Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

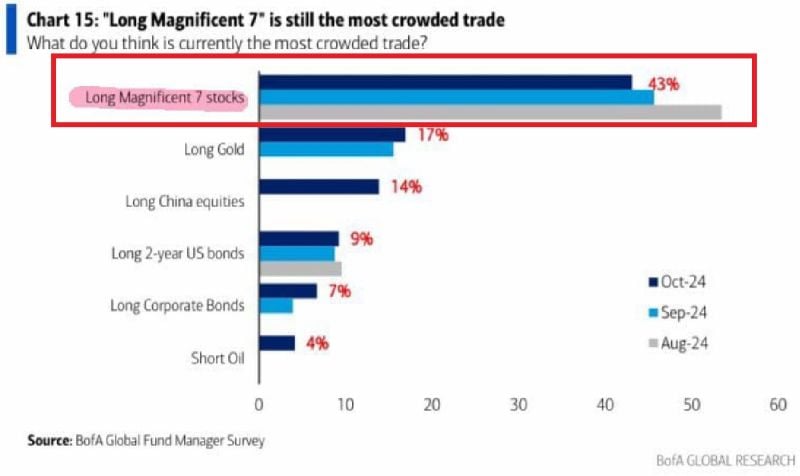

🔥LONG MAGNIFICENT 7 IS THE MOST CROWDED TRADE ACCORDING TO GLOBAL INVESTORS🔥

43% of global investors* believe Long Magnificent 7 is the most crowded trade, down from ~54% in August. Has the trade become overcrowded? *BofA survey of 195 participants with $503 billion assets. Source: Global Markets Investor

After Alphabet $GOOG, it is now the turn of Amazon $AMZN to go nuclear...

It's investing $500 million across 3 new projects: • Building 4 SMRs (small modular reactors) with Energy Northwest • Exploring SMR development with Dominion Energy • Leading SMR developer X-Energy's funding round Source: Stocktwits

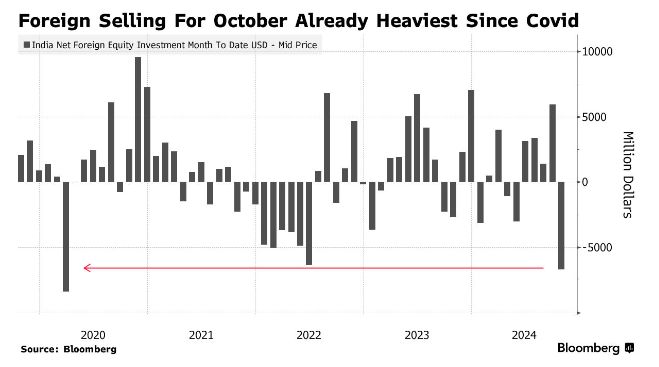

India stocks foreign selling

Foreign Investors have dumped Indian Stocks EVERY SINGLE day this month for a total value of $6.7 billion. This month's selling is on track to surpass even March 2020. Source: Barchart, Bloomberg

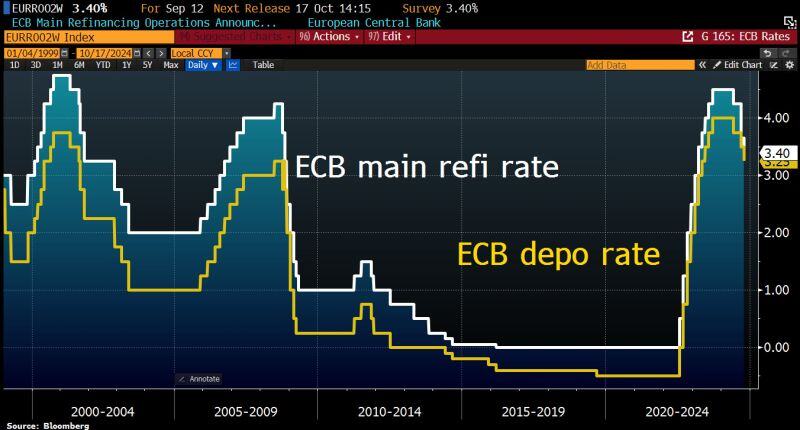

ECB cut the key rates by 25bps as expected.

Depo rate to 3.25%, Main Refi to 3.4%. Guidance is unchanged: ECB to follow data-dependent, Meeting-by-Meeting approach. • Even after this third rate cut of the year, monetary policy remains restrictive in Europe, with the real short-term rate still at a level not seen over the past 15 years. Given the ongoing dynamics in economic activity and inflation, this implies that the ECB will have to continue to lower rates in the coming months, in order to bring its monetary policy to a neutral stance at minimum. Rate cuts at the coming meetings are therefore to be expected, in December and in the course of 2025. Given the worrying trend in economic activity data, an acceleration in the pace of rate cuts, with a possible 50bp cut at the December meeting, cannot be ruled out. If growth in the Eurozone stalls, a faster pace of rate cuts to remove the restrictiveness of the monetary policy, or even to move it into supportive territory, might prove to be warranted. Source chart: Bloomberg

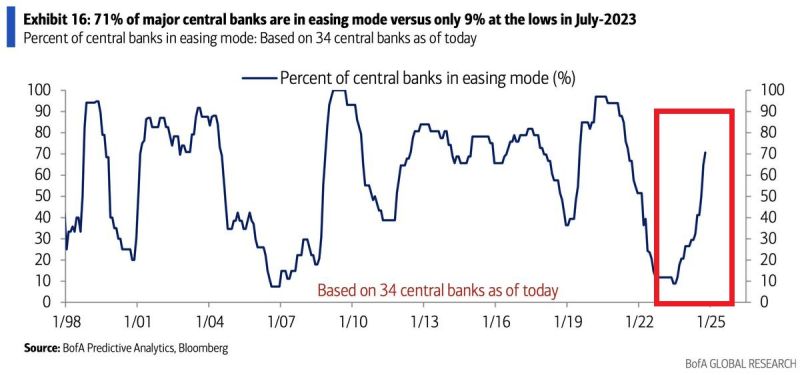

👉 A SYNCHRONIZED GLOBAL MONETARY POLICY EASING

71% of major central banks are now easing their monetary policy, the most since the 2020 CRISIS. This is also in line with the Financial Crisis and the 2001 recession. Source: BofA

Central Bankers from Mexico, Mongolia, and the Czech Republic say they will buy more Gold to add to their Reserves

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks