Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

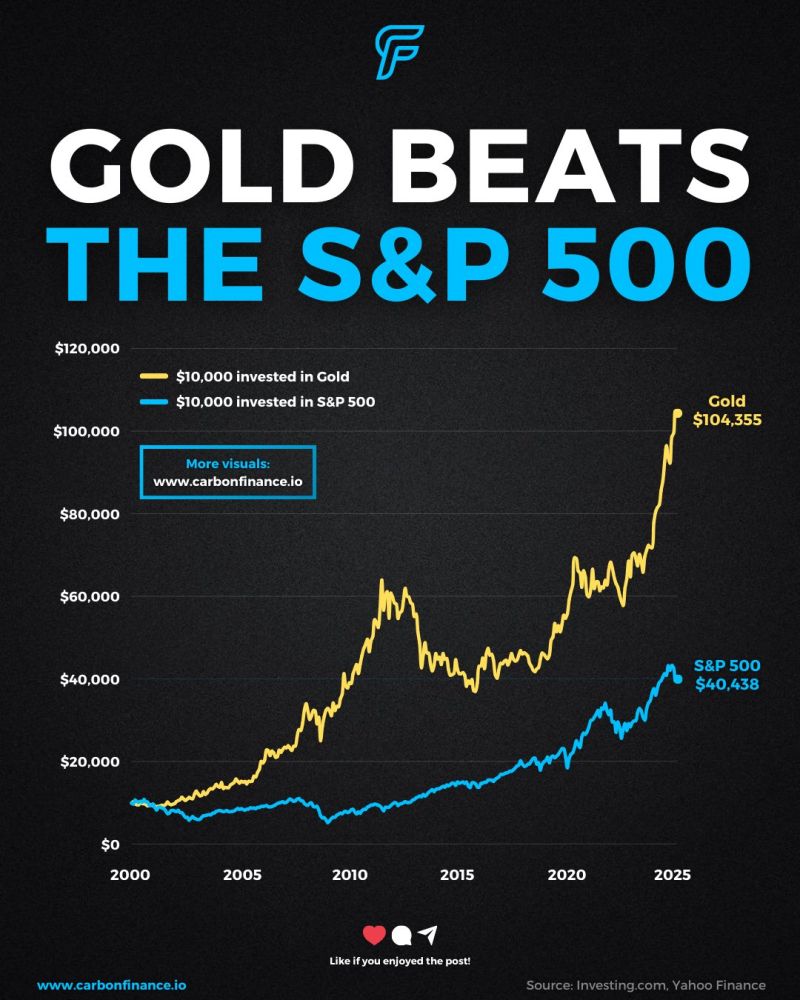

Gold $GLD has outpaced the S&P 500 $SPX by 2.5x since 2000.

A $10K investment in Gold is now $104K, while the S&P 500 sits at $40K. Source: Carbon Finance

Corporate Insiders are dumping shares at the fastest pace in AT LEAST the last 2 decades.

Source: Barchart, FT

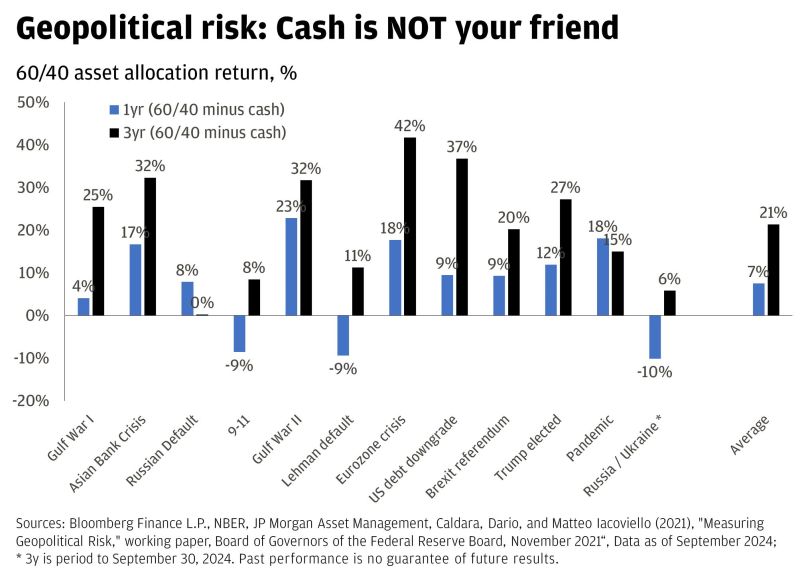

Geopolitical risk: Cash is NOT your friend - source: Christian Ryberg Jørgensen, M.Sc.

While you might find the headlines ugly or scary, data show that staying in cash is NOT a winning strategy. As the old adage says: "It t is time in the market, not timing the market, which wins in the long run". Source: JP Morgan, Christian Ryberg Jørgensen

Ferraris are becoming increasingly popular among younger buyers, with the CEO of the luxury automaker revealing that 40% of new buyers are now under the age of 40.

That reflects a significant upswing from just over 18 months ago, when Ferrari’s chief said the figure stood at 30%. The Maranello, Italy-based manufacturer is well known for keeping a tight rein on the production of its cars, seeking to maintain the brand’s promise of exclusivity. Indeed, as of last year, nearly three-quarters of all Ferraris were sold to existing customers. Famously, founder Enzo Ferrari once said that the company would “always deliver one less car than the market demands.” Source: CNBC

The gold-to-S&P 500 ratio is now near 4-year highs.

Source: Bloomberg, Crescat Capital

BREAKING

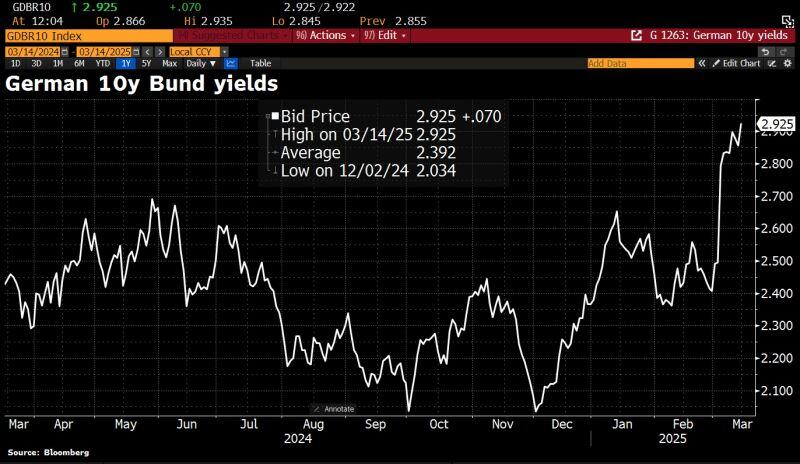

Germany's conservatives have agreed on a much-debated multibillion-euro financial package for defence and infrastructure (and on the country's €1,000bn debt plan) with the centre-left Social Democrats and the Green party, dpa learns. As a result, German 10y yields have jumped to 2.93%. Source: HolgerZ, Bloomberg, DPA

Here is a great theory on Trump’s plan originally proposed by @leadlagreport:

Source: Steve Burns @SJosephBurns

Investing with intelligence

Our latest research, commentary and market outlooks