Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The world's biggest exporters of goods.

Source: Civixplorer @Civixplorer

On June 29th 2010: Tesla went public.

$4,000 invested in the IPO would be worth more than $1 million today. Source: Jon Erlichman @JonErlichman

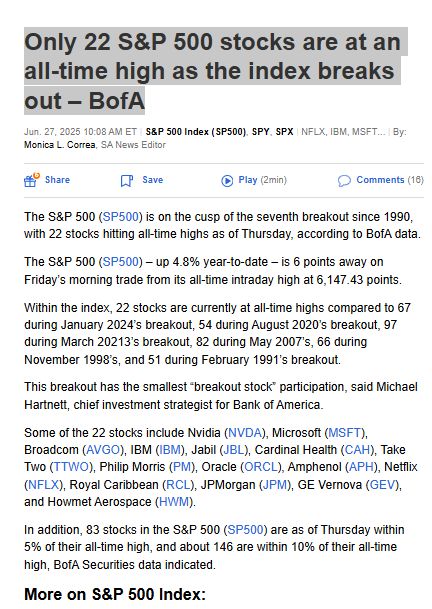

It would be great to see more new all-time-highs at the stock level. It would be great to see more new all-time-highs at the stock level.

Market breadth should confirm market action at the headline level

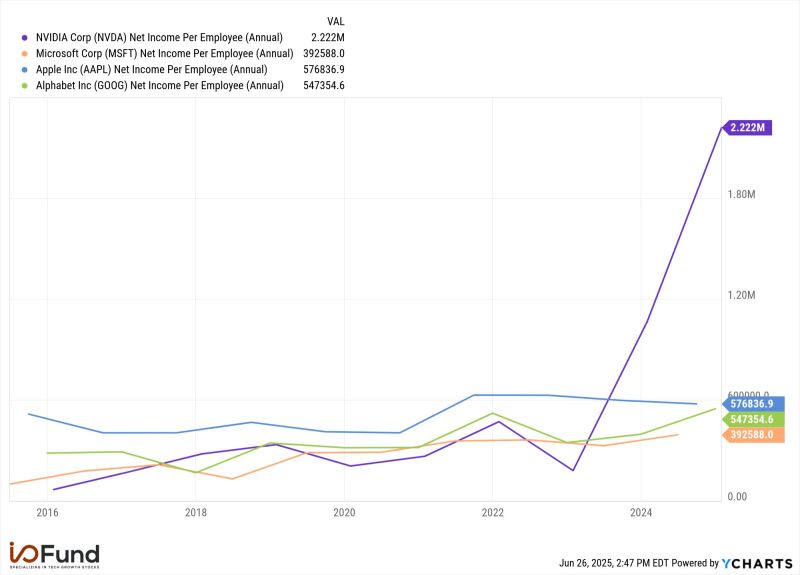

This chart comparing AI leaders and AI laggards highlights how artificial intelligence is reshaping companies and business models.

As the chart below shows, the pace of disruption has accelerated significantly in recent weeks. (HT Goldman Sachs) Source: HolgerZ, Bloomberg

Canada has scrapped a digital services tax that targeted US tech companies after Donald Trump described the levy as a 'direct and blatant' attack.

▶️ Canada has walked back on its digital services tax “in anticipation” of a mutually beneficial comprehensive trade arrangement with the United States, Ottawa announced Sunday night, just one day before the first tax payments were due. ▶️This decision from Ottawa was an about-turn from Canadian officials earlier this month, who said they would not pause the digital services tax, despite strong opposition from the U.S. ▶️Canada’s Minister of Finance and National Revenue Francois-Philippe Champagne added, “Rescinding the digital services tax will allow the negotiations of a new economic and security relationship with the United States to make vital progress and reinforce our work to create jobs and build prosperity for all Canadians.” Source: FT, CNBC

US TREASURY SECRETARY BESSENT JUST SAID:

• US tariffs on China: 30% • China’s tariffs on US: 10%

BREAKING: US INFLATION DATA RELEASED!

• May PCE rises to 2.3%, in-line with expectations • Core PCE inflation rises to 2.7%, above expectations of 2.6%. PCE inflation is now rising for the first time since February 2025 YoY Growth: PCE (May), 2.3% Vs. 2.3% Est. (prev. 2.1%) Core PCE, 2.7% Vs. 2.6% Est. (prev. 2.5%) MoM Growth: PCE (May), 0.1% Vs. 0.1% Est. (prev. 0.1%) Core PCE, 0.2% Vs. 0.1% Est. (prev. 0.1%) Source: Macrobond

Investing with intelligence

Our latest research, commentary and market outlooks