Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

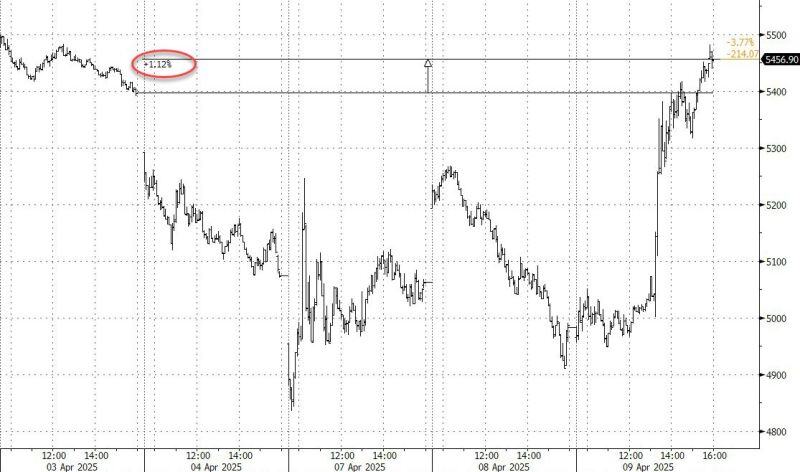

Just a reminder that this story was leaked on Monday, and then denied by the White House.

Source: James Chanos @RealJimChanos

CBOE Volatility Index $VIX drops by more than 35%, its largest decline in history

Source: Barchart

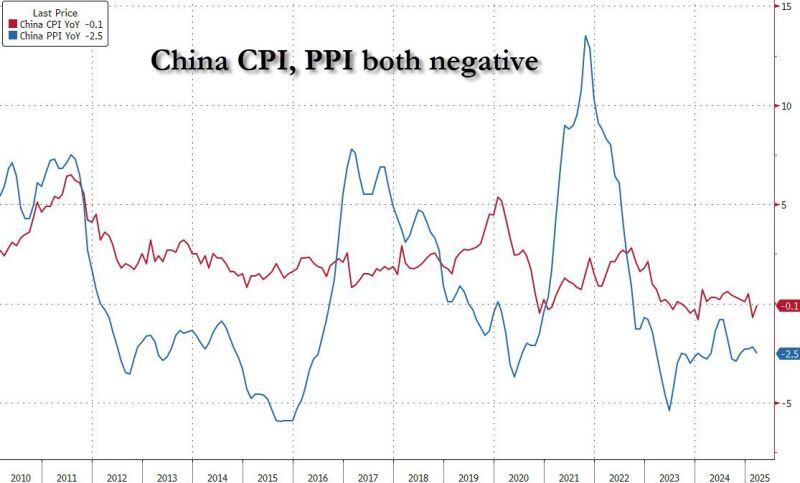

China remains in deflation

*CHINA MARCH CONSUMER PRICES FALL 0.1% Y/Y; EST. 0% *CHINA MARCH PRODUCER PRICES FALL 2.5% Y/Y; EST. -2.3% Trade war with the US won't help Source: zerohedge @zerohedge

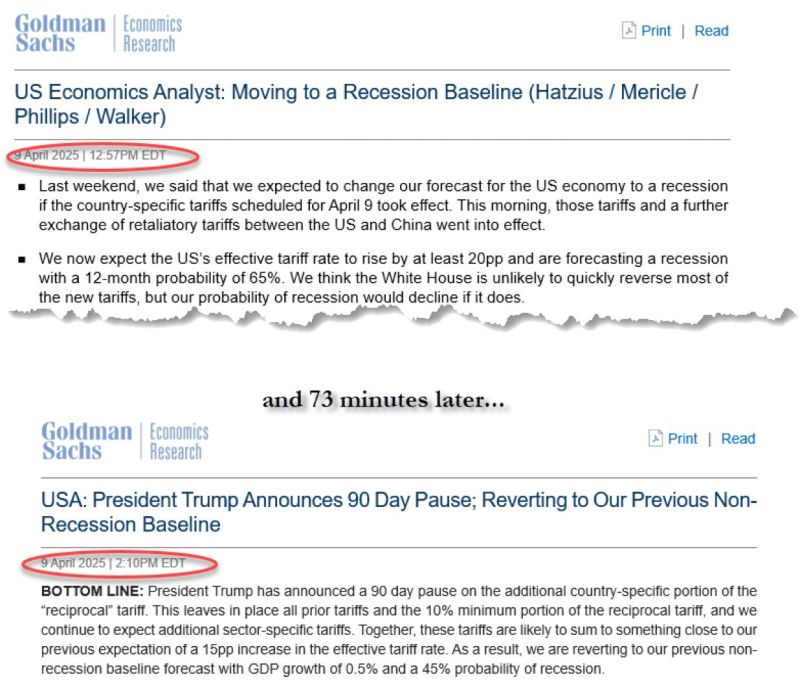

Macro volatility, market volatility and... sell-side volatility...

Goldman Sachs’ research department publishing these two headlines 73 minutes apart. Source. litquidity @litcapital

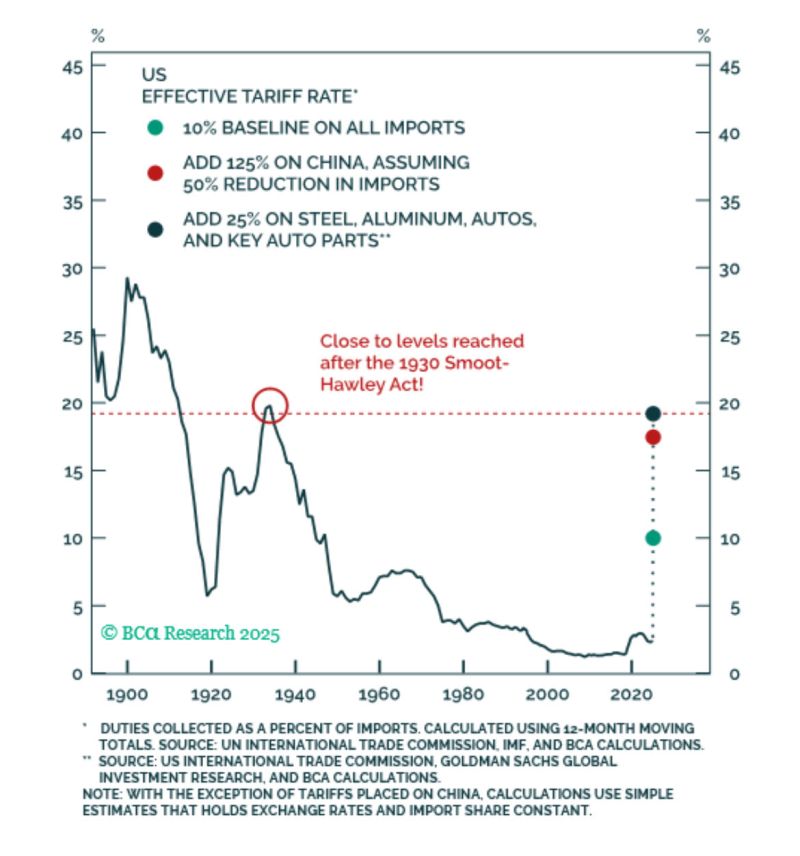

Sorry folks, but even after today’s flip-flop, we’re still looking at the biggest tariffs since the 1930s.

Source: BCA thru Peter Berezin

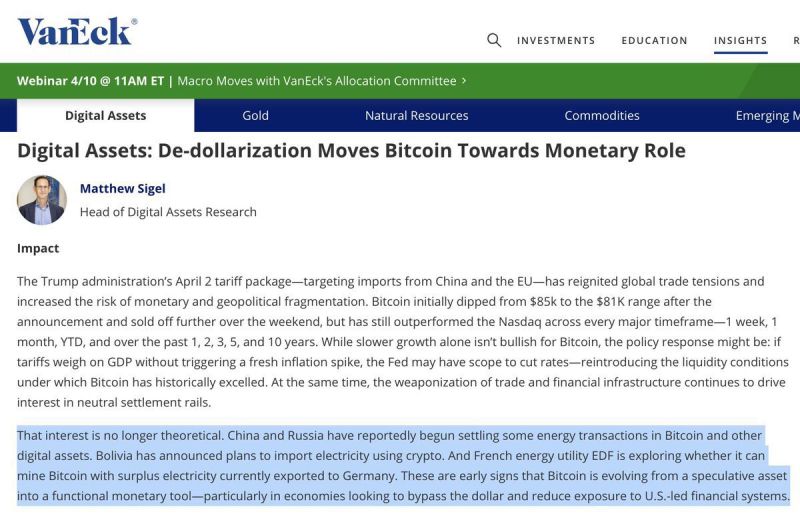

VanEck confirms that China and Russia are settling energy trades in Bitcoin.

Has De-dollarization already started?

Investing with intelligence

Our latest research, commentary and market outlooks