Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

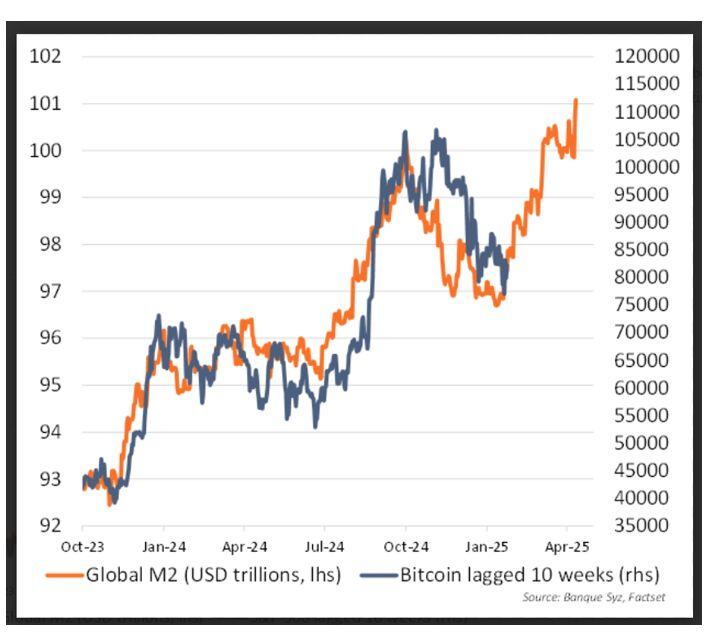

Global M2 (in orange) vs bitcoin lagged 10 weeks (in blue)

M2 proxy vs BTC continues to hold. Could the surge in Global M2 push $BTC to new highs?

Isn't it the most compelling chart for being a stock market investor?

Over the last 50 years: -US Inflation: up 6x -S&P 500 dividends: up 21x -S&P 500 total return: up 323x Over the long run, stocks trounce inflation and protect your purchasing power. Source: Peter Mallouk

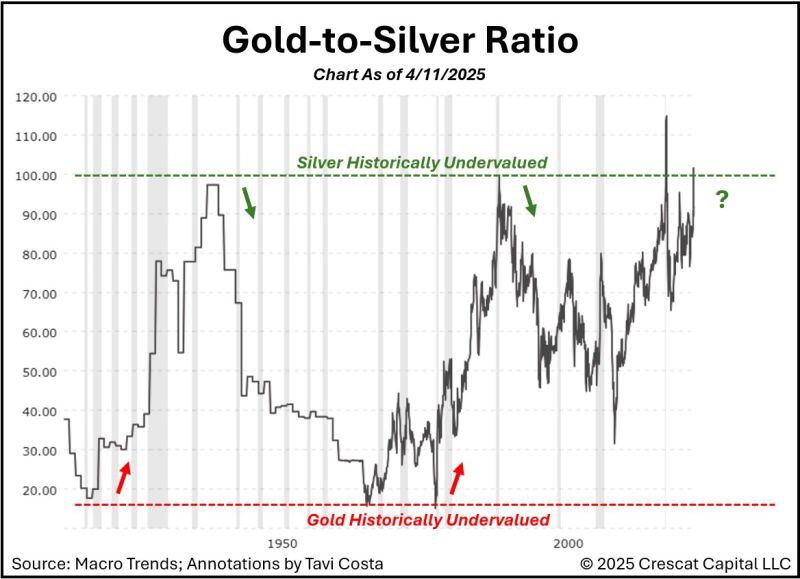

This is a fascinating chart for anyone looking at the gold-to-silver ratio in a historical context - courtesy of Otavio (Tavi) Costa.

Over the past 125 years, the ratio has only spent brief moments above the 100 level — extremes like this tend not to persist for long... Source: Tavi Costa, Crescat Capital

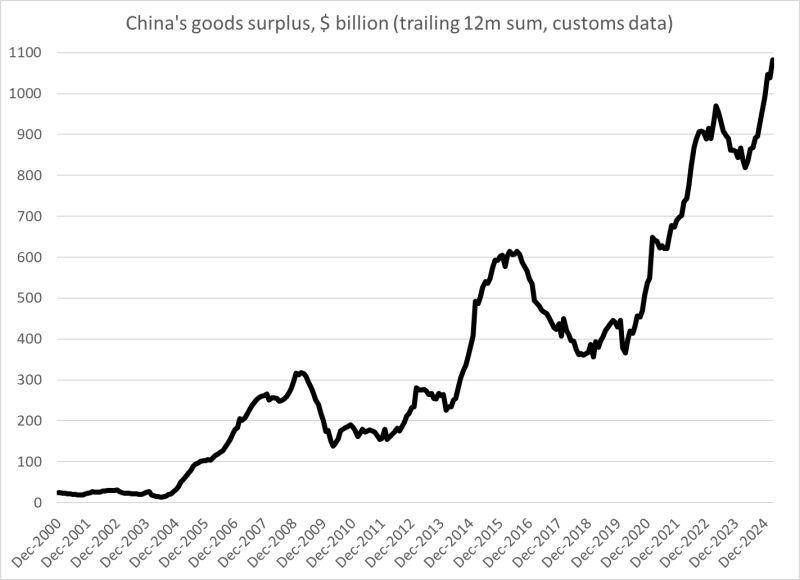

Crazy numbers coming out of China

A $100 billion (goods) surplus in March, a $275 billion goods surplus for q1 (up from $185 billion last year) and a surplus of nearly $1.1 trillion over the last 4 quarters... The easy explanation is tariff front running. But it seems "too easy" as an explanation. China's exports to the US and the EU look identical -- and there is no "reciprocal" tariff threat out of the EU. Same story with emerging markets: more exports and fewer imports. Source: Brad Setser @Brad_Setser on X

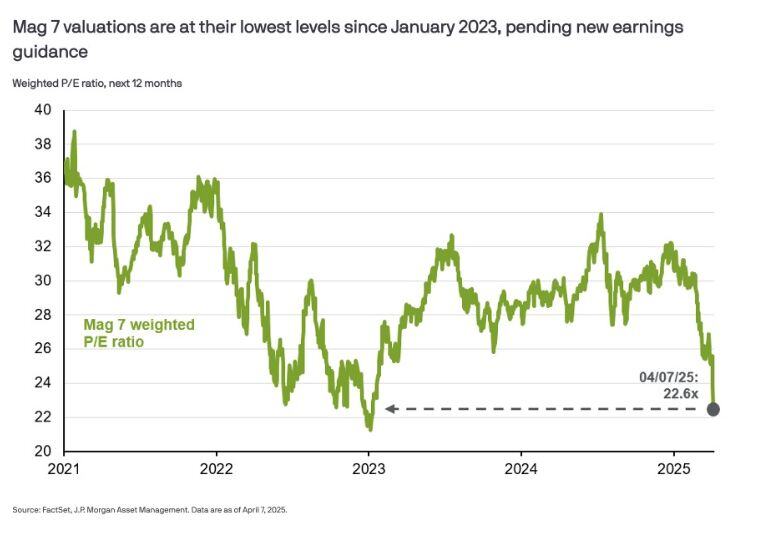

Mag7 stocks trade at the cheapest in more than 2 years

Source: Mike Zaccardi, CFA, CMT @MikeZaccardi

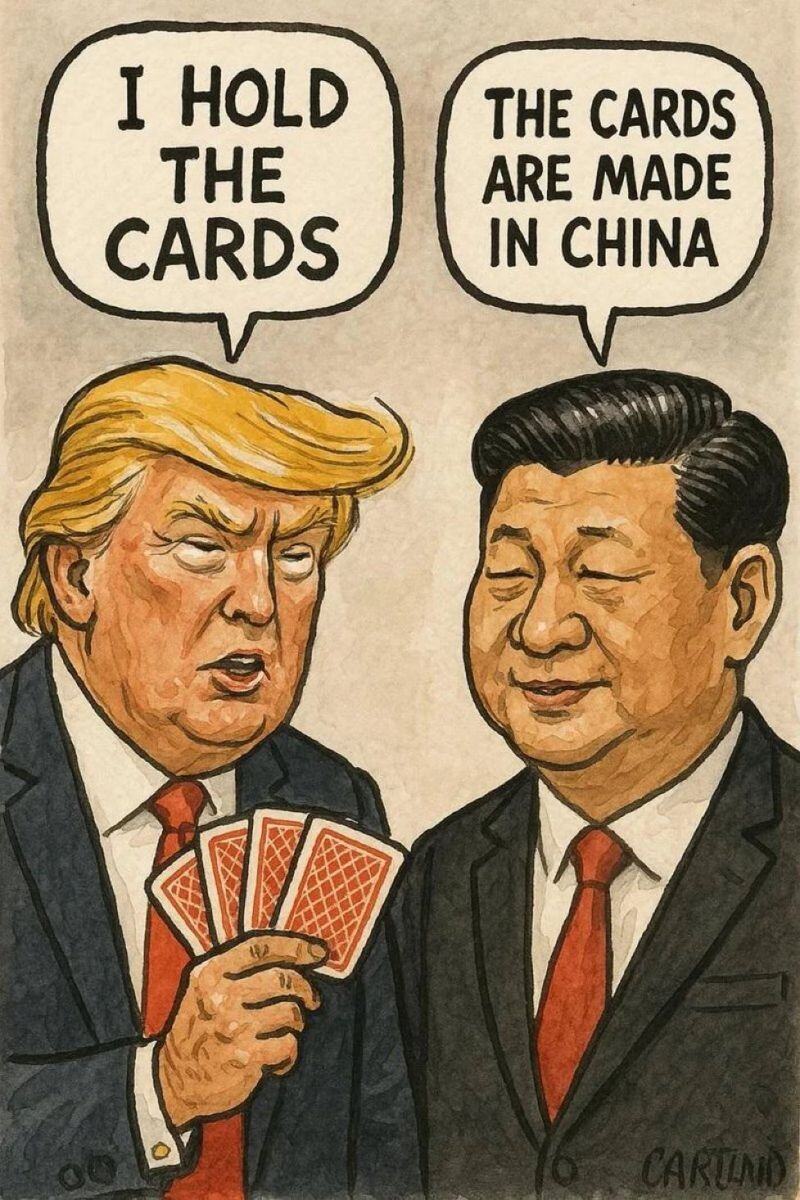

China has suspended exports of certain rare earth minerals and magnets to the U.S. and other countries

It’s also drafting new regulations to block these materials from reaching American companies Source: Stocktwits

BILLIONAIRE RAY DALIO: ‘I’M WORRIED ABOUT SOMETHING WORSE THAN A RECESSION’ - CNBC

“Right now we are at a decision-making point and very close to a recession,” Dalio said on NBC News “And I’m worried about something worse than a recession if this isn’t handled well”

Investing with intelligence

Our latest research, commentary and market outlooks