Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

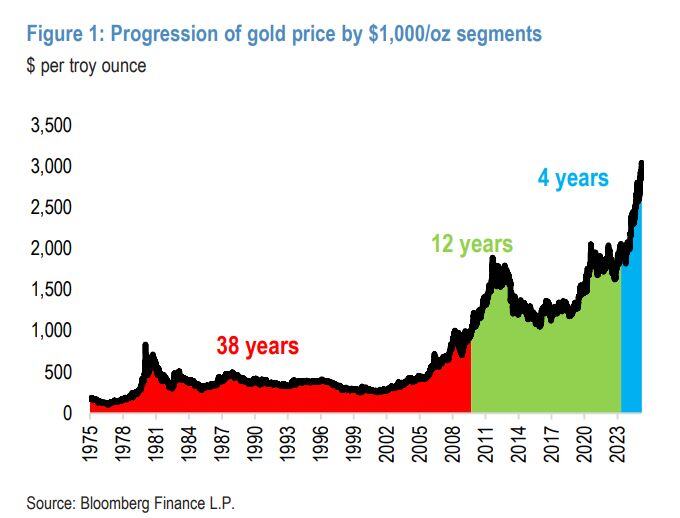

It took 38 years for gold to rise from $35/oz to $1,000/oz. Then it took 12 years to rise from $1,000/oz to $2,000/oz in 2020.

It only took 4 years to go from $2,000 ~~~> $3,000 Source: CEO Technician, Bloomberg

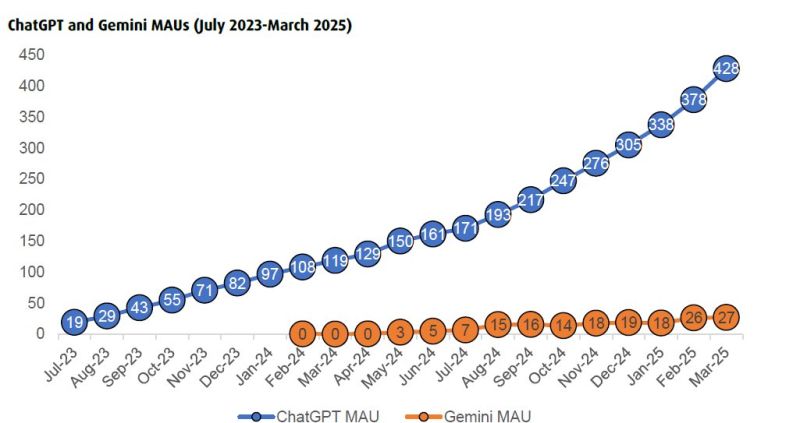

Absolutely brutal chart for Alphabet $GOOGL MAU = Monthly Active Users

Source: Pythia Capital, No Brainer @PythiaR

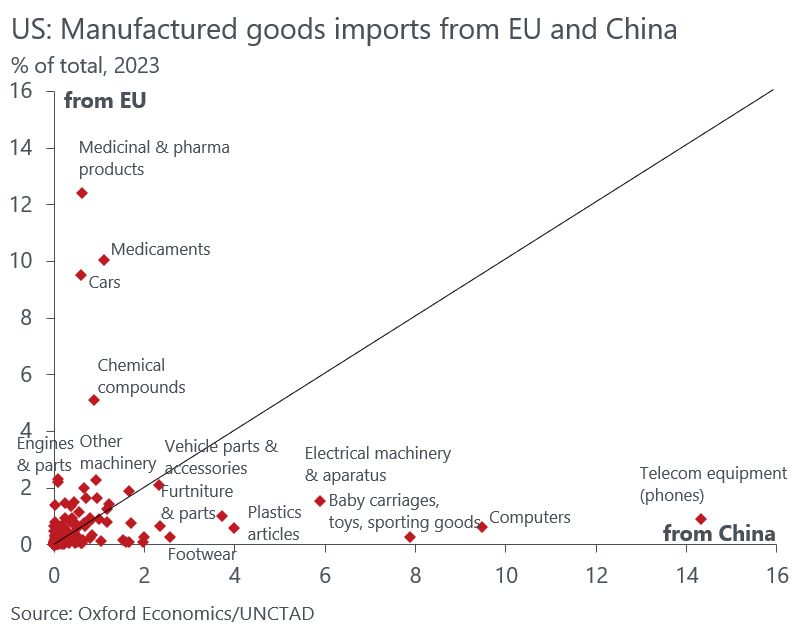

Remarkable how little overlap there is between the main categories of 🇺🇸 imports from 🇪🇺 (pharma, cars, chemicals) & 🇨🇳 (phones, computers, semi-durable consumer goods).

This means limited scope for 🇪🇺 to supplant China imports, which face prohibitive tariffs (main beneficiary is Vietnam). Source: Daniel Kral @DanielKral1

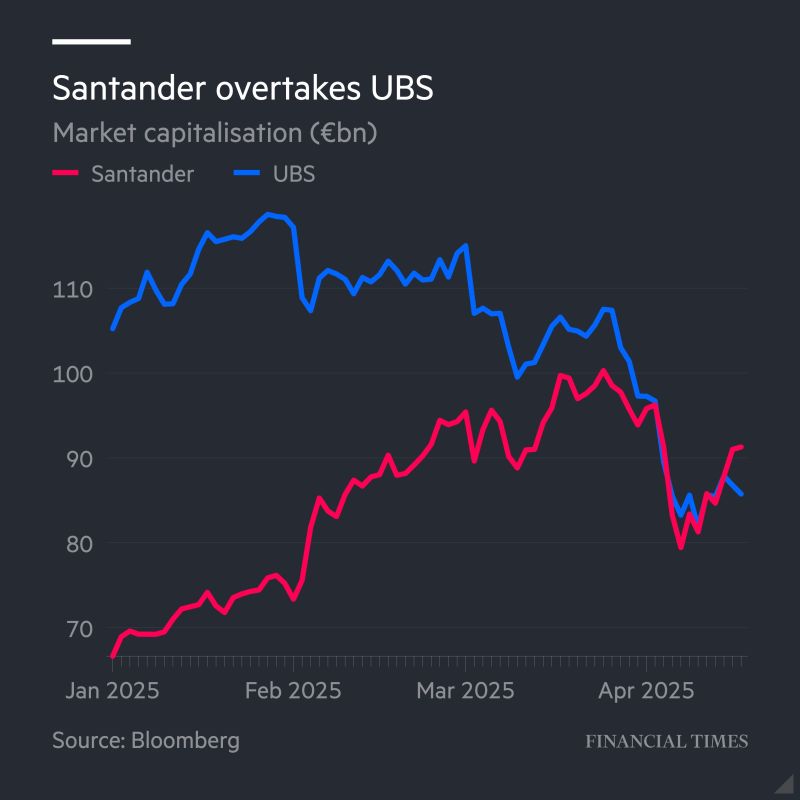

Santander has overtaken UBS as continental Europe’s most valuable bank after Donald Trump’s tariff-induced market rout hit the Swiss lender harder than peers.

Santander Executive Chair is Ana Botín is with no doubt one of the greatest visionaries of our industry. Source: FT, Bloomberg

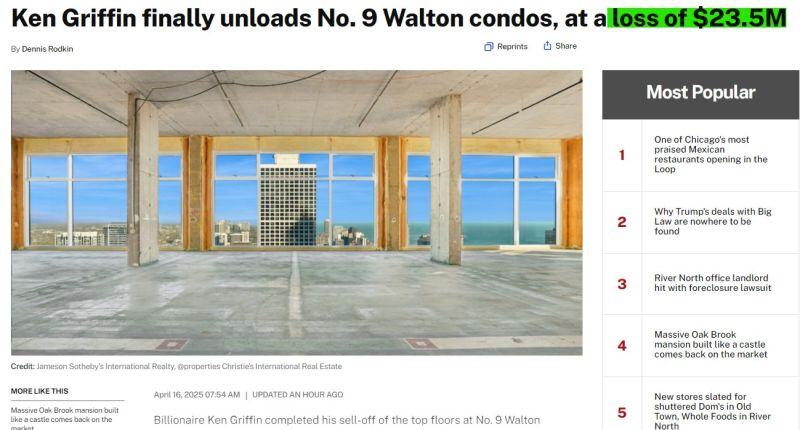

Why does Citadel's Ken Griffin keep selling his properties at massive losses (in this case $24,000,000)?

Source: Reese Politics

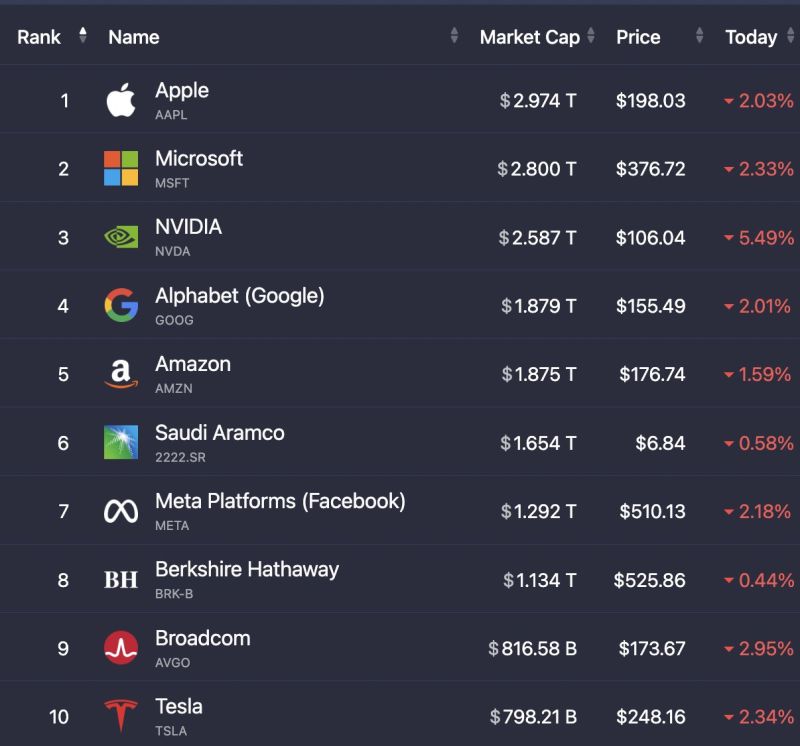

We're back to having 0 companies with a $3+ Trillion market cap

Source: Evan

Investing with intelligence

Our latest research, commentary and market outlooks