Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING 🚨: Illegal SHORT SELLERS in South Korea now face the possibility of LIFE IN PRISON

#freemarkets Source: Barchart

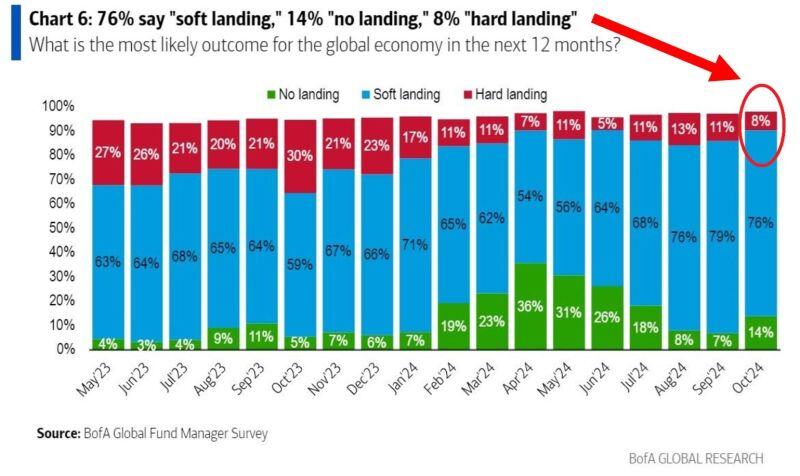

😎 ALMOST NO GLOBAL INVESTORS EXPECT A RECESSION 😎

Only 8% of investors from the BofA survey* expect a hard landing for the global economy within next 12 months, second-lowest reading in 2 years. 76% expect a soft landing. *Survey of 195 participants with $503 billion asset Source: BofA, Global Markets Investor

Chinese e-commerce giant $BABA Alibaba’s international arm launched an updated version of its artificial intelligence-powered translation tool

It says, is better than products offered by Google, DeepL and ChatGPT. 👉 The product supports 15 languages: Arabic, Chinese, Dutch, English, French, German, Italian, Japanese, Korean, Polish, Portuguese, Russian, Spanish, Turkish and Ukrainian. 👉 “The idea is that we want this AI tool to help the bottom line of the merchants, because if the merchants are doing well, the platform will be doing well,” Kaifu Zhang, vice president of Alibaba International Digital Commerce Group and head of the business’ artificial intelligence initiative, said https://lnkd.in/eJrhxVrM Source: CNBC

$NVDA notches record high, looks to unseat Apple as world's most valuable company:

1- Apple $3.517 Trillion; 2- Nvidia $3.387 Trillion Why is Nvdia stock still running? • $GOOGL ordered 400K GB200 chips valued at $10B • $MSFT purchased 60K GB200 chips worth $2B • $META acquired 360K GB200 chips for $8B. Demand for Nvidia's Blackwell chip is absolutely INSANE...

Washington Post: Israeli Prime Minister Benjamin Netanyahu has told the Biden administration he is willing to strike military rather than oil or nuclear facilities in Iran.

Oil gaps down on the new 👇 Source: Markets & Mayhem

Google $GOOGL will back the construction of 7 small nuclear power reactors in the US, a first-of-its kind deal

Under the deal’s terms, Google committed to buying power generated by seven reactors to be built by nuclear-energy startup Kairos Power. The agreement targets adding 500 megawatts of nuclear power starting at the end of the decade (Source WSJ)

BREAKING: The equity put-to-call ratio has dropped to 0.44, the lowest since July 2023.

This is also the second-lowest level since March 2022. In other words, the appetite for hedging against a stock market decline is at its lowest in years. This is despite October being the worst month for stocks on average during Presidential Election years. Meanwhile. the SP500 has hit 45 all-time highs this year and is up 23% YTD. The resilience of this market is truly remarkable. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks