Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

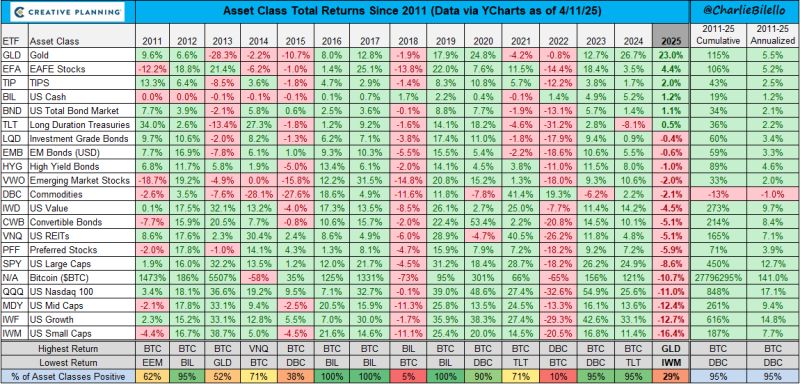

- performance

In Germany, investor confidence in the economy has taken a sharp hit following US President Trump's erratic trade policy.

The ZEW Institute’s expectations index plunged to -14 in April, down from 51.6 in March – a massive drop. Analysts surveyed by Bloomberg had expected a decline, but only to +10. The unpredictable shifts in US trade policy have fuelled global uncertainty, which is now weighing heavily on economic expectations in Germany. At the same time, any initial optimism about the new government's spending plans has quickly faded. Source: HolgerZ, Bloomberg

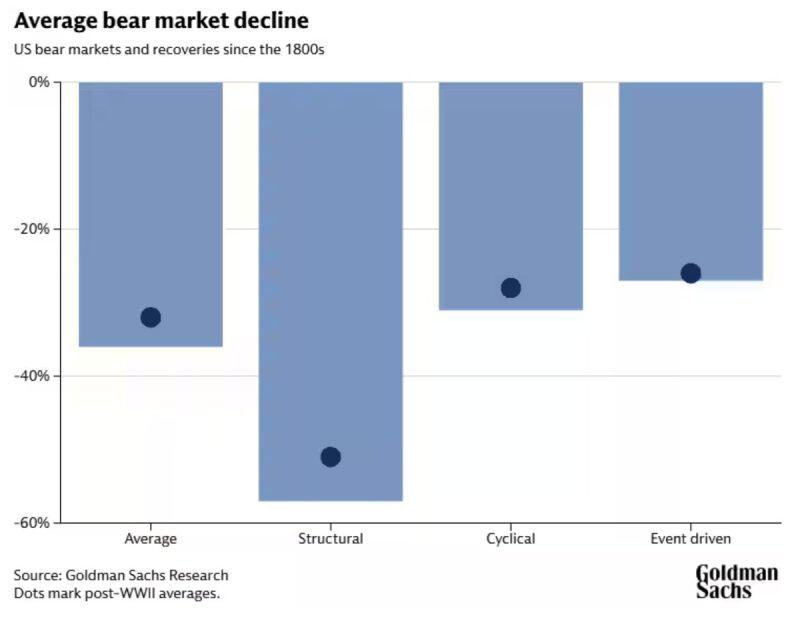

"There are three distinct categories of bear market."

- Goldman Sachs Source: Daily Chartbook @dailychartbook

Last week’s trade data shows an incredibly bleak picture for the economy:

- 49% drop in global container bookings - 64% drop in U.S. imports. - 30% drop in U.S. exports. If this continues for more than a few weeks, there is no doubt that we are headed for tough times ahead. Source: Brian Krassenstein @krassenstein on X

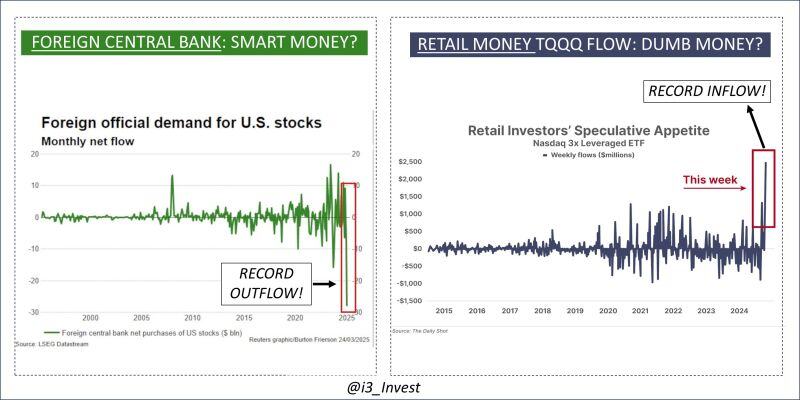

Who do you think is smarter here?

Source: Guilherme Tavares @i3_invest

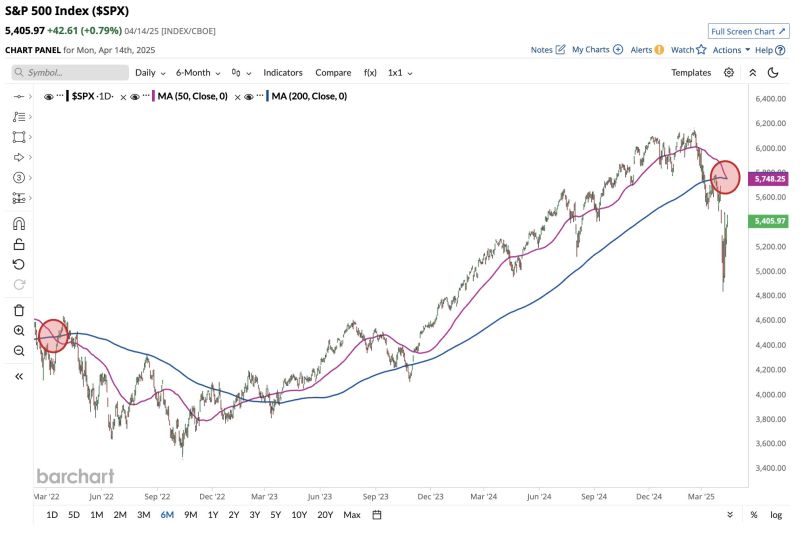

JUST IN 🚨: S&P 500 forms Death Cross ☠️ for the first time since March 2022

Source: Barchart

Extreme anti-US sentiment or just the start of a trend?

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks