Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Chip companies are eventually going to be banned entirely from working with China in the next 3.5 years.

Source: Spencer Hakimian, FT

Nvidia $NVDA stock is up almost 4% in after hours after beating EPS and Revenue expectations

Source: Barchart

NVIDIA $NVDA CEO JENSEN HAUNG JUST SHARES HIS THOUGHTS ON US EXPORT CONTROLS FOR AI:

"The question is not whether China will have AI. It already does. The question is whether one of the world's largest AI markets will run on American platforms. Shielding Chinese chipmakers from US competition only strengthens them abroad. Weakens America's position. Export restrictions have spurred China's innovation and scale. The AI race is not just about chips. It's about which stack the world runs on." "The US has based its policy on the assumption that China cannot make AI chips. That assumption was always questionable, and now it's clearly WRONG. China, has enormous manufacturing capability. In the end, the platform that wins the AI developers wins AI. Export controls should strengthen US platforms not drive half of the world's AI talent to rivals" Source: Evan on X

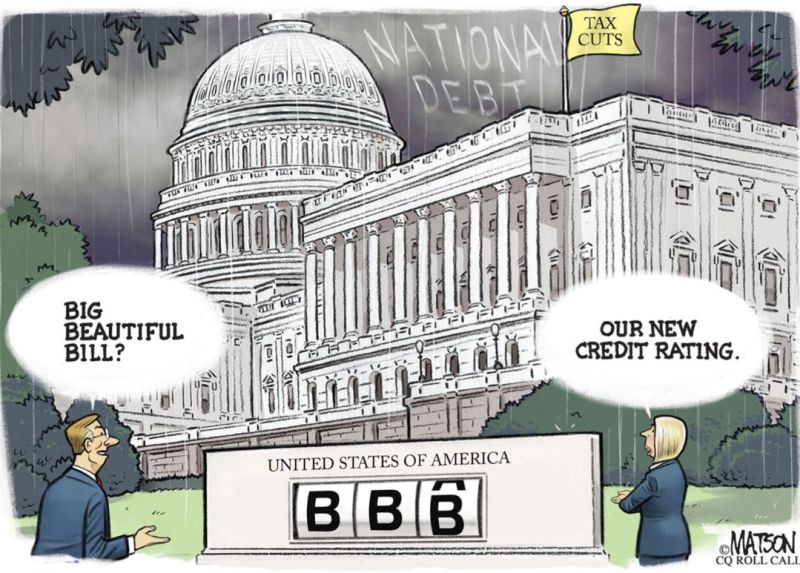

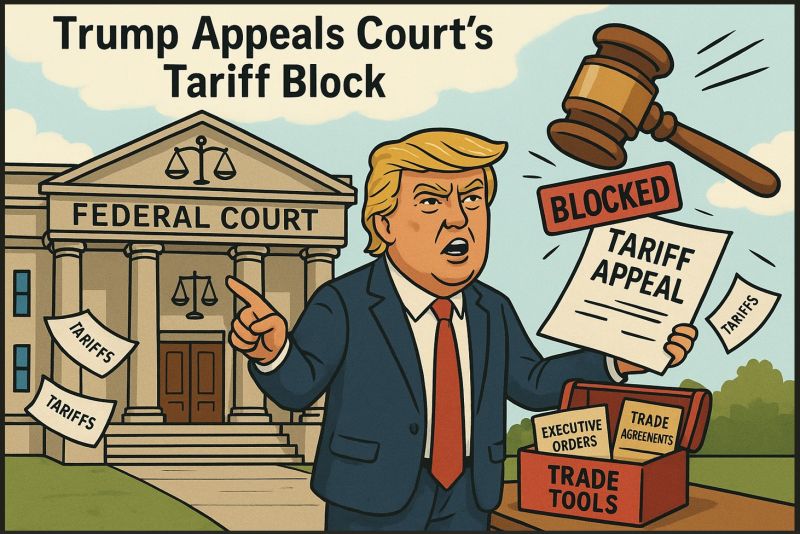

LIBERATION DAY TARIFFS - GONE.

Any “national emergency” blanket tariffs - GONE. Dow futures are up 500 points 🚀 President Donald Trump’s global tariffs were deemed illegal and blocked by the US trade court, dealing a major blow to a pillar of the Republican’s economic agenda. 👉 A federal trade court struck down President Donald Trump’s worldwide reciprocal tariffs and ordered the administration to stop collecting them. 👉 A three-judge panel on the Court of International Trade said Trump exceeded “any authority granted” by the International Emergency Economic Powers Act in imposing the import levies. 👉 In halting tariffs Trump ordered on Canada, Mexico, and China to combat drug trafficking, the judges said they “fail because they do not deal with the threats set forth in those orders.” 👉 The government immediately appealed the ruling to the U.S. Court of Appeals for the Federal Circuit.

Elon Musk is formally stepping down from his role in the Trump administration after just five months

ending a tumultuous period during which he oversaw cost-cutting by the so-called Department of Government Efficiency (source: FT) 👉 It's no coincidence that he's leaving DOGE as of the end of May. After 130 days at the DOGE, the billionaire would have had to go before Congress to publish his accounts and fulfill his obligations of control and transparency...

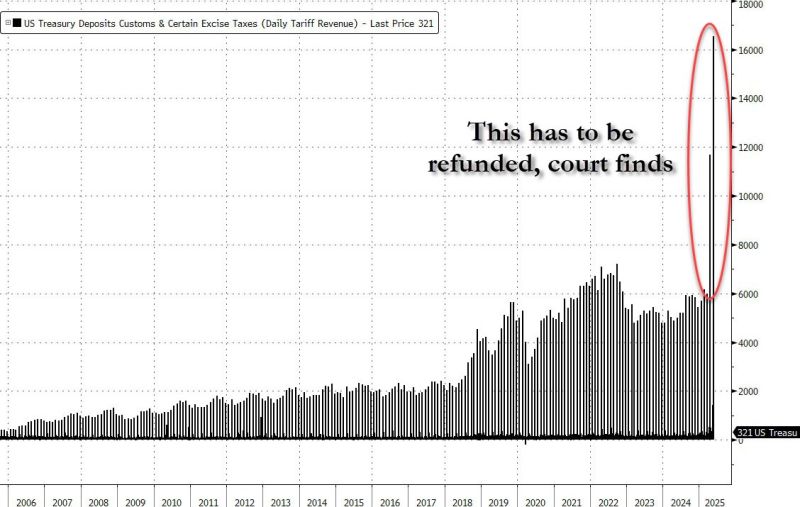

So tariffs - which have already been spent on Congressional grift and corruption - somehow now have to be refunded...

Source: zerohedge

WHAT ARE THE TOOLS AT THE TRUMP ADMINISTRATION? DISPOSAL AFTER A U.S COURT BLOCKS TARIFFS?

The U.S. Court of International Trade struck down President Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose tariffs. The court ruled that IEEPA does not authorize tariffs, and trade deficits aren't a valid "unusual and extraordinary threat" required under the act. ➡️ Response Options for the Trump Administration 👇 1. Appeal the Ruling - Already filed; may reach the Supreme Court. - A stay could allow tariffs to continue during litigation. - Outcome uncertain, depending on how courts view executive power. 2. Use Alternative Legal Authorities - Section 122 of the Trade Act (15% tariffs for 150 days). - Section 232 (national security rationale). - Section 301 (unfair trade practices). - Currency manipulation designations. Pros: Based on existing law. Cons: Some are limited or slow to implement. 3. Seek Congressional Authorization - Could pass new legislation to restore or expand tariff authority. - Mixed outlook due to bipartisan skepticism. 4. Adjust Tariff Strategy Within Legal Bounds - Use industry-specific or targeted tariffs under Sections 232 or 301. - Avoids IEEPA issues but may lack desired economic impact. 5. Negotiate Trade Deals During Appeal - Use paused tariffs as leverage. - Some deals (e.g., with China) already in motion. - Less effective now due to weakened legal position. 6. Declare New or Reframed National Emergencies - Possible but unlikely to succeed legally. - Courts already skeptical of broad use of IEEPA. 7. Use Non-Tariff Executive Actions - Sanctions, export controls, and financial restrictions. - Legally safer under IEEPA but less direct in addressing trade goals. 8. Request Emergency Stay - Would pause the court ruling, preserving tariffs temporarily. - Moderate chance of success; would delay impact while appeals proceed. ➡️ Most Viable Temporary Measures👇 : - Requesting a stay and appealing the ruling (keeps tariffs in place during litigation). - Using Section 122 for short-term, limited tariffs. - Expanding Section 232 or 301 actions for longer-term solutions. ➡️ Conclusion: The court ruling challenges executive power over tariffs. The Trump administration’s best short-term path is to appeal with a request for a stay, while Section 122 offers a fast, legal workaround. Longer-term strategies like Section 232/301 or new legislation face political and procedural hurdles.

Investing with intelligence

Our latest research, commentary and market outlooks