Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

📢 President Trump is expected to invoke the wartime Defense Production Act over US dependence on Russia and China for enriched uranium and nuclear fuel processing

Reuters reports in a post on X, citing sources. 🔴 Trump is expected to sign multiple nuclear-related executive actions as soon as Friday, Reuters reports 🔴Shares of Uranium Energy and Centrus Energy rose more than 6% in post-market trading

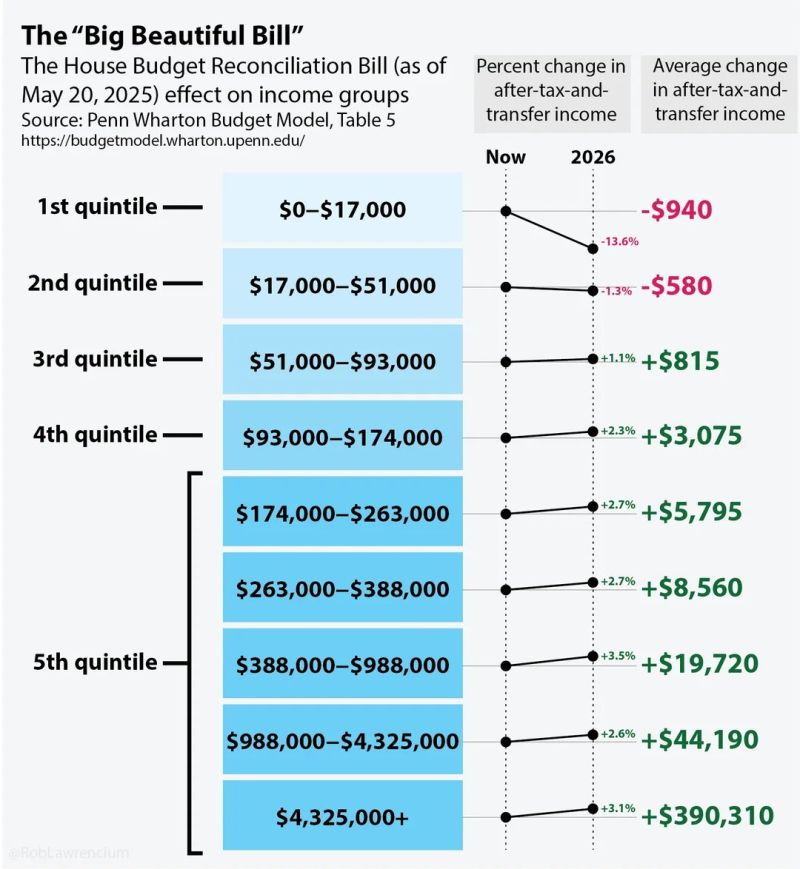

Breaking: President Trump’s One Big Beautiful Bill officially PASSES🔥

✅ No tax on tips or overtime ✅ $175B for deportations and the wall ✅ Tax relief for seniors ✅ Making his 2017 tax cuts permanent Below is the Big beautiful bill impact on various income groups Source: Markets & Mayhem

📢 CHINA SAYS U.S. DIALOGUE TO CONTINUE AS CHINA HINTS TRADE TALKS ARE ADVANCING - CNBC

The U.S. and China have agreed to maintain communication following a call between Chinese Vice Foreign Minister Ma Zhaoxu and U.S. Deputy Secretary of State Christopher Landau, according to a brief readout released by the Chinese Foreign Ministry on Friday. Both sides exchanged thoughts on crucial issues during the call on Thursday, the statement said, without elaborating. The U.S. Department of State issued a similar statement Thursday, briefly noting the consensus on the importance of the bilateral relationship and an agreement to keep open lines of communication. The statement came as Beijing and Washington continued to trade swipes at each other, despite the tariff de-escalation following a meeting between both sides in Switzerland earlier this month. Source: CNBC

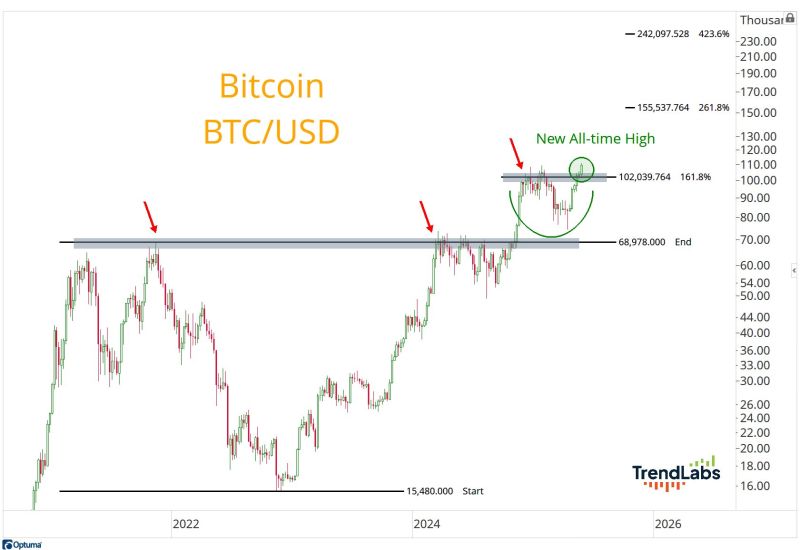

Bitcoin technicals by J-C Parets

Satoshi Nakamoto passes Nvidia CEO Jensen Huang to become the 11th richest person in the world.

Poland standard of living will surpass Japan this year.

Free market, hard work and entrepreneurial spirit do pay off. Congratulations Poland.

House to vote post-midnight on President Trump's Big Beautiful Bill, pushing tax cuts, spending reductions, and America First policies. Speaker Johnson confident in passage despite GOP holdouts.

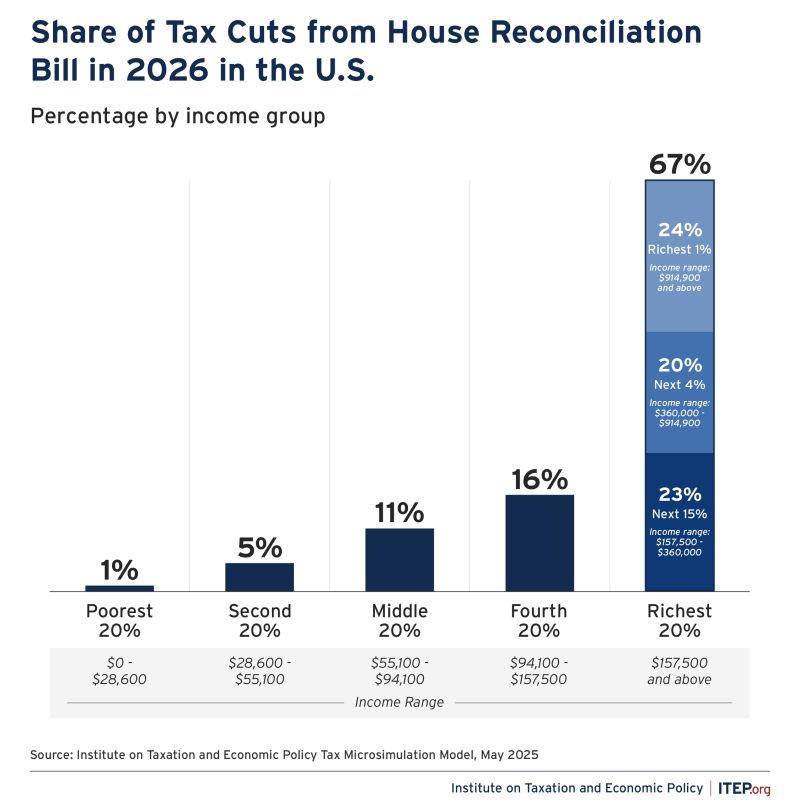

An analysis by itep.org comes to the conclusion that two-thirds of the tax cuts offered in 2027 would go to the top 20 percent of families, and 41 percent would flow to just the top 5 percent of families. https://lnkd.in/dS-KWdQV.

Will 2-day work pay be enough for the bills in 10 years?

Source: Wall Street Mav, Fortune

Investing with intelligence

Our latest research, commentary and market outlooks