Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

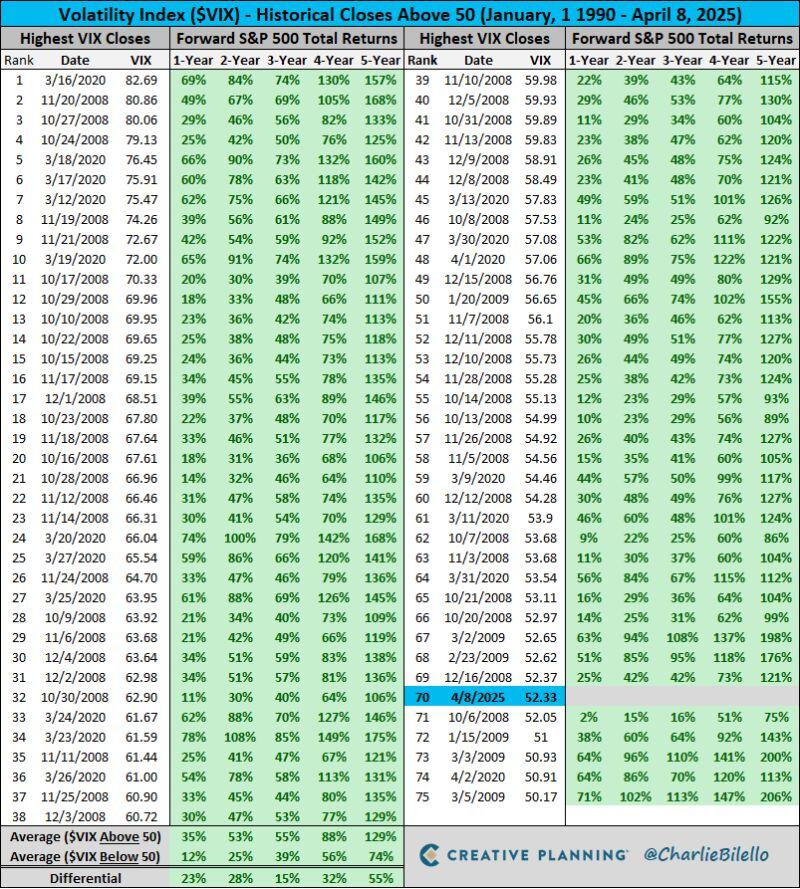

The $VIX closed above 50 today which is in the top 1% of historical readings.

What has happened in the past following closes above 50? S&P 500 gains over the next 1, 2, 3, 4, 5 years every time with above-average returns overall. Source: Charlie Bilello

The vix (S&P 500 implied volatility) is now back above 50 (extreme fear).

The move index (30Y Treasuries implied volatility) is also skyrocketing... What's going on here? If volatility and market stress stay too high for too long, the risk of a financial accident is real. Source: TradingView

😨 What is the SOFR 3Y Swap spread trying to tell us???

➡️ The SOFR 3Y swap spread refers to the difference between the 3-year U.S. Treasury yield and the fixed leg of a 3-year SOFR interest rate swap. SOFR (Secured Overnight Financing Rate) is a benchmark interest rate based on overnight loans collateralized by U.S. Treasuries. It replaced LIBOR as the primary benchmark for U.S. dollar interest rate derivatives. 🔍 Why does it matter? 👉 A positive spread suggests higher credit/liquidity risk in the swap market relative to Treasuries. 👉 A negative spread can suggest technical factors, strong demand for Treasuries, or dislocations in the market. 🔴 Powell may pretend he doesn't need to get involved, but the market is about to force him doing so... Source: zerohedge

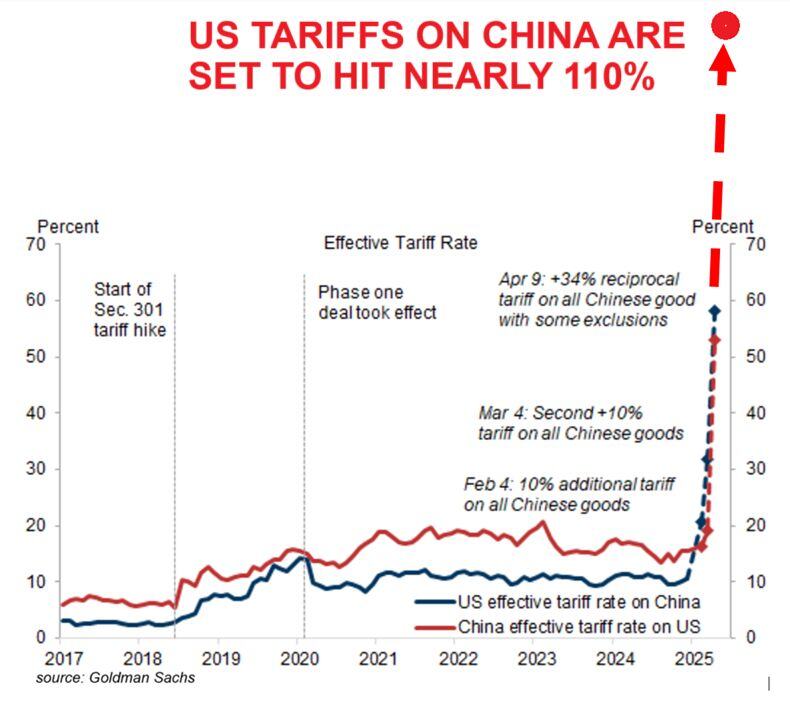

US tariffs on China are set to SKYROCKET off the charts:

If China does not withdraw its 34% tariff increase the US will impose ADDITIONAL 50% tariffs on China from April 9. This would bring the US effective tariff rate on China to ~108% on top of the previously announced 58%. Source: Global Markets Investor, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks