Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

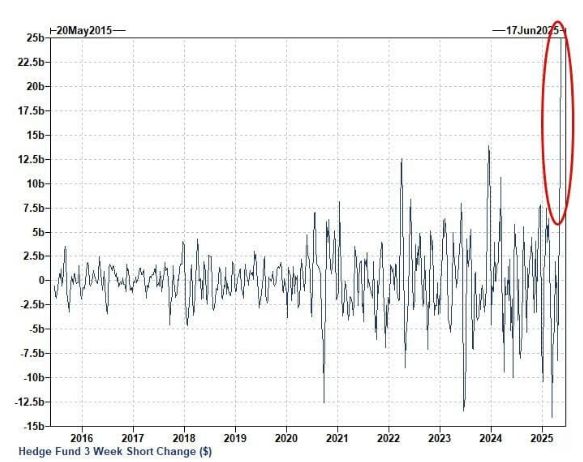

HedgeFunds have added $25 Billion of short equity futures exposure over the last 3 COT reports, the largest increase AT LEAST the last decade 🚨🚨

Source: Barchart

The Conference Board Leading Economic Index FELL to the lowest level in 11 YEARS.

The drawdown since the peak has been 17.3%, the biggest since the Great Financial Crisis. Such a drop has never been seen outside of recessions and is higher than in 2001. Source: Bloomberg, Liz Ann Sonders, Global Markets Investor

Canada's national pension fund piled into US market in Q1 despite the 'Buy Canada' push.

Another proof that the "Sell America" narrative is overdone? Source: Eric Balchunas, Bloomberg

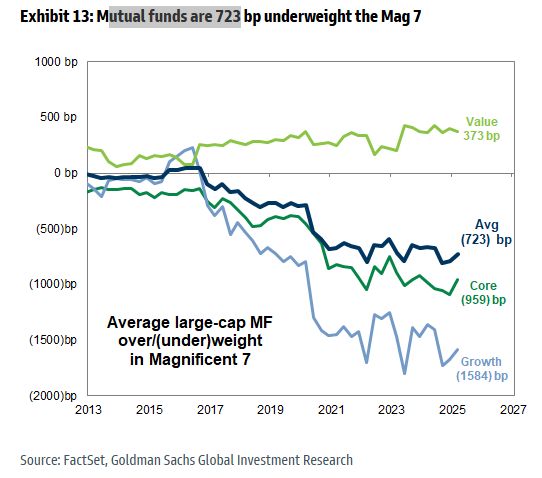

Mutual funds are 723bps underweight the Mag7

Source: Mike Zaccardi, CFA, CMT, MBA

In case you wonder why stocks when down yesterday

BOND AUCTION FOR THE US 20-YEAR TREASURIES WAS UGLY Because of the lack of bidders…it caused the 20-year bond yield to surge to 5.1%. Stock markets didn't like it Source: amit @amitisinvesting

Are rising bond yields the elephant in the room for equities?

Source: Trend Spider

The rise in Japanese 30-year yields is getting some attention but one should not forget the sharp move higher across the entire US Treasury curve, which is probably the real elephant in the room.

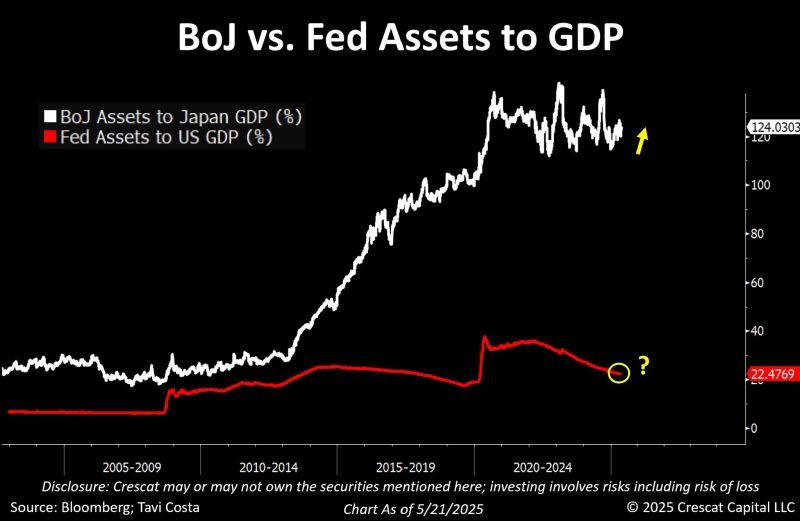

I tend to agree with Tavi Costa that the US will need at some point to implement yield curve control. We should thus see Fed assets as a percentage of GD starts rising again. Maybe Bitcoin and Gold are starting to price something like this Source: Tavi Costa, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks