Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Donald Trump signalled he may offer carmakers some relief from tariffs, in the latest sign the US president will offer carve-outs to selected industries.

Trump said he was “looking at something to help car companies” that were making vehicles in North America. “They’re switching to parts that were made in Canada, Mexico and other places, and they need a little bit of time, because they’re going to make them here,” Trump said from the Oval Office on Monday. His remarks came after the administration at the weekend exempted smartphones, laptops and other consumer electronic goods from steep “reciprocal” tariffs, although US officials later said those items could be caught in a later round of levies. Trump unveiled steep tariffs of 25 per cent on imports of cars and parts last month, in a move that threatens to push up costs for American consumers and upend global auto supply chains. Under the trading regime, cars and parts made in Canada and Mexico face lower levies and only attract the 25 per cent tariff on their non-US content if they otherwise comply with the rules of the 2020 USMCA trade agreement. Trump’s comments on Monday suggest he may offer carmakers more time to move supply chains to North America. Source: FT

Some Europeans start to realize what is coming...

▶️ British retailers have warned that Chinese companies risk flooding the U.K. with low cost goods, as U.S. President Donald Trump’s tariffs choke off access to the world’s largest consumer market. ▶️“Retailers are very concerned about the risk of some lower quality goods being rerouted from the US to Europe as a result of the tariffs,” said Helen Dickinson, chief executive at the British Retail Consortium. ▶️Analysts said that risk was especially pronounced among Chinese producers selling via online marketplaces such as Amazon, Shein and Temu. Source: CNBC

In trade negotiations. Bessent is highly qualified for the role, but is also tasked with finding quick solutions to complex issues while maintaining investor confidence in U.S. policies.

Bessent’s ascent is the direct outcome of the market turmoil that followed Liberation Day. When reporters asked him where the tariff negotiations were headed, his response was he did not know because he was not part of the negotiating team Source: Forbes

LVMH on Monday shared its financial results for the first quarter of 2025, revealing that sales fell 3% to €20.3 billion EUR in the three months ending March 31.

Per Reuters, the results were well below analysts’ expectations of 2% growth, as the conglomerate struggles to buoy amid the ongoing luxury slowdown. The group’s key fashion and leather goods division, which houses heavyweight names like Louis Vuitton, LOEWE, Dior, and Fendi, saw sales fall 5%. Notably, analysts forecasted a 0.55% decline in the category, which makes up 75% of LVMH’s overall profit. Elsewhere, the company’s wine and spirits division saw sales decline by 9%, while perfume and cosmetics both dropped by 1%. Watches and jewelry, meanwhile, remained constant. The cause of such sluggish numbers is one part caused by post-pandemic spending fatigue, another the product of high inflation rates, and a third the product of a slowing economy, mounting debt crisis, and real estate crash in China, a target market for high-end labels. In the US, President Donald Trump’s tariff announcements have eliminated any hopes that American shoppers would spend more on luxury this year. Source: Quartr, Hypebeast

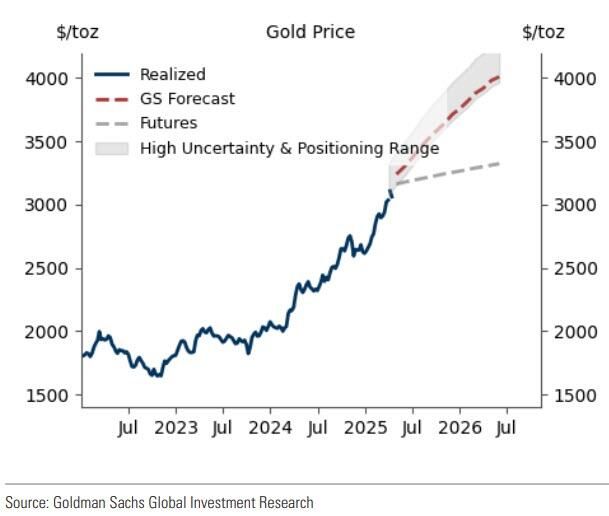

Gold could reach $4,000 over the next year+, according to a forecast by Goldman

Goldman Sachs now sees gold prices to hit $3,700 by the end of 2025. In the most extreme scenario, the bank sees gold prices to spike to $4,500 by the end of the year. Source: Markets & Mayhem

World's Biggest Pension Funds have halted their investments in the U.S. until the country stabilizes

Some of the world’s biggest pension funds are halting or reassessing their private market investments into the US, saying they will not resume until the country stabilises after Donald Trump’s erratic policy blitz. The moves underscore how big institutional investors are rethinking their exposure to the world’s largest economy as the US president’s trade policy upends markets, adding pressure to America’s private capital industry, which is under increasing liquidity strain. Some top Canadian funds are backing away from taking on more US private assets because of geopolitical concerns and fears they will lose tax breaks on their American investments. Canada Pension Plan Investment Board, which has C$699bn ($504bn) in assets, is among those considering its approach. Meanwhile, one of Denmark’s biggest retirement funds has paused new investments in US private equity because of concerns over stability and Trump’s threats to take over Greenland, an executive at the fund told the Financial Times. Source: FT, Barchart

$AAPL Apple gets upgrade at KeyBanc, Wedbush keeps bullish views amid Trump's tariffs scenario.

$APPL is up +4% Source: @DivesTech

NVIDIA TO MANUFACTURE AMERICAN-MADE AI SUPERCOMPUTERS IN US FOR FIRST TIME:

RTRS NVDA PLANS TO PRODUCE UP TO $500BN INFRASTRUCTURE IN THE US US VIA PARTNERSHIPS WITH TSMC, FOXCONN Source: zerohedge Image by created with DALL·E

Investing with intelligence

Our latest research, commentary and market outlooks