Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The stagflation trade is proving to be a rare winner as the stock market rout continues.

The Goldman L/S Stagflation basket—which benefits from rising commodity & healthcare stocks while betting against consumer discretionary and chip stocks—has gained nearly 18% in 2025. Source: HolgerZ, Bloomberg

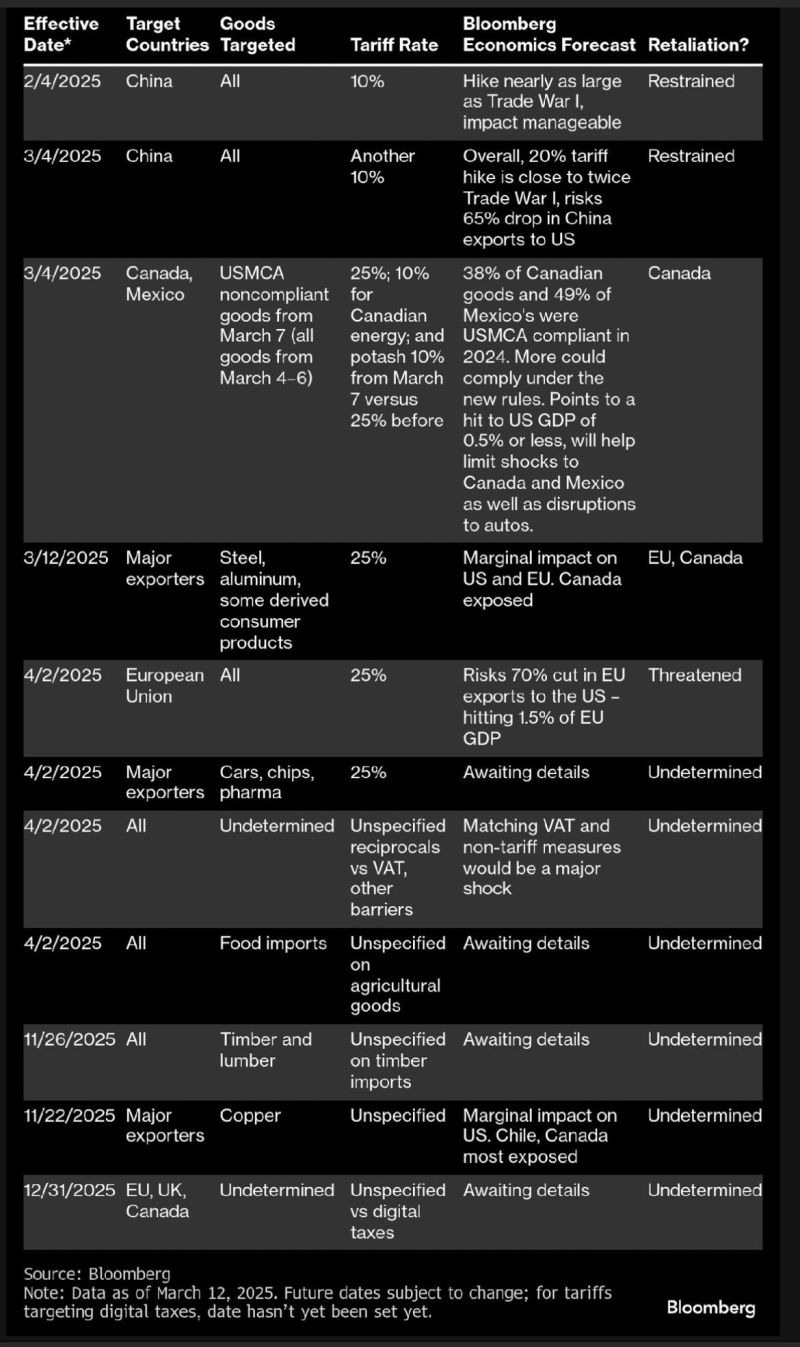

U.S. TARIFFS CHEAT SHEET

Source: Wall St Engine @wallstengine, Bloomberg

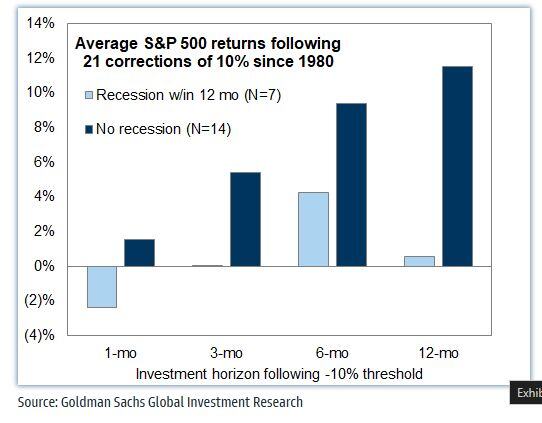

SP500 corrections are usually good buying opportunities

Source: Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi

Visualizing the Rise in Global Coal Consumption ⚡️

Source: Visual Capitalist

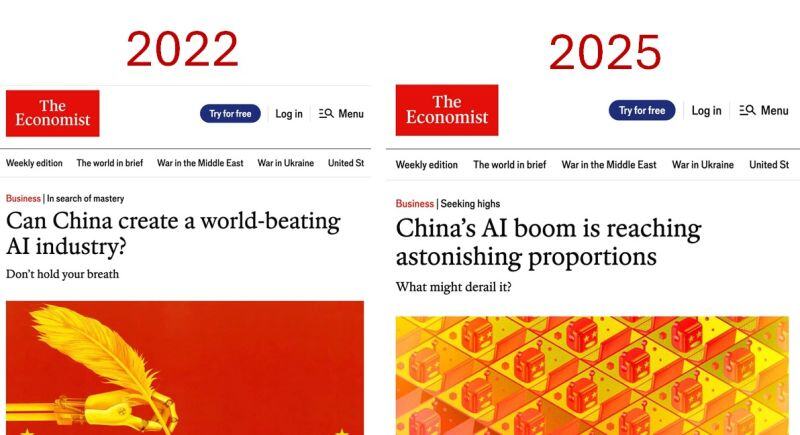

What a change of perception in 3 years...

It seems that the West too often underestimates China China has achieved what they deemed impossible to do. We've seen this first hand in the EVs, electric batteries, solar panels, wind turbines and renewable energy. We might see it with AI as well Source: Cyrus Janssen @thecyrusjanssen @richardturrin

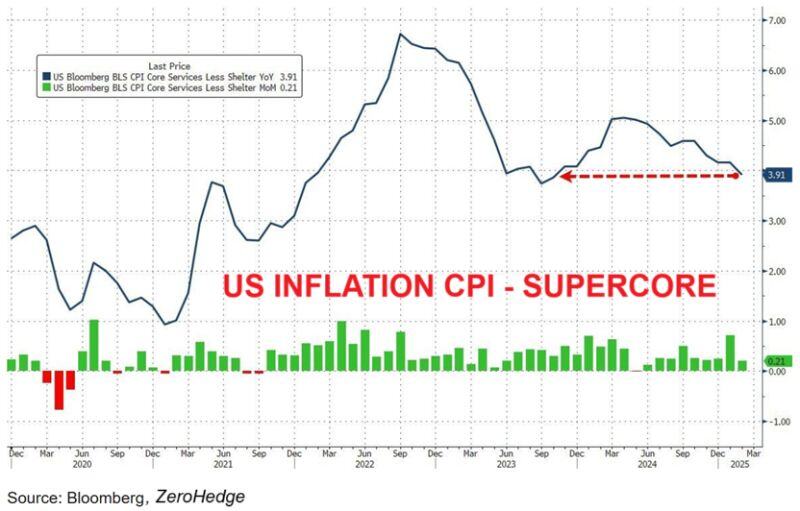

🚨US inflation rate is FALLING as expected and there is more to come:

US CPI Core Inflation dropped to 3.1% in February, the lowest in 4 YEARS. Supercore CPI fell to 3.9%, the lowest since October 2023 (driven by Airfares). All metrics came below forecasts. Expect more progress as economy slows. Source: zerohedge

Mag 7 valuation premium now the lowest in 8 years

Source: Mike Zaccardi, CFA, CMT, MBA, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks