Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Nvidia said on Tuesday that it will take a quarterly charge of about $5.5 billion tied to exporting H20 graphics processing units to China and other destinations

The stock slid almost 5% in extended trading. ➡️ Biden placed these original restrictions on Nvidia, to not allow China to get their hands on the latest generation chips. Nvidia spent billions on new less powerful chips that met the U.S. original criteria so it could still sell to China. And now Trump has ruled those same chips as illegal to be sold to China. For businesses, it is very difficult to operate with this level of policy volatility... Source: Bloomberg, Spencer Hakimian @SpencerHakimian

china first-quarter GDP topped Reuters poll expectations for a 5.1% growth year on year, building on a recovery that began in late 2024, thanks to a broad policy stimulus push.

▶️Retail sales in March rose by 5.9% year on year, sharply beating analysts’ estimates for a 4.2% growth. Industrial output expanded by 7.7% from a year earlier, versus median estimates of 5.8%. ▶️The urban unemployment rate slipped to 5.2% in March, following a two-year high of 5.4% in February. Source: CNBC

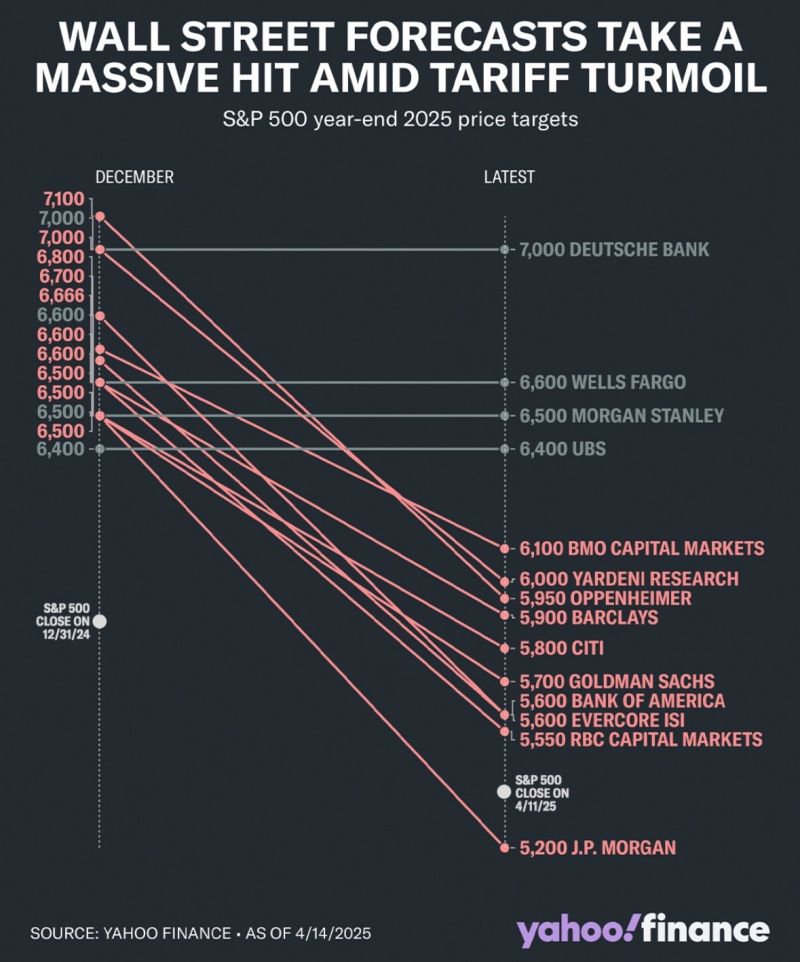

Here’s how Wall Street’s year end 2025 targets for the S&P 500 have changed

Source: Blossom @meetblossomapp, Yahoo Finance

Yesterday, hermes $RMS' market cap surpassed $LVMH's for the first time ever. $279B.

Source: Quartr

China has the largest manufacturing workforce on Earth, by far.

Source: UN, Markets & Mayhem

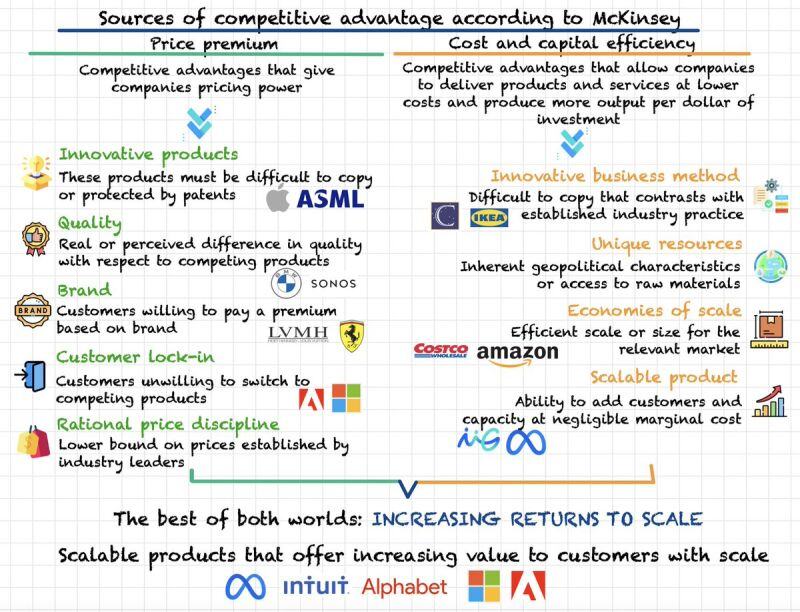

Types of competitive advantage.

Nice pic by @Invesquotes thru Brian Feroldi

In case you missed it:

30 year Japanese government bond yields have climbed even more sharply than their US counterparts. Since April 2, Japan’s 30y yield has risen 33bps, while the US 30y yield is up 29bps over the same period. Source: (HT @bilalhafeez123), HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks