Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

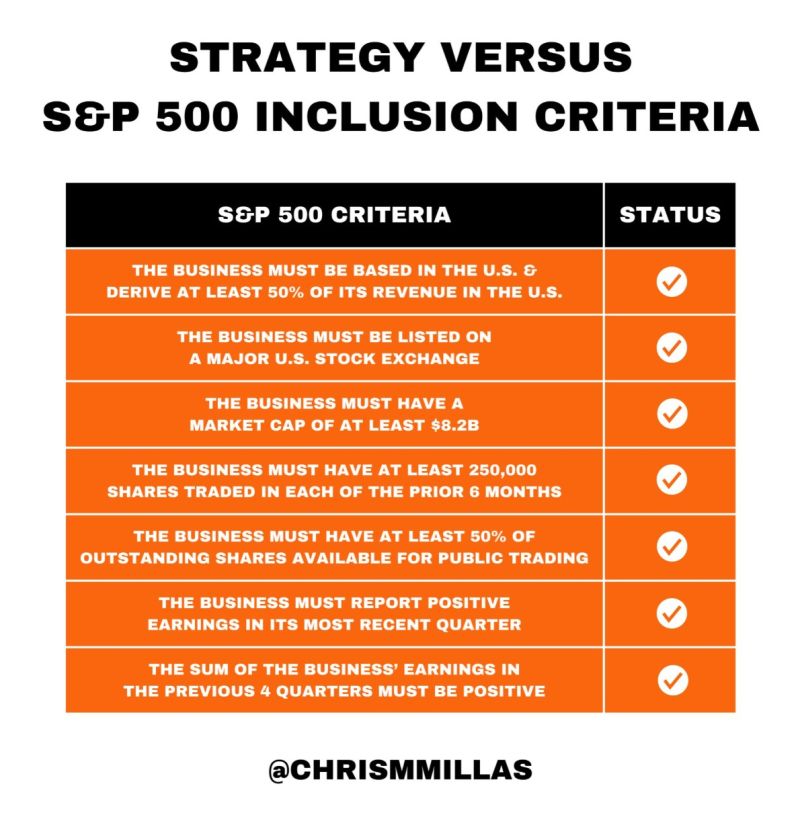

Strategy now satisfies all SP500 inclusion criteria. $MSTR

Source: Chris Millas @ChrisMMillas

JPMORGAN $JPM JUST ANNOUNCED A NEW $50 BILLION SHARE BUYBACK PROGRAM

JPMORGAN JUST INCREASED ITS QUARTERLY DIVIDEND OF $1.50 PER SHARE UP FROM $1.40 Source: Evan on X

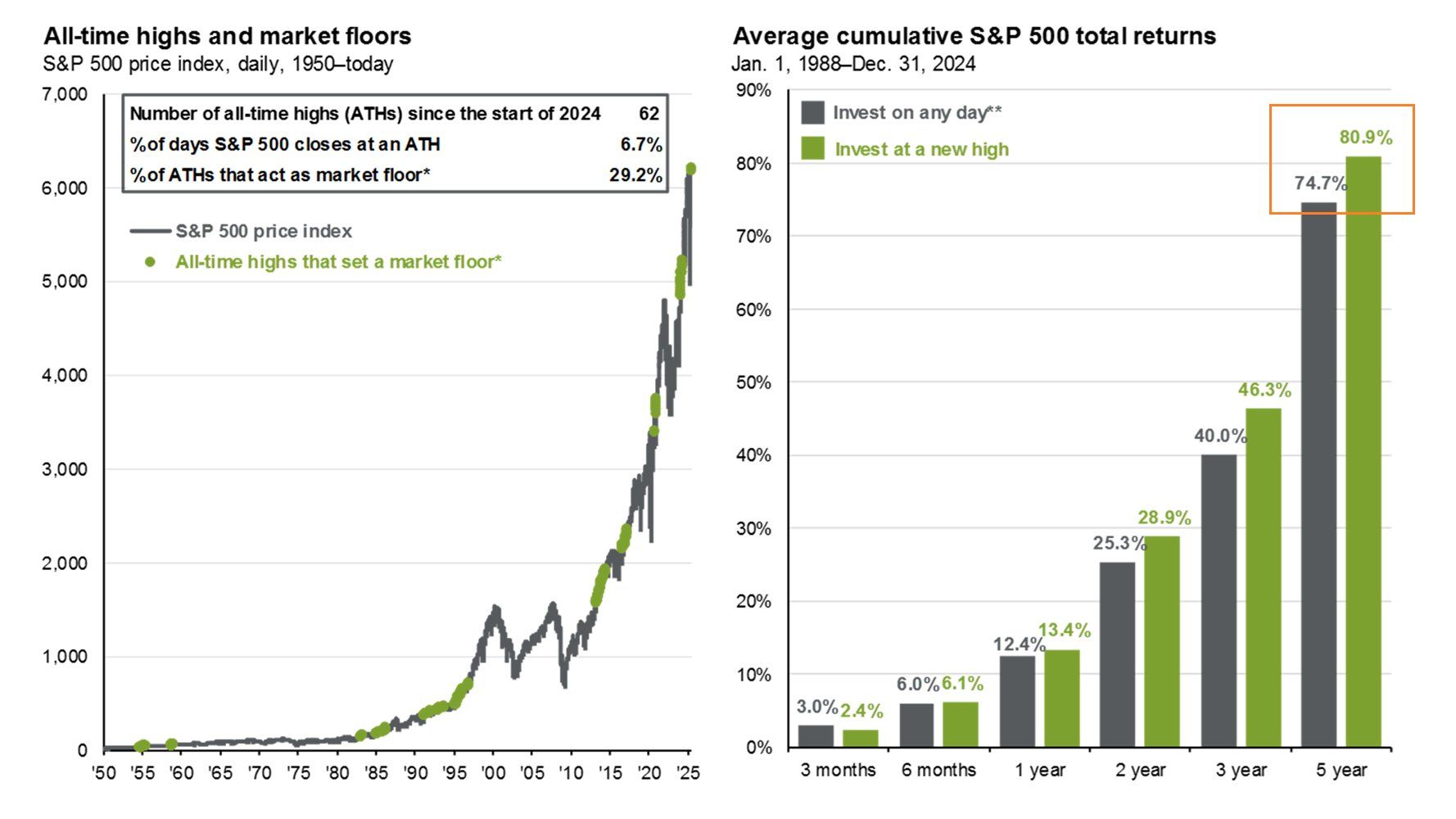

This is counterintuitive: It's safer to invest when the sp500 is at an all-time high...

Source: @MikeZaccardi on X

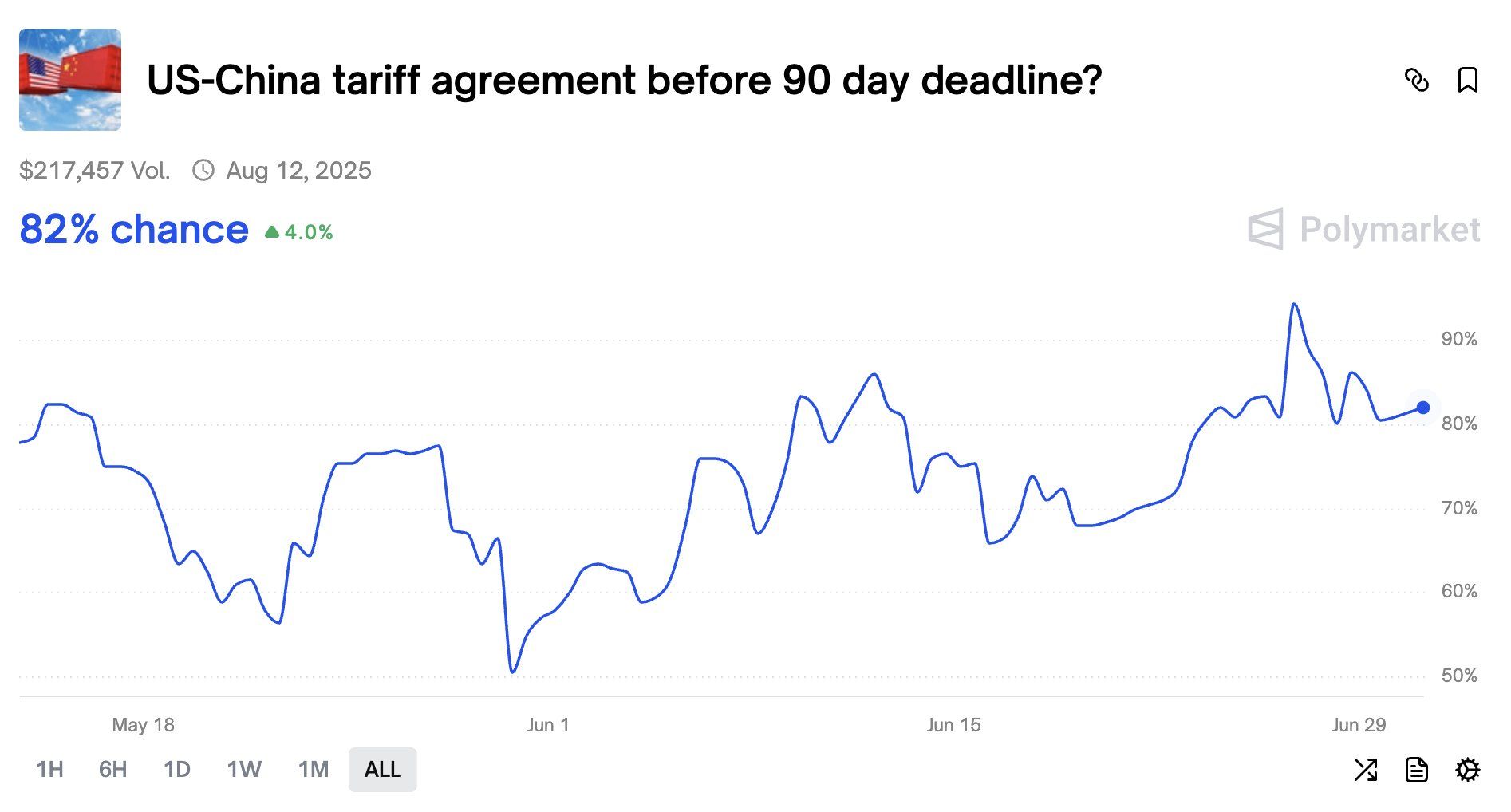

ALERT: There’s only 8 days remaining until the tariff negotiation deadline

Betting markets are placing an 82% chance of US-China reaching an agreement before that deadline. Source: Bravos Research

The lowest close since February 2020 for the VIX index

Source: Charlie Bilello

The bill’s passage through Congress’s upper chamber now leaves its fate in the hands of the House of Representatives, where it could still face considerable opposition

Donald Trump’s landmark tax and spending legislation moved a step closer to becoming law on Tuesday after the US Senate ended days of haggling and narrowly passed the so-called big, beautiful bill. The bill’s passage through Congress’s upper chamber now leaves its fate in the hands of the House of Representatives, where it could still face considerable opposition ahead of a looming July 4 deadline. The Senate approved the sweeping legislation, 51-50, after vice-president JD Vance cast the tiebreaking vote. The president celebrated the legislation’s progress and turned up the pressure on the House to approve it by the end of the week. He urged Republicans in the lower chamber to ignore “GRANDSTANDERS” and do “the right thing, which is sending this Bill to my desk” to be signed into law. Source: FT

In case you missed it... As of July 1, 2025, gold will officially be classified as a Tier 1, high-quality liquid asset (HQLA) under the Basel III banking regulations.

That means U.S. banks can count physical gold, at 100% of its market value, toward their core capital reserves.

Investing with intelligence

Our latest research, commentary and market outlooks