Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

From US exceptionalism to US bashing..

Looking forward to see the October cover page... Source: Jim Bianco, The Economist

‼️Wall Street strategists are CAPITULATING on earnings estimates:

➡️ S&P 500 earnings have been revised DOWN for 17 consecutive weeks, the longest streak since the 2022 BEAR MARKET. ➡️The share of firms with higher less lower EPS revisions hit 48%, the highest since the 2020 CRISIS. Source: Global Markets Investor, Liz Ann Sonders, Bloomberg

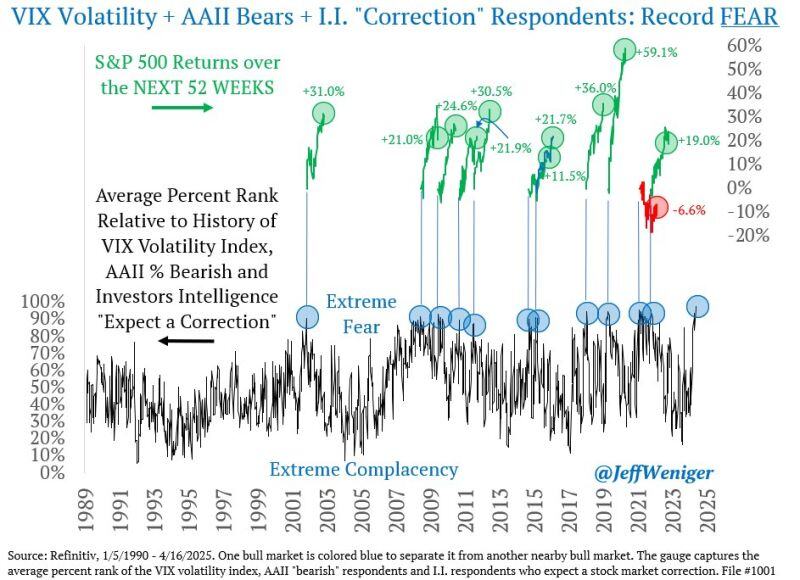

🔴 A very interesting chart by Jeff Weniger on X

You're looking at the highest reading on record in 1,841 weekly stock market sentiment observations from 1990 to 2025. ▶️ The inputs: the VIX volatility index + AAII survey bearish respondents + Investors Intelligence survey respondents who expect a correction. ▶️In 10 of the last 11 fear spikes, the S&P 500 went on to gains over the next 52 weeks. Returns were often large too (+31.0%, +21.0%, and so on)...

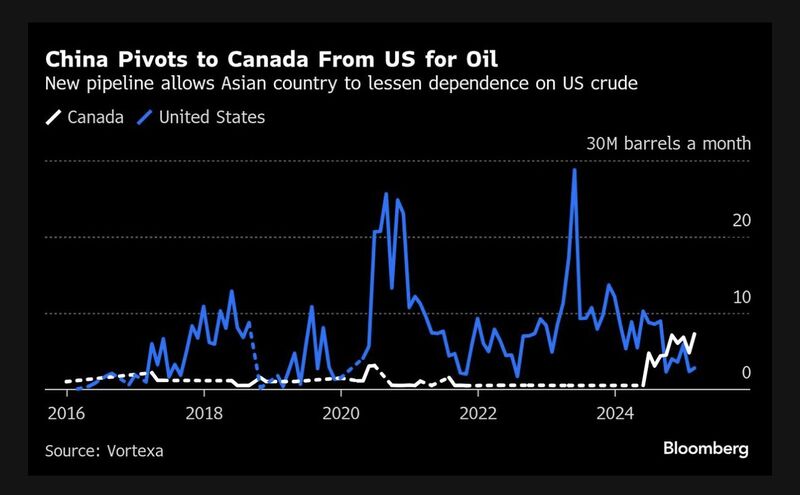

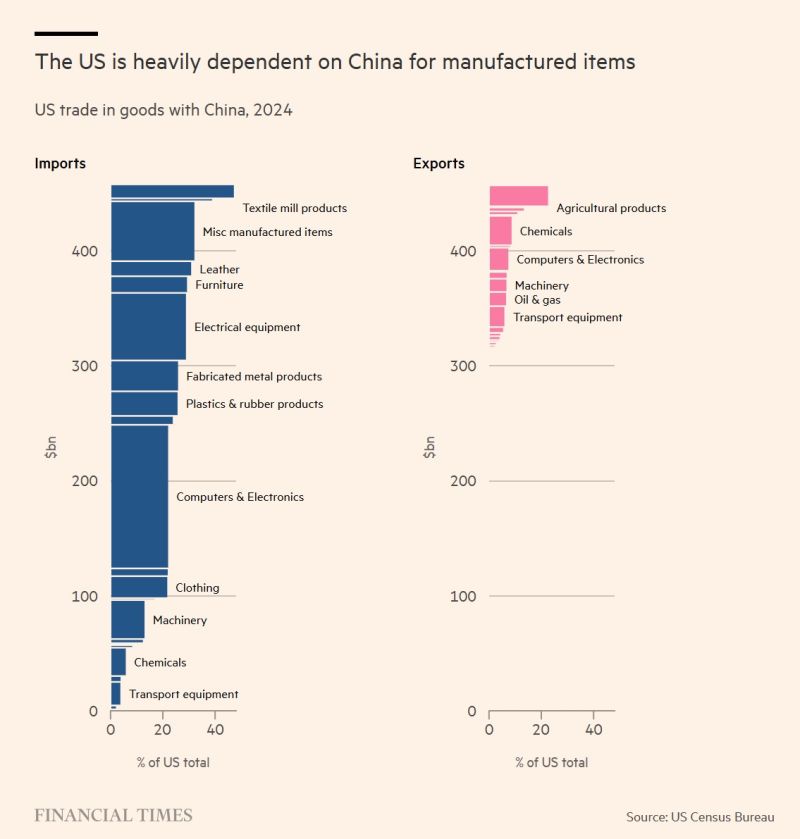

Trade, tech and Treasuries: China holds cards in US tariff stand-off - by FT

Marta Bengoa, professor of international economics at City University of New York, said that while the US and China remained heavily interdependent in trade, this meant the ultimate balance of risk was on the US side. “US dependence on China is higher, because China can source agricultural products from elsewhere more easily than the US can replace electronics and machinery,” she said. “Beijing is already buying up soyabeans from Brazil, for example, so in the end China has a bit more leverage.”

Investing with intelligence

Our latest research, commentary and market outlooks