Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

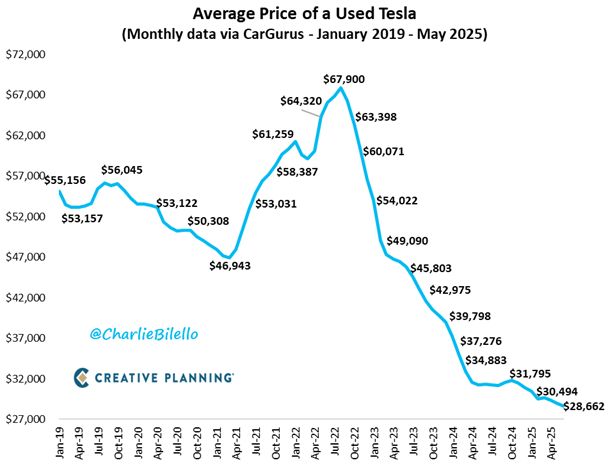

Buying a Tesla is becoming more and more affordable with each passing month.

The average price of a used Tesla has moved down to a record low of $28,662. That's 58% below the peak price from July 2022. $TSLA Source: Charlie Bilello

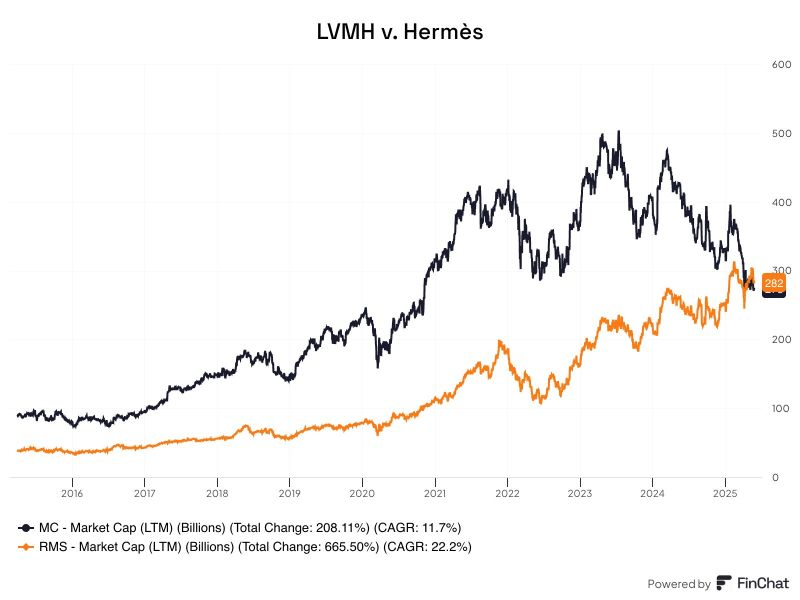

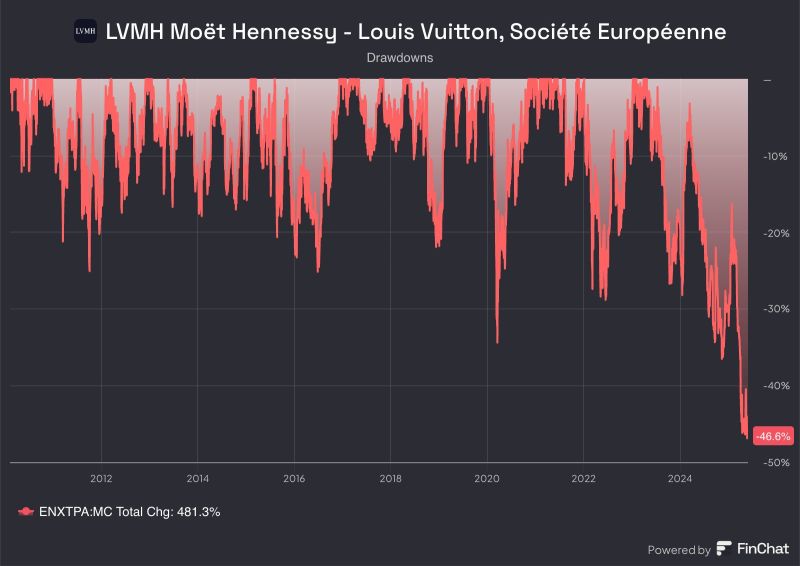

Hermès just surpassed LVMH to become the world's largest luxury company.

"We're about craft, we're not machines" Source: Finchat

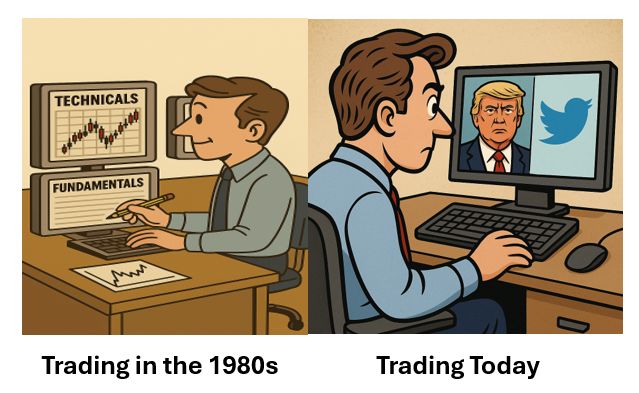

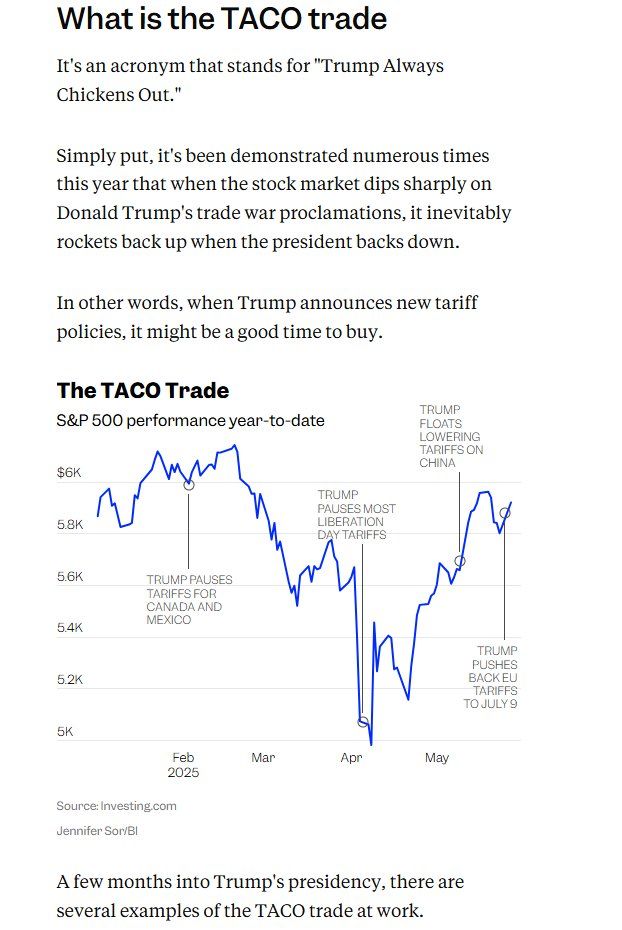

The TACO trade is the new Trump trade

TACO = "Trump Always Chickens Out." Source: Wall St Engine @wallstengine

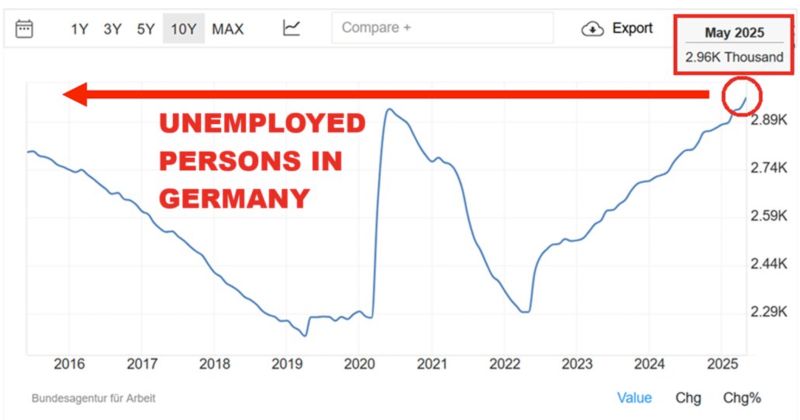

German job market is deteriorating:

The number of unemployed people in Germany hit 2.96 MILLION in May, the highest in at least 10 YEARS. This is even higher than at the 2020 CRISIS peak. The unemployment rate sits at 6.3%, the second-highest in 10 years. Source: Global Markets Investor

$NVDA Q1 2026

"AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate." - Jensen Huang Revenue +69% *Data Center +73% *Gaming +42% *Professional Vis. +19% *Automotive +72% EBIT +28% *marg. 49% (65) EPS +27% Source: Quartr

Investing with intelligence

Our latest research, commentary and market outlooks