Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

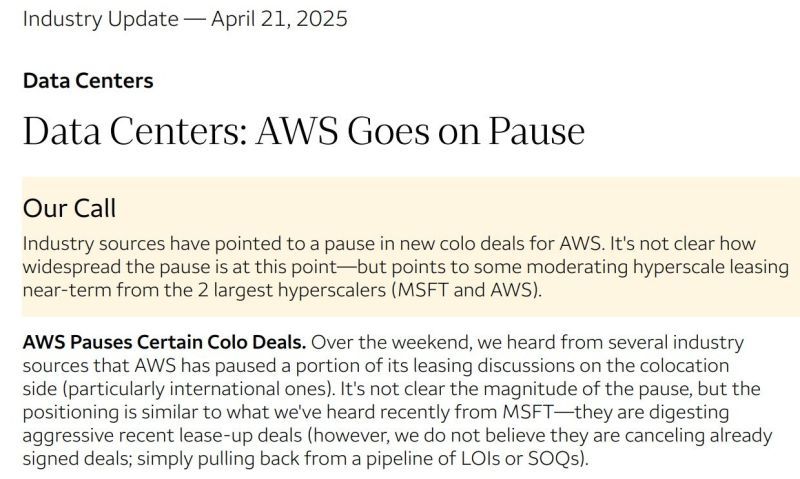

WELLS FARGO + COWEN FLAG AWS DATA CENTER LEASING PAUSE

Both banks say Amazon $AMZN AWS has hit pause on some colocation leasing deals—mainly international. Cowen notes hyperscale demand is cooling a bit, especially in Europe, with Amazon slightly pulling back on U.S. colocation activity too. Wells Fargo heard from multiple sources that AWS is stepping back from ongoing leasing talks, mirroring what’s been seen from Microsoft lately. Source: Wall St Engine

CHINA HITS BACK: RARE EARTH EXPORT CRACKDOWN RISKS GLOBAL CAR CRISIS

China’s hitting back at Trump’s 145% tariffs by choking off exports of rare earths — the weird metals your car, wind turbine, and fighter jet desperately need. That includes stuff like dysprosium and terbium which power the super-strong magnets in EV motors and defense tech. China’s latest export controls on rare earth minerals could cause shutdowns in automotive production, with stockpiles of essential magnets set to run out within months if Beijing fully chokes off exports. Beijing expanded its export restrictions to seven rare earth elements and magnets vital for electric vehicles, wind turbines and fighter jets in early April in retaliation for US President Donald Trump’s steep tariffs of 145 per cent on China. Government officials, traders and auto executives said that, with inventories estimated to last between three and six months, companies would be racing to stockpile more material and find alternative supplies to avoid major disruption. Jan Giese, a metals trader at Frankfurt-based Tradium, warned that customers had been caught off guard and most car groups and their suppliers appear to be holding only two to three months’ worth of magnets. “If we don’t see magnet deliveries to the EU or Japan in that time or at least close to that, then I think we will see genuine problems in the automotive supply chain,” said Giese. Source: FT

Here's how every stock in the SP500 has performed so far in 2025 Wall Street 2025 Performance:

🔴 $DIA is down 8% 🔴 $SPY 500 is down 10.1% 🔴 $QQQ is down 15.6% 🔴 $IWM 2000 is down 15.7% 🟢 $VIX is up 70.9% Source: Bloomberg

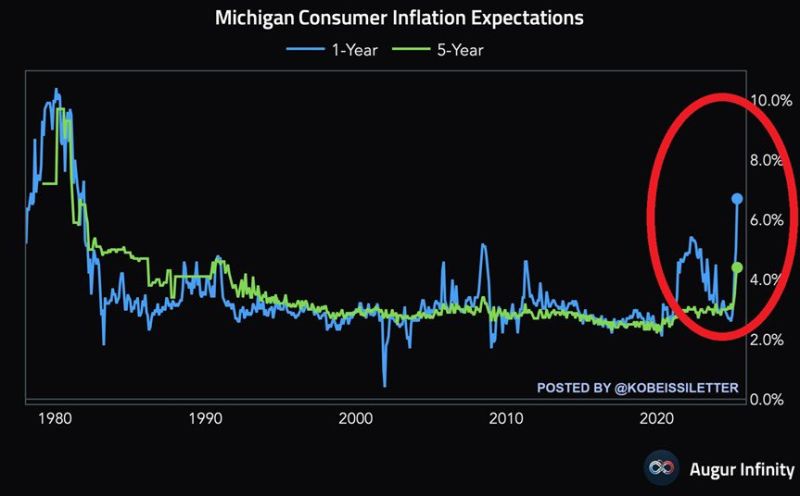

US inflation expectations continue to climb…

In April, 1-year inflation expectations surged by 1.7 percentage points to 6.7%, the highest level since November 1981 (h/t @KobeissiLetter), Augur infinity

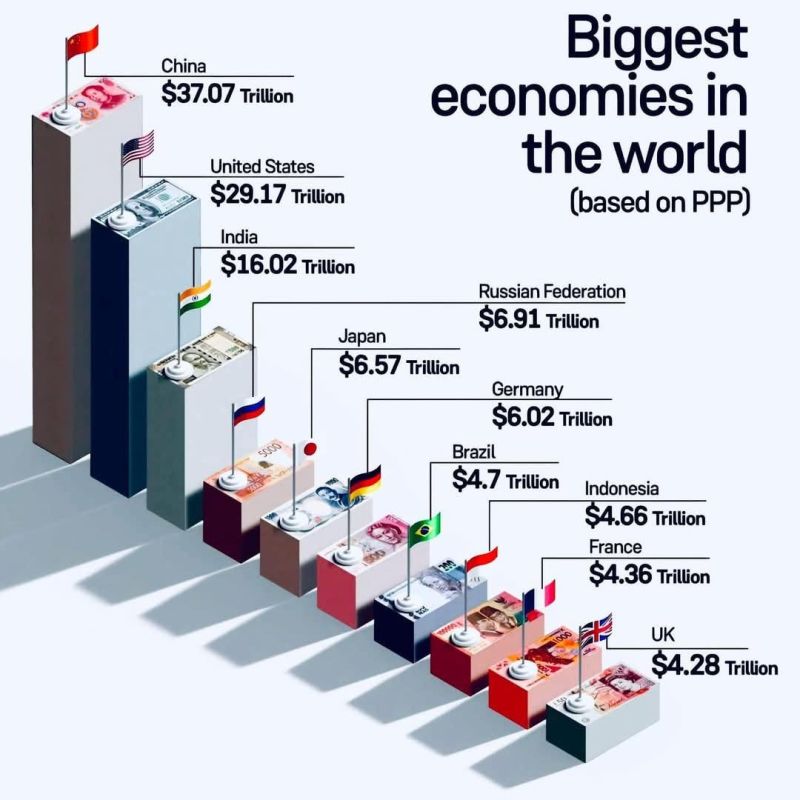

The world’s biggest economies based on purchasing power parity (PPP), not nominal GDP — according to the IMF.

(PPP adjusts for cost of living and inflation, so it reflects what people can actually buy in their own countries — not just raw dollar totals.) Source: Wall St Engine on X

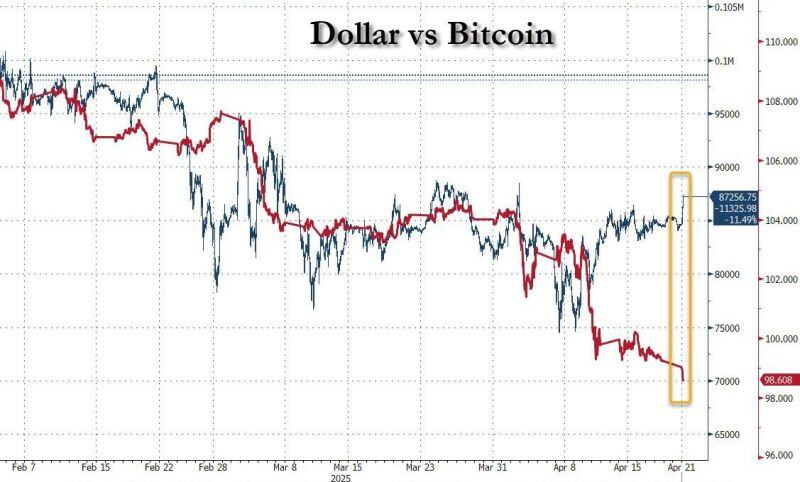

Dollar Crashes On Powell Removal Speculation, Gold Soars To All Time High And Bitcoin Suddenly Spikes

The result is that while bitcoin had generally tracked the DXY Dollar index lower for much of 2025, the last few weeks - and certainly Sunday night - have seen a very tangible snap in this relationship. Source: zerohedge, Bloomberg

BREAKING: U.S. Dollar

U.S. Dollar Index $DXY plunging to its lowest level since March 2022 Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks