Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

long-term yields continue to rise following the announcement of a major debt package, with 10y yield on the way to 3%.

Financial markets expect neither the Greens nor the Federal Constitutional Court to block the package. While a two-thirds majority is needed in parliament, legal challenges are still pending before the court. Source: Bloomberg, HolgerZ

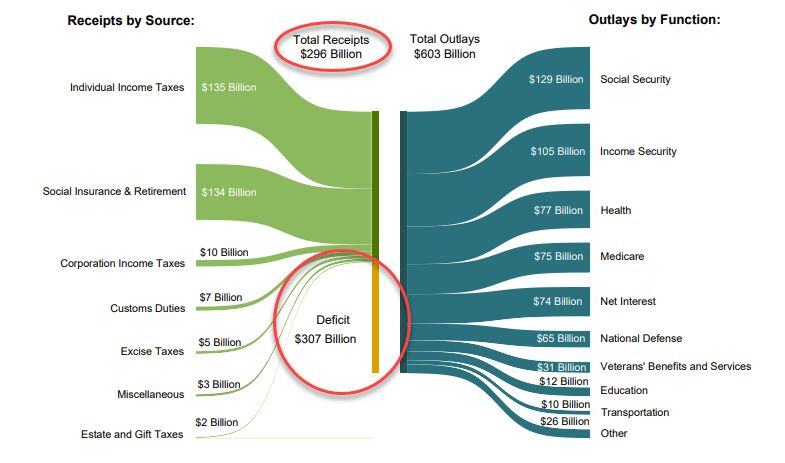

Musk’s cuts fail to stop US federal spending hitting new record...

In February the US budget deficit was BIGGER than ALL TAX REVENUE. Can it be ever be fixed? Source: zerohedge

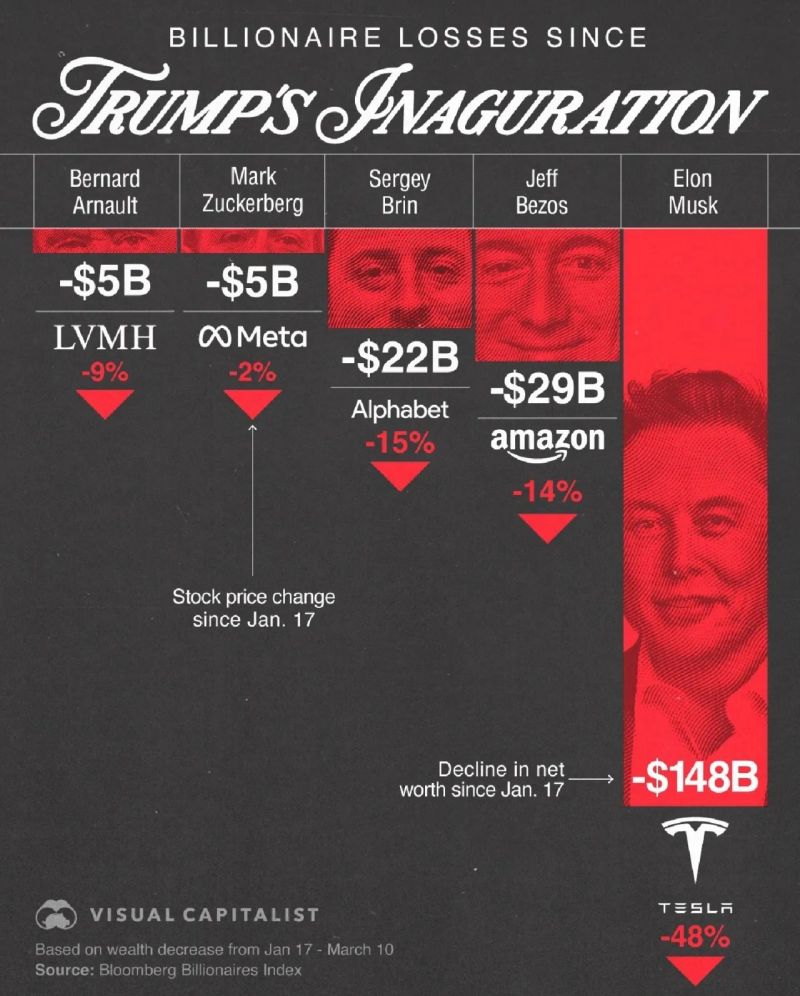

What a club...

Most of the billionaires who attended Donald Trump’s 2017 inauguration have since seen substantial financial losses, with none taking a bigger hit than Elon Musk, who has lost a staggering $148 billion. Source: Visual Capitalist

The Interest Expense on US National Debt rose to a record $1.178 trillion in the last 12 months, an increase of 142% over the past 4 years.

The US Government now spends more money on interest than it does on National Defense. Source: Charlie Bilello

Markets start to be leaning towards this idea...

Source: Damaan, AKA "Philly's Finest"! @Damaan4u33

Mind the gap...

WisdomTree launches first European-only defence ETF. In white >>> Wisdom Tree Europe Defence index In yellow >>> NYSE Arca Defense Index (DFI) Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks