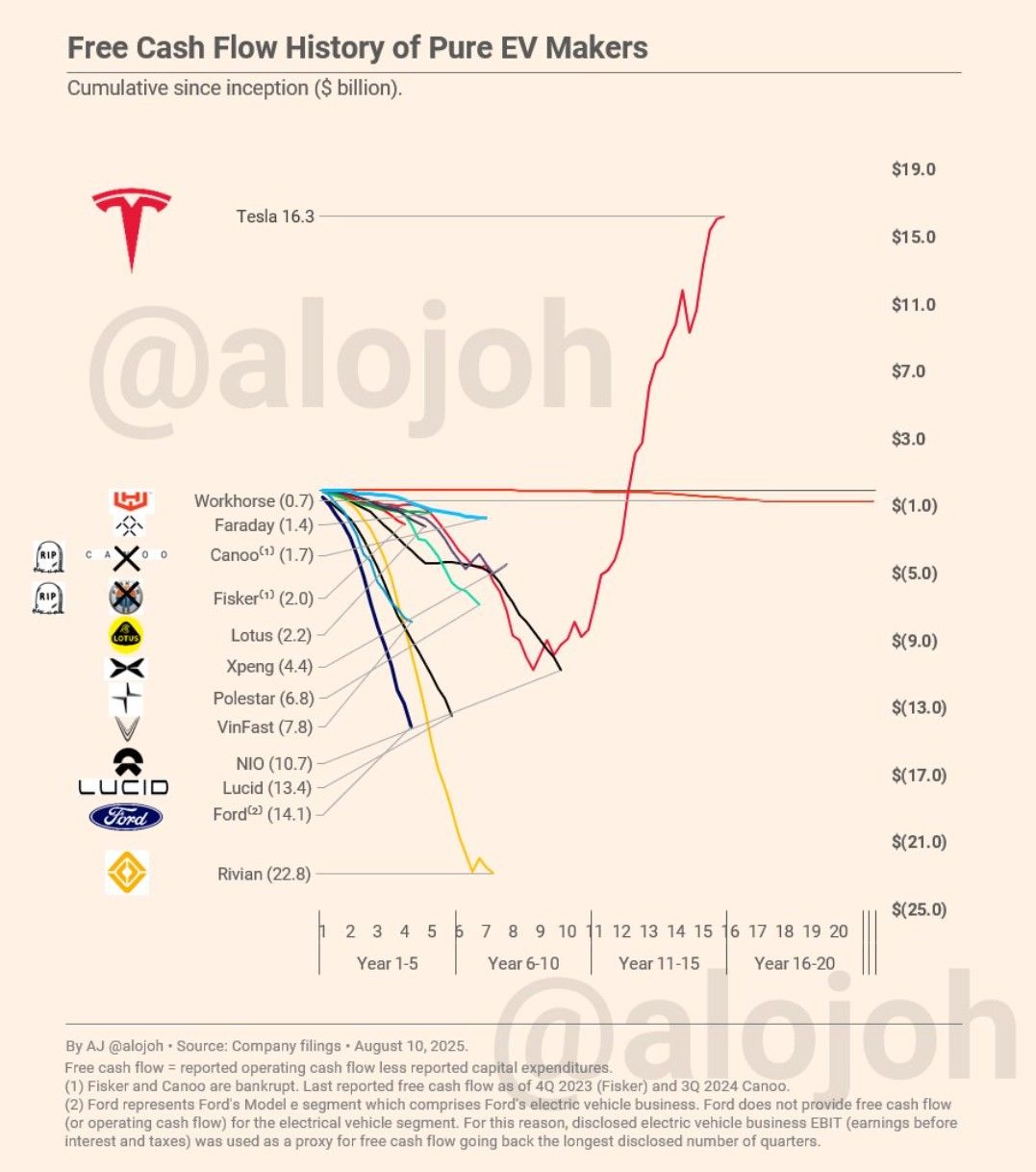

Free cash flow of pure electric vehicles makers

Updated for Tesla, Rivian, Lucid, and Ford EV Q2 2025. His key observations: 1. The EV business is a tough one 2. Only Tesla manages to generate positive free cash flow. 3. Ex Tesla, the shown companies accrued $88 billion in cash burn (net negative cumulative free cash flow). 4. In terms of cash burn, Rivian is the most underperforming EV maker: nobody has accrued a higher cash burn, not nearly. Will we see a similar story with robotaxis? Source: AJ @alojoh

Investing with intelligence

Our latest research, commentary and market outlooks