Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

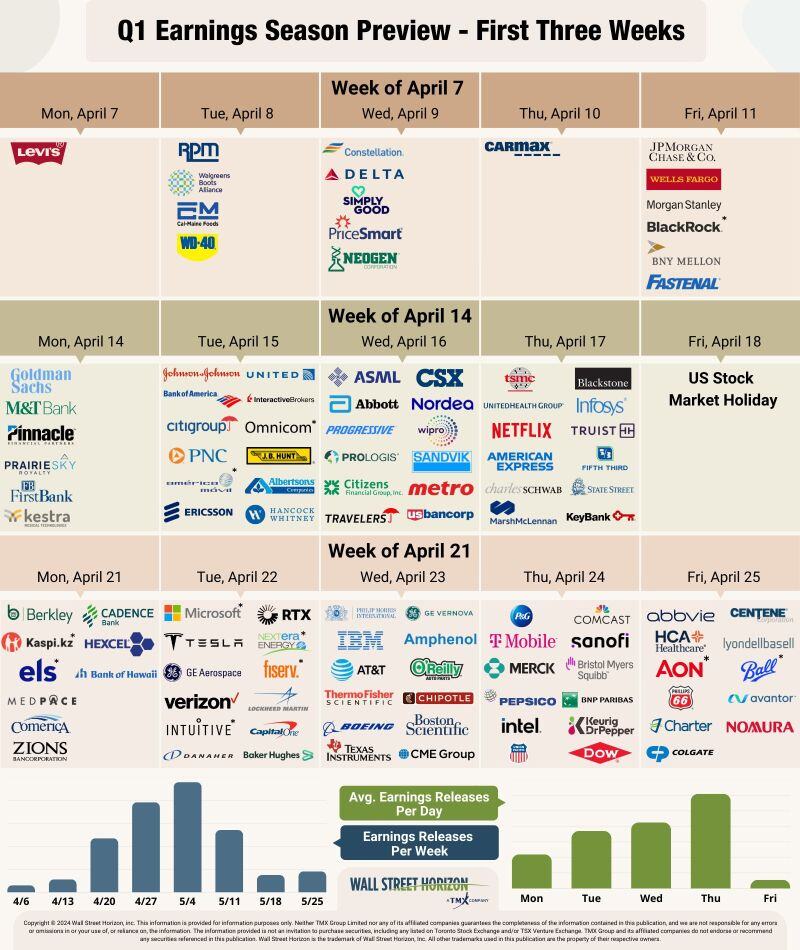

Updated version of our Q1 2025 earnings season preview, data as of April 7, 2025.

The season kicks off this Friday with all eyes on the big banks. Over 50% of S&P 500 firms mentioned tariffs in their Q4 conference calls according to FactSet, could we see that number go higher? Source: Wall Street Horizon @WallStHorizon

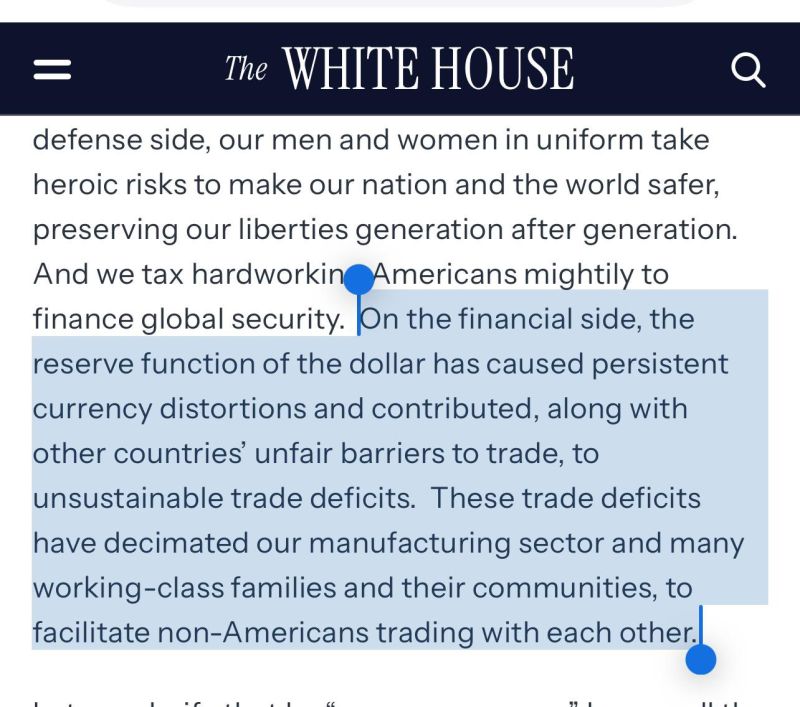

CEA (Council of Economic Advisors at the White House) Chairman Stephen Miran says USD reserve asset status is a problem.

The Trump administration may move to purposely dismantle dollar hegemony. Source: Philip Pilkington @philippilk

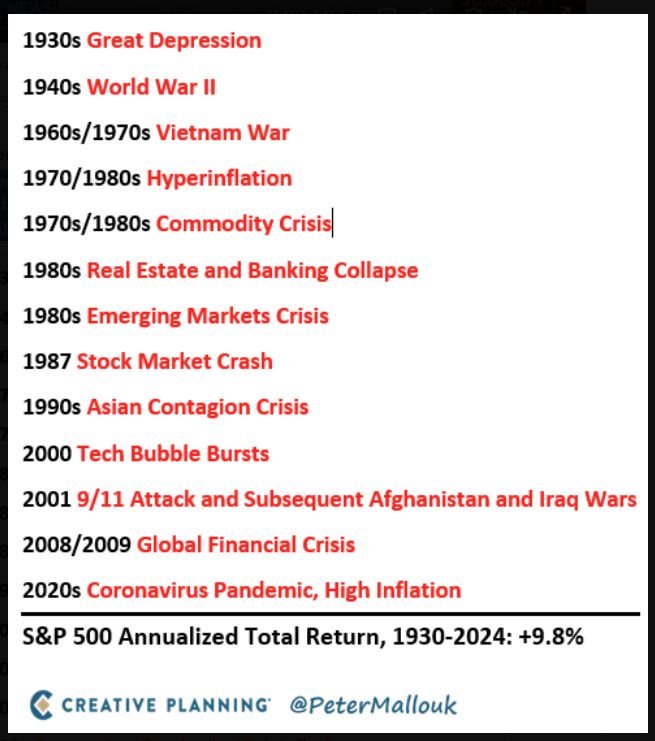

Well said by Peter Mallouk

"It’s been a rough year so far for US equity markets, but we’ve been through much worse in the past and gotten through it. We’ll get through this as well. As Abraham Lincoln once said: This, too, shall pass.”

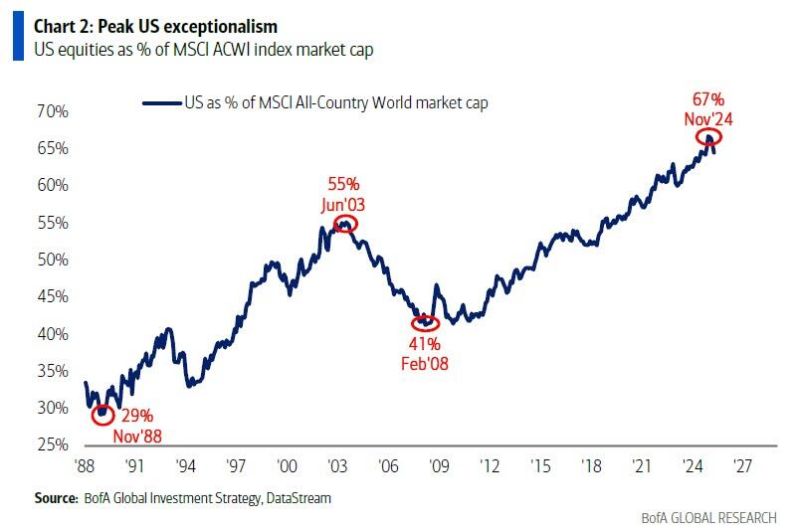

Has a new secular BEAR MARKET begun in the US?

The US share in the global stock market has fallen 3-4 percentage points since its November 2024 peak of 67%. This comes as the US has significantly underperformed other markets this year. Many investors are not ready for this.. Source: BofA, Global Markets Investor

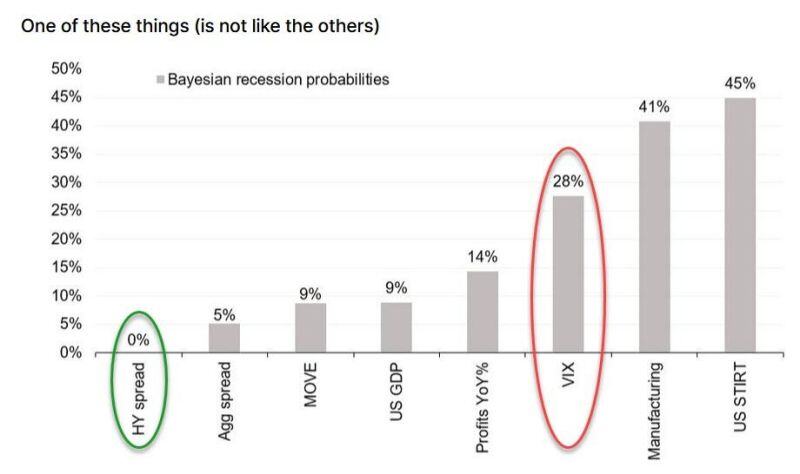

🔴 The VIX Is Pricing In A Recession, While Junk (Still) Sees Zero Risk

➡️ SocGen's Jitesh Kumar writes that high yields spreads remain below 4%, and "we have never been in recession with high yield spreads below 4.5% (data going back to 1987)." In other words, US HY credit spreads are pricing in 0% recession probability. ➡️ However while credit remains complacent, one asset is starting blast a recession warning siren: according to UBS trader Antonya Allen, the VIX is now pricing in a recession. Which one will be correct? Source: SocGen, www.zerohedge.com

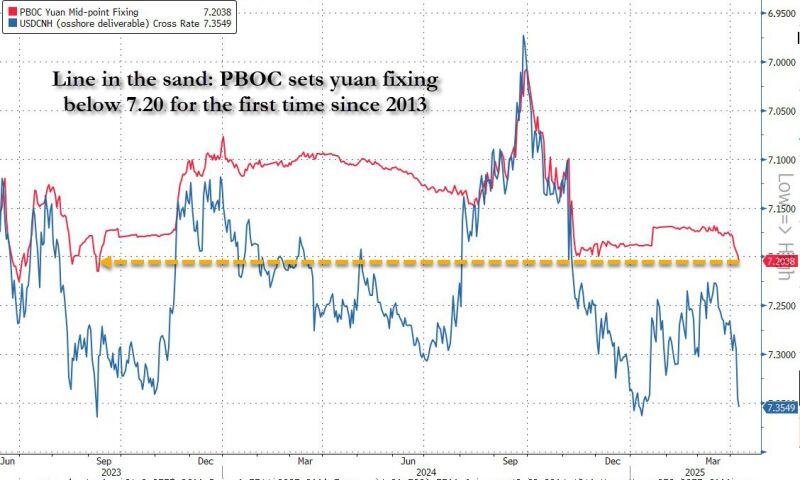

Here's another retaliation from china...

Beijing just crossed a line in the sand. The PBOC fixing was on the other side of the closely watched 7.20 "devaluation" line, first time since 2023. Offshore yuan tumbles and is about to hit a record low against the USD. Source: zerohedge

Ray Dahlio

"Don't Make the Mistake of Thinking That What's Now Happening is Mostly About Tariffs" "At the moment, a huge amount of attention is rightly being paid to the newly announced tariffs and their significant impacts on markets and economies. But very little attention is being paid to the circumstances that caused them—and to the even bigger disruptions likely still ahead. Don’t get me wrong: these tariff announcements are important developments. But most people are overlooking the much larger forces that are driving just about everything, including the tariffs. In my latest article, I discuss what I believe is far more important to keep in mind: we’re witnessing a classic breakdown of the major monetary, political, and geopolitical orders. This kind of breakdown happens only once in a lifetime—but it has happened many times in history, when similarly unsustainable conditions were in place".

Investing with intelligence

Our latest research, commentary and market outlooks